The financial year end 31st March is always a difficult month for bond markets given tight liquidity conditions and prospects of supply hitting the markets in April, through fresh government borrowing. This year, the last week of March looks to be even more hectic for markets given many events including a long maturity USD/INR swap auction.

Bond yields will be volatile this week as events unfold and tight liquidity conditions would add to volatility.

RBI will conduct its first long maturity USD/INR swap auction for USD 5 billion on the 26th of March. The auction is at a time when the INR has rallied strongly against the USD, touching 2019 highs. Global markets closed volatile last Friday, with bond yields plunging, equities falling sharply and Yen rising on safe haven demand for currencies. The swap may see the INR falling as demand for the currency rises ahead of the swap. A weak INR may hurt bond market sentiments.

The RBI will release the government borrowing calendar for the first half of fiscal 2019-20 and also indicative SDL issues. The government is slated to borrow Rs 7.04 trillion in the coming fiscal year and markets will brace for supply starting April. Last fiscal year, the government did not front load the borrowing and the same could be the case this year, given elections in May and a new budget in July. However, if the government front loads borrowing, bond yields could rise sharply.

Liquidity closed last week in deficit of over Rs 1 trillion and this deficit would rise this week on year end demand for funds. The market is also credit risk averse given the issues in credit markets post IL&FS default. Borrowing cost could rise sharply as borrowers look for refinance in a credit risk averse market.

Mutual funds witness large scale outflows and may resort to selling if there is not enough liquidity to meet redemptions and this would also have an impact on bond and money market securities yields.

Bond yields, if sold off, would find support at higher levels on expectations of RBI rate cut in its April policy meet. A dovish Fed too is positive for bonds though this would not have an immediate impact on yields given many other issues facing the market.

The 10-year benchmark government bond, the 7.26% 2029 bond, was unchanged at 7.34% on a weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 1 bps down at 6.86% and the 6.68% 2031 bond yield closed 4 bps down at 7.64%. The long bond, the 7.06% 2046 bond saw yields close 1 bps up at 7.71% on a weekly basis.

One-year OIS yield closed up by 2 bps and five-year OIS yield closed up by 1 bps. One-year OIS yield closed at 6.02% while five-year OIS yield closed at 6.08%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 1018 billion as of 22nd March 2019. Liquidity was in a deficit of Rs 509 billion as of 15th March 2019.

FIIs exposure to corporate debt is rising sharply

As on 22nd March, FIIs exposure to corporate debt was at Rs 2147 billion, rising to its highest levels in the last 11 months. During the week, FIIs bought Rs 47 billion of corporate bonds on the back of stronger rupee and steady bond yields.

As on 22nd March, FII debt utilisation status stood at 57.81% of total limits, 87 bps higher against the previous week. FII investment position was at Rs 4126 billion in INR debt. FII investment position stands at Rs 1979 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2147 billion in corporate bonds.

· For the week ended 22nd March, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.18%, spreads were 10 bps higher at 126 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.35%. Spreads were 2 bps lower at 126 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.63% with spreads 7 bps lower at 115 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.16% and 7.50% levels at spreads of 91 bps and 110 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.37% and 7.70% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 7.87% and 8.10% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields fell by 4-8 bps while 10-year G-sec yields remained unchanged.

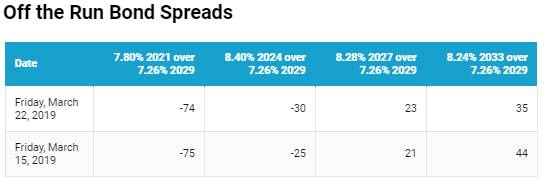

· Off the run bond spreads with the 10-year G-sec were mixed last week

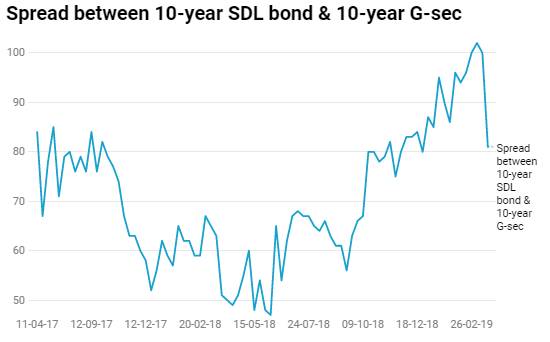

· On the 19th March 2019 auction, the spread between SDLs with 10-year G-sec came in at 81 bps. On 12th March 2019 auction, the spread between SDLs with 10-year G-sec was at 100 bps.