The release of a dovish RBI policy minutes of the February MPC meeting failed to stop yields from rising across the market segment. Government bond, money market securities and corporate bond yields rose last week in anticipation of extreme liquidity tightness in March.

The month of March is traditionally a tight month for liquidity given advance tax outflows and financial year end demand for funds by the system. This year, March looks to be a month of very high demand for funds and given tight liquidity conditions, the most affected will be credits. CP yields, especially NBFC CP yields can rise substantially as will short end of the curve corporate bond yields. G-secs and SDLs are repoable with the RBI and do not suffer too much from lack of liquidity.

Liquidity will tighten on advance tax outflows mid March, demand for cash given elections in May and high demand for funds by the system for financial year end.

The March liquidity problem is heightened by the credit crisis that is on currently with IL&FS default, LAS issues and NBFC crisis. Corporates and NBFCs in particular will look to draw down all their lines from banks or take fresh credit from banks in the absence of market liquidity.

Mutual Funds traditionally face redemptions from institutional borrowers in March and try to stay neutral on liquidity by floating FMPs but given the credit crisis, investors are shunning FMPs. Mutual funds will have to sell any asset that is liquid to create liquidity and a few may even have to draw down on bank lines, within regulatory limits.

March rise in credit yields will provide an opportunity to investors in corporate bonds as they will get high yields.

April will see the liquidity situation easing and RBI will be pumping in money through OMOs. However, the system will have a tough time riding out March.

RBI Policy Minutes– The decision to change the monetary policy stance was unanimous. As regards the reduction in the policy repo rate, Dr. Ravindra H. Dholakia, Dr. Pami Dua, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted in favour of the decision. Dr. Chetan Ghate and Dr. Viral V. Acharya voted to keep the policy rate unchanged.

Ravindra Dholakia said there are concerns about the GDP growth slowing down, which is reflected in the marginal reduction in the RBI’s growth forecast. Therefore, it would be appropriate to consider a rate cut not only to correct the past inaction but also provide impetus to growth without materially risking inflation beyond the targeted 4%. Under these circumstances, I think space has opened up for a substantial rate cut of about 50 to 60 bps going forward.

Viral Acharya suggested that the MPC should wait till the next policy for a rate cut. He recalled that he had voted for a rate cut in August 2017, when all components of inflation had experienced downward trends, upside risks to inflation had reduced, and growth was weaker.

Shaktikanta Das said neutral stance will provide flexibility and the room to address challenges to the sustained growth of the Indian economy over the coming months, as long as the inflation outlook remains benign. However Governor is also worried about the slowdown, Governor said global growth is also losing traction amidst lingering trade tensions and uncertainty around Brexit, looking ahead, there are signs of domestic growth slowing down, recent high-frequency indicators point to investment demand losing some traction, with production of capital goods and import of capital goods contracting in recent months. High-frequency indicators also suggest moderation in demand (passenger cars, consumer durables, motorcycles, and tractor sales).

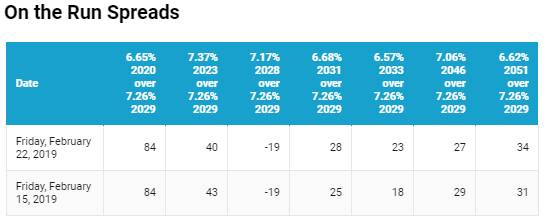

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 2 bps up at 7.41% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 5 bps up at 7.01% and the 6.68% 2031 bond yields close 5 bps up at 7.69%. The long bond, the 7.06% 2046 bond saw yields stay flat at 7.68% on weekly basis.

OIS market saw one-year yield close down by 1 bps and five-year OIS yield close up by 2 bps last week. One-year OIS yield closed at 6.25% while five-year OIS yield closed at 6.34%. OIS yields will stabilize at current levels given the sharp fall in yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 747 billion as of 22nd February 2019. Liquidity was in a surplus of Rs 117 billion as of 15th February 2019.

Since January 2019,FIIs exposure to government securities fell by more than USD 1 billion

In the beginning of January 2019, FIIs exposure to government securities was at Rs 2087 billion.Since then, FIIs have sold government securities and as on 22nd February 2019, FIIs exposure to government securities was at Rs 2001 billion, down by Rs 85.98 billion.

As on 22nd February, FII debt utilisation status stood at 56.69% of total limits, 31 bps lower against the previous week. FII investment position was at Rs 4046 billion in INR debt. FII investment position stands at Rs 2001 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2045 billion in corporate bonds.

· For the week ended 22nd February, credit spreads were mixed.Three-year AAA corporate bonds were trading at levels of 8.55%, spreads were 3 bps up at 153 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.60%. Spreads were 8 bps higher at 141 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.90% with spreads 4 bps higher at 135 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.18% and 7.75% levels at spreads of 79 bps and 125 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.34% and 7.70% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.32% and 8.55% levels respectively.

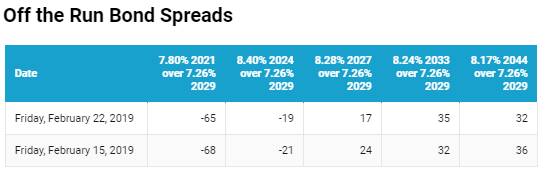

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the short end on profit taking in the 5 year G-sec

· Off the run bond spreads with the 10-year G-sec were mixed last week,

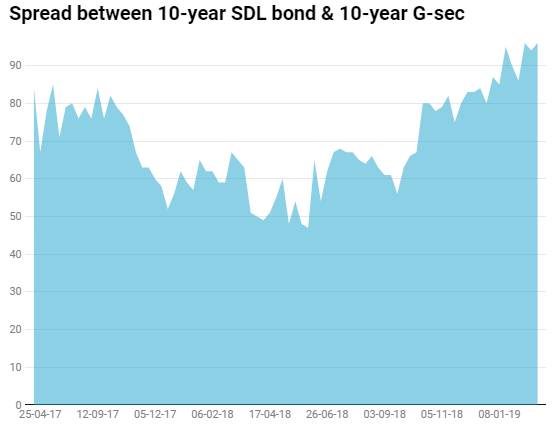

· On the 18th February 2019 auction, the spread between SDLs with 10-year G-sec came in at 96 bps. On 12th February 2019 auction, the spread between SDLs with 10-year G-sec was at 94 bps.