Government bond yields are expected to trend down from highs on the back of RBI rate cut and easing of higher than expected borrowing worries. The government is also expected to issue a new 10 year benchmark government bond in replacement of the existing 10 year benchmark bond, the 7.26% 2029 bond, which has reached an outstanding of close to Rs 1.14 trillion.

RBI October policy review will see the RBI delivering a 35bps to 40bps rate cut given the weak economy and the need to push growth. Good monsoons, falling credit offtake (credit growth has come off to 10.26% levels in September against over 12% levels seen a couple of months ago) and stable oil prices despite Middle East tensions will prompt RBI to cut rates. Guidance too is expected to be accommodative given that both inflation and growth outlook are weak.

The bond market worries of higher than expected borrowing for the 2nd half of this fiscal year is likely to ease in October. The market is worried about the funding of the Rs 1.45 trillion fiscal gap that has arisen from the big bang tax rate cuts effected this month. The government has not raised fiscal deficit or borrowing targets and is still awaiting incoming data on revenues. The higher compliance rate on tax rate cuts is also likely to see more taxes coming into the government’s kitty.

In case of revenue shortfall, the government can access global bond markets to fund extra borrowing. Higher domestic borrowings can be funded by increasing FII limits in bonds, as low to negative global bond yields can prompt FIIs to search for higher yields in INR Bonds.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps down at 6.74% on a weekly basis. In the same line, the benchmark 5-year bond, the 7.32% 2024 bond saw yields down 4 bps at 6.42% and the 6.68% 2031 bond yield closed 5 bps down at 6.94%. The long bond, the 7.63% 2059 bond yield closed 7 bps down at 7.17% levels.

One-year OIS yield closed flat and five-year OIS yield closed down by 3 bps. One-year OIS yield closed at 5.10% while five-year OIS yield closed at 5.13%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 1389.57 billion as of 27th September 2019. Liquidity was in a surplus of Rs 324 billion as of 20th September 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as 10-year G-sec yield fell by 5 bps while long-end bond yields rose by 2-10 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec rose last week

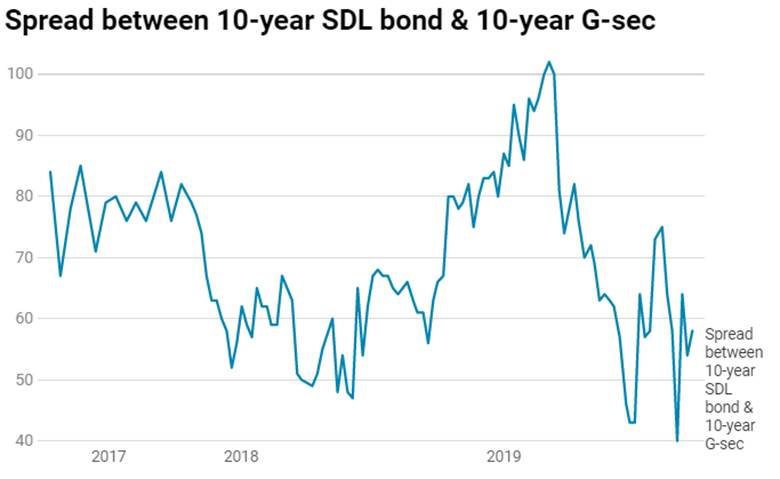

· On the 24th September 2019 auction, the spread between SDL with 10-year G-sec came in at 52 bps,states borrowed Rs 203.50 billion last week through SDLs auction. On 17th September 2019 auction, the spread between SDLs with 10-year G-sec was at 58 bps.