The yield on the 10 year benchmark bond, the 6.45% 2029 bond, moved up by 1bps week on week to close at 6.52% levels on worries of extra borrowings by the government. The government could hit the market with addition Rs 1 trillion borrowing. However, given the fact that the RBI is keeping its policy accommodative and that banks incremental credit deposit ratio has fallen to 71% from over 100% levels seen a few months back would see demand from the market for the 10 year bond at higher levels.

The MPC is expecting weaker data going forward and this will lead to more rate cuts.

System liquidity is in huge surplus of close to Rs 2 trillion and credit risk aversion is extremely high leading to fall in credit growth to 8.8% as of September 2019, and banks will buy government bonds with their excess liquidity.

10 year government bond yields will initially trend up until the additional borrowing announcement and then it will look to trend down from higher levels.

The big bang tax cuts coupled with a visibly slowing economy are making the finances of the government weaker leading to overshoot of fiscal deficit targets. The government could look to borrow extra Rs 1 trillion from the market to make up for its shortfall in revenues.

Tax collections are down with direct tax collection growth of 4.76% in the April-September 2019 period, well below the budgeted target of 16% growth while GST collections dropped to a 19 months low in September. The big bang corporate tax cut will lead to a Rs 1.45 trillion revenue hit.

The economic data and high frequency data is showing weakness all around. Read our Economic Data Report for details.

The avenues for bridging the shortfall through other sources apart from market borrowings is limited with sentiments weak in equity markets due to a visible fall in corporate earnings growth, read our Results Tracker for details. RBI has already paid a dividend of Rs 1.76 trillion to the government and head room to pay a lot more in low.

Given the revenue shortfall and the fact that the government is spending heavily, as seem from its consistent drawdown from RBI WMA facility, bridging the gap will have to be through borrowings.

The fiscal deficit target of 3.3% of GDP could go up by 40bps to 50bps, as per a reuters report and this roughly translates to Rs 1 trillion of extra borrowing from the market.

The new benchmark 10 year gilt, 6.45% 2029 bond, increased marginally by 1 bps to 6.52% on a weekly basis. Benchmark 5-year bond, the 7.32% 2024 bond witnessed yields falling by 3 bps to 6.29% and the 6.68% 2031 bond yield closed 3 bps down at 6.91%. The long tenure bond, the 7.63% 2059 bond yield closed 6 bps up at 7.18% levels.

One-year OIS yield climbed up by 2 bps to close at 5.07% while five-year OIS yield rose by 4 bps to 5.13%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 1942.50 billion as of 18th October 2019. Liquidity was in a surplus of Rs 2211.22 billion as of 11th October 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the short end of the curve and remained steady at the long end. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec was flat last week.

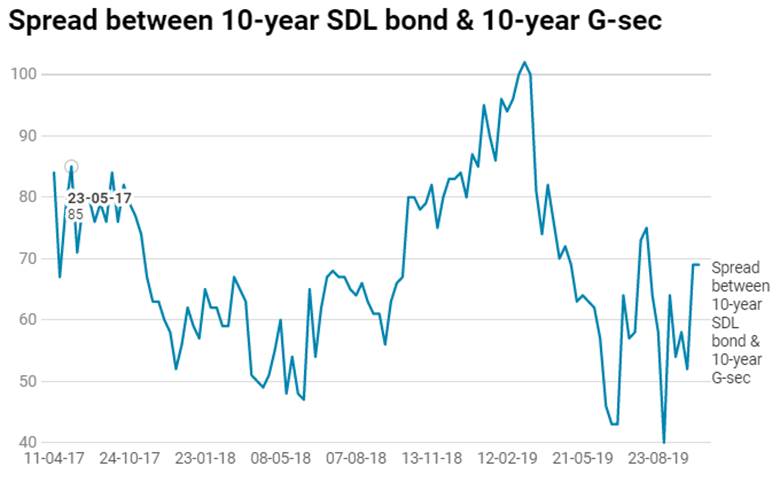

· On 15th October, the spread between SDL with 10-year G-sec stood at 69 bps. States borrowed Rs 149 billion through SDL auction. On the 7th October 2019 auction, the spread between SDL with 10-year G-sec came in at 69 bps.