The interim budget for 2019-20 unveiled higher spending by the government on farmers and unorganized workers and tax sops for the middle class, which have led to fiscal deficit being set at 3.4% of GDP, higher than target of 3% of GDP. Read our Budget note for details. The result of higher fiscal deficit is higher borrowing by the government and this is leading to supply concerns for the bond market.

Gross borrowing of over Rs 7 trillion will hit the market from April 2019 and with elections in May leading to uncertain market conditions, the demand will be weak. RBI will not be present with OMOs unless liquidity is seen as extremely tight. Government bond yields will trend higher in anticipation of supply hitting the market.

On the positive side for bond markets, RBI is expected to change its monetary stance from calibrated tightening to netural in its policy review this week. Low inflation, weakening global economic growth and Fed hinting at rate hike pause will prompt the RBI to change its stance.

The Fed is hinting at pausing rate hikes in 2019 unless data surprises on the upside that can elevate inflation expectations. The recent downtrend in global economic data has caused concerns for the Fed. US economy is healthy with January 2019 job numbers showing strong gains through unemployment rate rose as more people joined the labour force. Wage growth too did not surprise on the upside. Read our Global Currency and Bond Market report for details.

The bond market will worry about supply, as states borrowing too has risen 37% from last year and would increase next fiscal year as well. Immediately this week, states are borrowing Rs 220 billion, which would be the highest weekly borrowing on record. Markets will take up bond yields in anticipation of higher yield cut off in the state loan auction.

The positives will kick in at higher levels of yields and it remains to be seen where yields will stabilize over the next three months.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps up at 7.38% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 3 bps up at 7.28% and the 6.68% 2031 bond yields close 2 bps down at 7.68%. The long bond, the 7.06% 2046 bond yields close 4 bps down at 7.62% on weekly basis.

OIS market saw one-year yield close down by 1 bps and five-year OIS yield close up by 2 bps last week. One-year OIS yield closed at 6.49% while five-year OIS yield closed at 6.66%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 187 billion as of 1st February 2019. Liquidity was in a deficit of Rs 720 billion as of 25th January 2019.

As on January 2019, total CD outstanding was Rs 1821.4 billion, up by 20.61% against Rs 1510 billion in September 2018 and total CP outstanding was at Rs 5540.20 billion, down by 0.39% against Rs 5562 billion in September 2018. Post ILFS default, there was a liquidity crisis in credit markets and investors preferred CDs over CPs

· As on 1st February, FII debt utilisation status stood at 57.25% of total limits, 14 bps lower against the previous week. FII investment position was at Rs 4086 billion in INR debt.FII investment position stands at Rs 2053 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2033 billion in corporate bonds.

· For the week ended 31st January, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.48%, spreads were 4 bps lower at 134 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.70%. Spreads were 6 bps lower at 124 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.80% with spreads at 139 bps.

· Three months and twelve months PSU bank CD yields were trading at 6.97% and 7.90% levels at spreads of 46 bps and 117 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.00% and 7.27% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.27% and 8.50% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened further at the long end as the new 10-year G-sec yield rose by 5 bps while other long end bond yields fell by 2-4 bps.

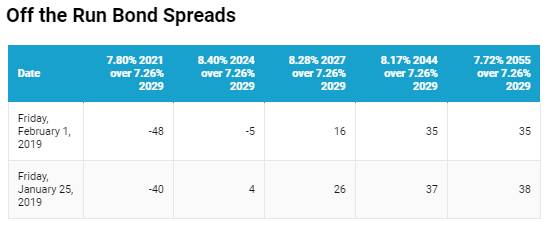

· Off the run bond spreads with the 10-year G-sec largely fell last week

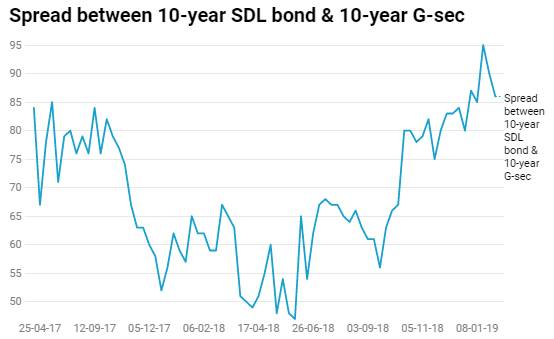

· On the 29th January 2019 auction, the spread between SDLs with 10-year G-sec came in at 86 bps. On 22nd January 2019 auction, the spread between SDLs with 10-year G-sec was at 90 bps.