Bond market sentiments are turning distinctly positive with INR strengthening to below Rs 70 to the USD, FIIs turning net buyers of bonds, central banks across the globe turning dovish and RBI buying bonds through OMOs to infuse liquidity into the system.

The 10 year benchmark government bond yield fell by 1bps last week while credits saw spreads coming off, as yields fell across the curve. Sentiments are likely to stay positive on markets slowly removing pre election uncertainty.

The INR strengthened last week as ECB promised to hold rates at record lows till end of this year and longer if required and added liquidity through long term refinance operations. The Fed will keep rates on hold on growth uncertainties and a weak Fed jobs data. Global bond yields fell sharply on ECB policy.

RBI is adding Rs 250 billion of liquidity through OMO bond purchase auctions in the 1st half of this month, taking total OMO purchases for this fiscal year to close to Rs 3 trillion, which is just marginally below 50% of the gross borrowing for the year. OMO purchases have helped banks carrying excess SLR to pare down bond holdings and this will give them space to participate in government bond auctions next fiscal year.

RBI is expected to lower the repo rate by 25bps in its April policy meet and this coupled with OMO purchases will keep bond market sentiments positive,

Equity markets rallied last week on the back of the market starting to factor in reelection of the current government in the May polls. The election outcome can be completely different from market expectations but until then expectations will drive sentiments. The equity market sentiments are also improving sentiments for bonds and currency.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 1 bps down at 7.37% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 2 bps down at 6.94% and the 6.68% 2031 bond yields close 1 bps down at 7.69%. The long bond, the 7.06% 2046 bond saw yields close 5 bps up at 7.73% on weekly basis.

One-year yield closed down by 2 bps and five-year OIS yield closed down by 2 bps last week. One-year OIS yield closed at 6.13% while five-year OIS yield closed at 6.14%,

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 104 billion as of 8th March 2019. Liquidity was in a deficit of Rs 28 billion as of 1st March 2019.

FIIs exposure to corporate debt is rising

As on 8th March, FIIs exposure to corporate debt was at Rs 2094.69 billion, rising to its highest levels in the last 10 months. During the week, FIIs bought Rs 46.70 billion corporate bonds on the back of stronger rupee and steady bond yields.

As on 8th March, FII debt utilisation status stood at 56.50% of total limits, 62 bps higher against the previous week. FII investment position was at Rs 4033 billion in INR debt. FII investment position stands at Rs 1938 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2094 billion in corporate bonds.

· For the week ended 7th March, credit spreads were down. Three-year AAA corporate bonds were trading at levels of 8.40%, spreads were 11 bps lower at 139 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.32%. Spreads were 11 bps lower at 132 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.85% with spreads 11 bps lower at 132 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.23% and 7.60% levels at spreads of 83 bps and 112 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.41% and 7.73% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.22% and 8.45% levels respectively.

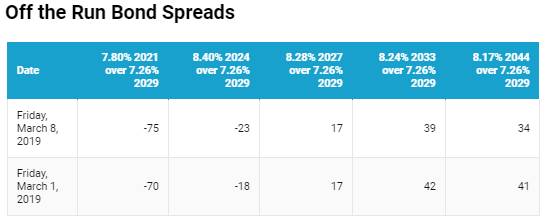

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve

· Off the run bond spreads with the 10-year G-sec largely fell last week

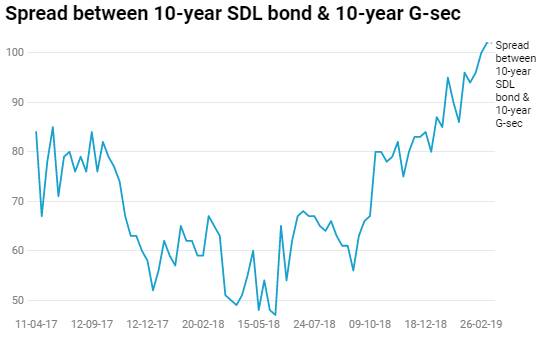

· On the 05th March 2019 auction, the spread between SDLs with 10-year G-sec came in at 102 bps. On 26th February 2019 auction, the spread between SDLs with 10-year G-sec was at 100 bps.