Liquidity deficit went above the Rs 1 trilion mark last week, as high government cash balance and rise in currency in circulation sucked out liquidity from the system. Liquidity deficit will be high in the first quarter of this fiscal on low government spending due to ongoing elections and rise in election demand for cash. Until the budget for 2019-20 post elections, government spending will not pick up and liquidity will be impacted by high government cash balances on the back of market borrowing and advance tax collections in June.

Government cash balance with the RBI is around Rs 500 billion and currency in circulation rose by around Rs 250 billion in the week to 12th April.

RBI is conducting its second long term USD.INR swap auction on the 23rd of April, which will infuse around Rs 350 billion of liquidity into the system.

RBI may resort to OMO bond purchase auctions in May to infuse liquidity if the INR is volatile on election uncertainty. Given the fact that the central bank cut rates on lower inflation expectations and on weak economic data, liquidity will have to be kept easy to ensure rate transmission. Bank one year CD yields are 140 bps over the repo rate, indication that cost of funds is yet to reflect fully the rate cuts.

Government bond yields are likely to stay ranged at higher levels until election results on 23rd May. Credit markets will continue to stay stressed and markets will be watchful of DHFL repaying its maturing debt obligations. OIS yields are likely to stay ranged at current levels on lack of fresh near term cues.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 1 bps up at 7.42% on a weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 2 bps up at 7.14% and the 6.68% 2031 bond yield closed 3 bps up at 7.71%. The long bond, the 7.06% 2046 bond yields was unchanged at 7.63% on a weekly basis.

One-year OIS yield closed down by 3 bps and five-year OIS yield closed down by 3 bps. One-year OIS yield closed at 6.07% while five-year OIS yield closed at 6.25%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 1064 billion as of 18th April 2019. Liquidity was in a deficit of Rs 644 billion as of 12th April 2019.

MF’s exposure to CDs increased by 26% in March 2019

As on March 2019, Mutual Fund’s exposure to CDs (Certificate of Deposits) was at Rs 2.02 trillion against Rs 1.60 trillion in February 2019. 26% higher. Banks CD iisuances were higher in March on demand for funds for year end and mutual funds took up by the supply, as credit risk aversion has lowered demand for CPs.

As on 19th April, FII debt utilisation status stood at 57.70% of total limits,1 bps higher against the previous week.. FII investment position was at Rs 4029 billion in INR debt. FII investment position stands at Rs 1908 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2120 billion in corporate bonds.

· For the week ended 19th April, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.15%, spreads were 5 bps higher at 107 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.30%. Spreads were flat at 97 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.73% with spreads 2 bps higher at 117 bps.

· Three months and twelve months PSU bank CD yields were trading at 6.85% and 7.60% levels at spreads of 53 bps and 114 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.10% and 7.32% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 7.90% and 8.15% levels respectively.

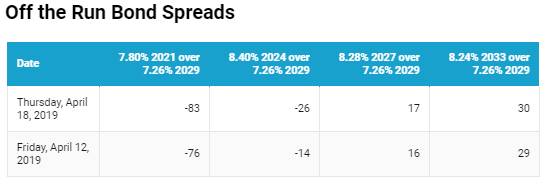

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields fell by 1 bps while 10-year G-sec yields rose by 1 bps on a weekly basis.

· Off the run bond spreads with the 10-year G-sec largely rose last week, long end bond yields were untraded last week

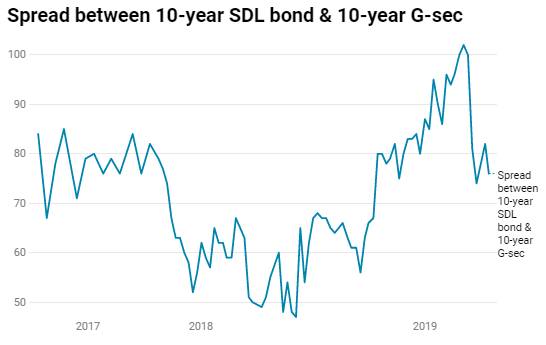

· On the 15th April 2019 auction, the spread between SDLs with 10-year G-sec came in at 76 bps. On 09th March 2019 auction, the spread between SDLs with 10-year G-sec was at 82 bps.