The bond markets reacted negatively to the big bang tax rate cut by the government on the 20th of September. The markets are worried about excess bond supply if the government borrows more than budgeted to fund the Rs 1.45 trillion fiscal hole caused by the rate cut. The higher than budgeted dividend of Rs 1.76 trillion paid by the RBI to the government is only enough to bridge part of the slowdown in revenues due to weak economic growth and will not in anyway go to bridge the new fiscal gap caused by the tax rate cut. The markets are also questioning further rate cuts by the RBI given the central bank’s concern on a higher fiscal deficit. Yields at the short end of the curve rose on this worry. However, rate cut of 35bps to 40bps is still very much on cards in the RBI poicy review in October.

The government by giving a tax rate cut has put money in the hands of corporates to make investments or give money to shareholders who in turn can spend on consumption or investment or save. The government by itself is not borrowing and spending, which is largely inflationary in nature. Increase in investments will bring in supply and keep inflation down in the economy even as more jobs are created, which improves consumption and boosts growth that in turn brings in more revenues to the government, keeping down the fiscal deficit. RBI Governor, Sakthikanta Das, said the tax rate cut was a bold move and will boost growth.

The government is also keen on boosting demand to push growth and is taking steps to make loans available for consumption and investments. RBI will act as an enabler through monetary policy given the lack of inflation and weak growth. In addition to rate cuts, RBI may also increase OMO bond purchases if liquidity tightens and this will absorb any increase in government borrowing.

The bond market will be cautious till the government comes out with the funding plans for the fiscal hole, though short end of the curve yields will fall on low rates and high liquidity.

10 year government bond yield rose on the back of expectations of a new benchmark bond given that the outstanding on the 7.26% 2029 bond is Rs 1140 billion against an informal cap of Rs 1200 billion. The bond market is also worried about fiscal slippages on the back of weak economic growth that may lead to higher borrowings.

Liquidity is likely to see outflows on advance tax payments but will come back through government spending.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close bps up 15 at 6.79% on a weekly basis. In the same line, the benchmark 5-year bond, the 7.32% 2024 bond saw yields up 26 bps at 6.46% and the 6.68% 2031 bond yield closed 12 bps up at 6.99%. The long bond, the 7.63% 2059 bond yield closed 24 bps up at 7.24% levels.

One-year OIS yield closed up by 2 bps and five-year OIS yield closed up by 11 bps. One-year OIS yield closed at 5.10% while five-year OIS yield closed at 5.16%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 324 billion as of 20th September 2019. Liquidity was in a surplus of Rs 1764 billion as of 13th September 2019.

Weekly G-sec Curve Spread Analysis

· The 5*10 segment of the yield curve flattened with 5 year G-sec yields rising faster than 10 year G-sec yields on the back of worries of RBI not cutting rates in its October policy review. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec remained steady last week

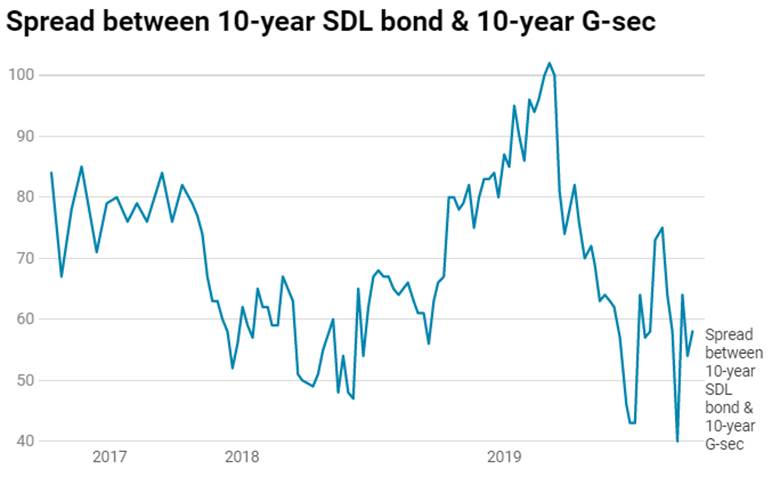

· On the 17th September 2019 auction, the spread between SDL with 10-year G-sec came in at 58 bps,states borrowed Rs 75 billion last week through SDLs auction. On 09th September 2019 auction, the spread between SDLs with 10-year G-sec was at 54 bps.