The weakening economic outlook prompted Moody’s to lower India’s sovereign rating to negative from stable citing the impact on government finances. The government is unlikely to stick to its budgeted fiscal deficit target amidst various packages to the the industry, big bang corporate tax rate cut and weakening tax collections.

Bond yields rose last week on the back of a jump in US 10 year treasury yields, as risk aversion eased on prospects of a US-China trade deal. Read our global bond market analysis for details. The rating downgrade helped yields move higher across the government bond, OIS and credit curves.

The outlook for bond yields remain negative given that the economy is showing no signs of improvement, as indicated by weak guidance from across companies releasing 2nd quarter results. Read our Results Tracker for details. Continuing economic weakness places pressure on government finances, weakens the INR and impacts capital flows. Rate cuts and high liquidity does not help bond yields if bond supply surges on higher government borrowing.

The benchmark 10 year bond, the 6.45% 2029 bond, saw yields rise by 11 bps to 6.56% on a weekly basis. New benchmark 5-year bond, the 6.18% 2024 bond yield stood at 6.24% and the 6.68% 2031 bond yield increased 6 bps to 6.96%. The long tenure bond, the 7.63% 2059 bond yield reached by 10 bps at 7.23% levels.

One-year OIS yield rose by 6 bps to 5.14% while five-year OIS yield jumped by 15 bps to 5.27%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 2535.09 billion as of 8th November 2019. Liquidity was in a surplus of Rs 2712.35 billion as of 1st November 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at shorter end and flattened at the longer end during last week (Table 1)

· Off the run bond spreads movement remained steady as compared to previous week.

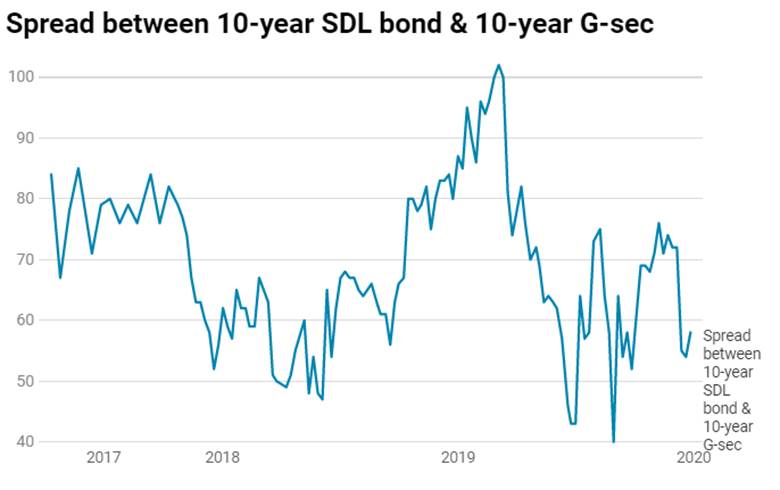

· On 5th November, the spread SDL with 10-year G-sec stood at 76 bps, States borrowed Rs 79 billion through SDL auction. On 29th October, the spread between SDL with 10-year G-sec stood at 71 bps.