Bond markets saw a sharp rise in yields across segments, as markets fretted over elections, rate cut uncertainty and supply. 10 year benchmark gsec yield rose by 6bps week on week while one and five year OIS yields rose by 4bps and 6bps respectively.

Elections, apart from results uncertainty, will also lead to a fresh budget in July and markets are wondering about fiscal prudence. RBI policy stance staying neutral has led to rate cut uncertainty while government bond supply of Rs 170 billion is hitting the market every week.

Yields rose sharply across the credit curve on the back of contagion worries post default by Essel Group Companies, that hit investors in FMPs. One year CP and CD yields rose by 20bps and 10 bps respectively while 3, 5 and 10 year AAA corporate bond yields rose by 22bps, 10bps and 15bps respectively.

The government bond and OIS market may get some respite on weak IIP growth data for February 2019 and fall in core inflation in March 2019. IIP growth for February was at 0.1% against 6.9% seen in February 2018 and manufacturing growth was negative 0.3% against 8.4%. CPI inflation for March 2019 came in at 2.86% against 2.57% seen in February. Core CPI inflation fell to below 5% levels after staying above 5% levels for well over a year.

The credit markets, however, will continue to stay weak on fresh credit events. Default by Essel Group companies has prompted MFs to either increase maturity of FMPs or pay back investors less than the capital invested.

This credit event has resulted in nervousness among MF investors, which could lead to redemptions and selling of credits by MFs to meet redemptions. Incremental demand for credits will also fall on worries over rise in spreads.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 6 bps up at 7.41% on a weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 7 bps up at 7.12% and the 6.68% 2031 bond yield closed 5 bps up at 7.68%. The long bond, the 7.06% 2046 bond saw yields close 2 bps down at 7.63% on a weekly basis.

One-year OIS yield closed up by 4 bps and five-year OIS yield closed up by 6 bps. One-year OIS yield closed at 6.10% while five-year OIS yield closed at 6.28%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 644 billion as of 12th April 2019. Liquidity was in a deficit of Rs 14.9 billion as of 5th April 2019.

Since IL&FS default, CP outstanding has fallen by 24%

As on 31st March 2019, total CP outstanding was at Rs 4.83 trillion, in September 2018 it was seen at Rs 6.40 trillion, a fall of 24%. The IL&FS default and market panic on DHFL caused a deep stress on credit markets leading to the sharp fall in CP outstanding.

As on 12th April, FII debt utilisation status stood at 57.69% of total limits,54 bps lower against the previous week.. FII investment position was at Rs 4028 billion in INR debt. FII investment position stands at Rs 1906 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2132 billion in corporate bonds.

· For the week ended 12th April, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.13%, spreads were 9 bps higher at 102 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.30%. Spreads were 6 bps lower at 97 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.70% with spreads 9 bps higher at 115 bps.

· Three months and twelve months PSU bank CD yields were trading at 6.83% and 7.50% levels at spreads of 53 bps and 113 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.10% and 7.32% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 7.90% and 8.15% levels respectively.

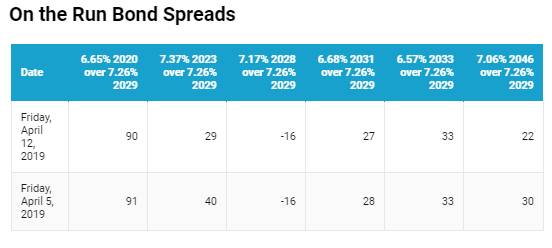

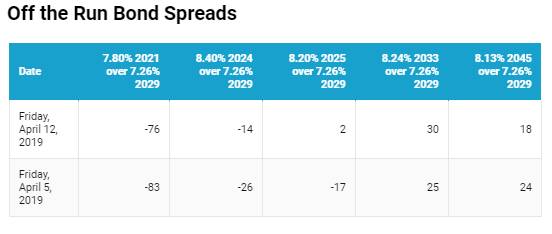

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields rose by 5-6 bps while 10-year G-sec yields rose by 6 bps on a weekly basis.

· Off the run bond spreads with the 10-year G-sec were mixed last week

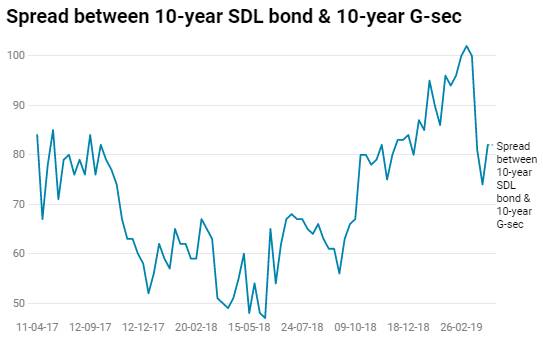

· On the 9th April 2019 auction, the spread between SDLs with 10-year G-sec came in at 82 bps. On 26th March 2019 auction, the spread between SDLs with 10-year G-sec was at 74 bps.