The rate cut by the RBI in its policy review last week, saw the markets pulling down yields at the short end of the yield curve with the benchmark 5 year government bond yield falling by 21bps while the 10 year benchmark bond yield fell by just 5bps on a week on week basis. The 5*10 spread rose by 16bps to 26bps, The OIS yield curve too fell with one and five year OIS yields falling sharply.

The bond markets believe that the 25bps rate cut could be followed by another 25bps cut in April, given the dovish tone of the policy. The only worry was core CPI inflation that was at over 5.5% for many months and RBI eased the worry by stating that rising education and health care costs are one off and will not sustain. Education and healthcare have largely contributed to a higher core inflation.

The market however, is still uncertain on how the government borrowing for fiscal 2019-20 get absorbed and that worry is being translated into a steepening yield curve. Read our RBI February Policy Note and Interim Budget 2019-20 note for details.

The question is whether the rate cuts can sustain throughout the year. At this point of time, the bond markets believe that rate cuts can sustain but that belief can change on many factors including the policies of the government post the elections in May 2019, pick up in global inflation if China pump primes its economy and supply shocks in commodities especially oil. These factors are benign at present and incoming data suggests that global inflation will be low on weak growth outlook, giving central banks room to stay easy on rates.

The market will stay bid at the short end of the yield curve until the RBI puts out the borrowing calendar for fiscal 2019-20 in end March, where there could be profit taking if supply is heavy at the short end.

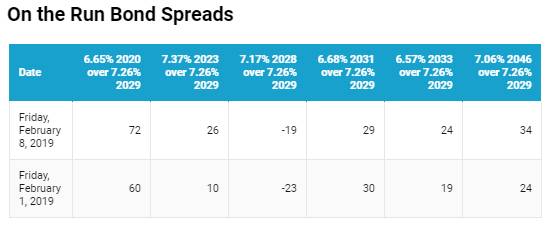

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps down at 7.33% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 21 bps down at 7.07% and the 6.68% 2031 bond yields close 6 bps down at 7.62%. The long bond, the 7.06% 2046 bond yields close 5 bps up at 7.67% on weekly basis.

OIS market saw one-year yield close down by 14 bps and five-year OIS yield close down by 21 bps last week. One-year OIS yield closed at 6.35% while five-year OIS yield closed at 6.45%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 412.03 billion as of 8th February 2019. Liquidity was in a surplus of Rs 412.63 billion as of 1st February 2019.

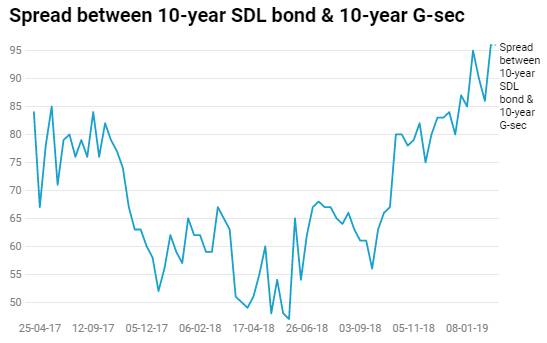

FIIs exposure to SDLs drop more than 65% in a year

As on February 2019, FIIs exposure to SDLs was at Rs 17.48 billion, in the last one year it has fallen by 67.11% from Rs 53.14 billion in February last year. State government borrowings are rising and rising fast. States borrowing is as much as government borrowing at the gross level for this fiscal year and this has led to spreads rising for SDLs.

As on 8th February, FII debt utilisation status stood at 57.02% of total limits, 23 bps lower against the previous week. FII investment position was at Rs 4070 billion in INR debt. FII investment position stands at Rs 2039 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2031 billion in corporate bonds.

· For the week ended 8thFebruary, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.50%, spreads were 17 bps higher at 151 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.55%. Spreads were 2 bps higher at 126 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.73% with spreads 12 lower at 127 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.00% and 7.82% levels at spreads of 65 bps and 127 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.18% and 7.56% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.27% and 8.45% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the short end as the new 10-year G-sec yield fell by 5 bps while the 7.37% 2023 G-sec yield fell by 22bps. RBI rate cut prompted the curve steepening.

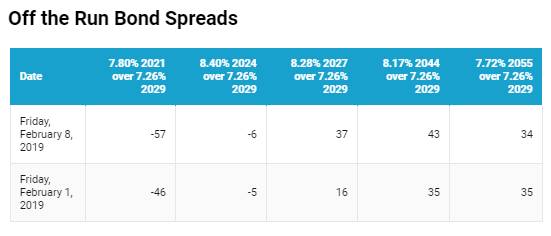

· Off the run bond spreads with the 10-year G-sec largely rose last week

· On the 5th February 2019 auction, the spread between SDLs with 10-year G-sec came in at 96 bps. On 29th January 2019 auction, the spread between SDLs with 10-year G-sec was at 86 bps.