The release of weak GDP growth data for the1st quarter of fiscal 2019-20, where GDP growth came in at 5%, against full year growth forecasts of around 7%, increased markets expectations of rate cuts by the RBI in its October 2019 policy review. The 5 year OIS yield closed at 4.88%, well below the current Repo Rate of 5.40% and all receivers of the swap incur negative carry and are betting on further rate cuts and also RBI letting overnight rates collapse to well below repo rate levels.

The sharp fall in OIS yields and the inversion of the curve where 5 year OIS yield is lower than the 1 year OIS yield, is in contrast to the government bond yield curve where the the 5*10 segment of the curve has steepened with rising 10 year government bond yields. To some extent, the issue of a new benchmark 10 year government bond could flatten the curve However, the spread between 5 year OIS and 5 year government bond is at over 130bps, indicating that the market is worries about bond supply.

The OIS yield curve is factoring deep rate cuts of more than 70bps but there is a growing expectation in the market that RBI may remove the floor on overnight rates by not accepting bids at the repo rate in the reverse repo rate auctions. The market is flush with liquidity on the back of RBI paying out dividend of Rs 1.76 trillion to the government, and is placing in large bids in reverse repo auctions.

RBI removing the floor on reverse repo rates will lead to overnight yields plunging to levels of below 2% and this would lead to a sharp drop in money market securities and short end of the curve yields.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 2 bps up at 6.59% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields down 3 bps at 6.23% and the 6.68% 2031 bond yield closed 4 bps down at 6.79%. The long bond, the 7.63% 2059 bond, yields remained unchanged at 6.98% levels.

One-year OIS yield closed down by 13 bps and five-year OIS yield closed down by 20 bps. One-year OIS yield closed at 5.02% while five-year OIS yield closed at 4.88%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 2157 billion as of 6th September 2019. Liquidity was in a surplus of Rs 1291 billion as of 30th August 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the short end of the curve, as 10-year G-sec yield rose by 3 bps while short-end bond yields fell by 2-5 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec remained steady last week

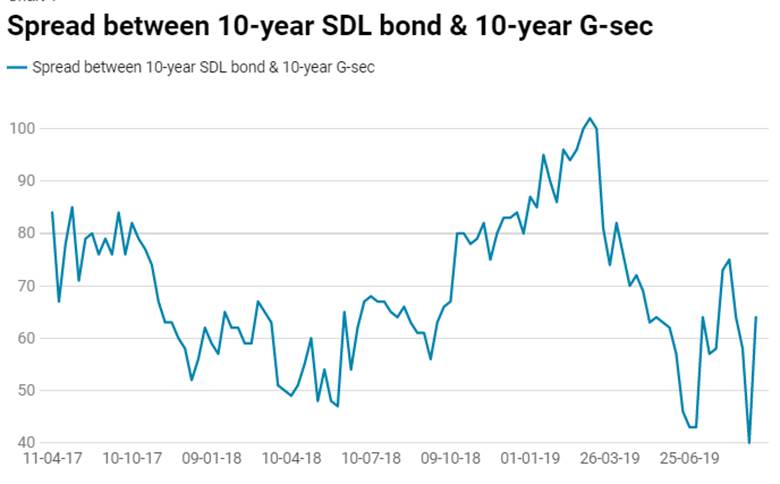

· On the 3rd September 2019 auction, the spread between SDL with 10-year G-sec came in at 64 bps,states borrowed Rs 143 billion last week through SDLs auction. On 27th August 2019 auction, the spread between SDLs with 10-year G-sec was at 40 bps.