The sharp deceleration in GDP growth in the 4th quarter of fiscal 2018-19, with growth at 5.8% against full year 2018-19 growth of 6.8%, could prompt RBI to cut rates by 50bps in its policy review this week. A strong political mandate for the NDA government will ensure continuity of fiscal policy and reforms and low inflation in the economy at below RBI target of 4% will aid the RBI in its growth policy. Falling global bond yields with 10 year UST yields at 19 months lows suggest prolonged hold on rates by the Fed with a possibility of rate cuts.

RBI may look at the lack of transmission of rates to the economy, given the credit concerns over NBFCs and given rising banks bad loan provisioning, with banks from ICICI Bank and PNB showing sharp rise in provisions for bad loans. Lack of credit plus weakness in demand with falling auto sales, falling volume growth for FMCGs and rising inventory in real estate is compounding the credit growth issue.

Bond markets saw bullish activity on rate cut hopes with yields falling across the curve. The 30year government bond, the 7.59% 2059 bond saw yields falling 30bps post auction cut off a couple of weeks back, indicating the bullishness in the market.

A 50bps rate cut will drive down yields sharply across the curve before profit taking sets in. a A 25bps rate cut is already factored in the market and yields will stabilize at lower levels unless RBI sounds caution on more rate cuts.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 20 bps down at 7.03% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 11 bps down at 6.85% and the 6.68% 2031 bond yield closed 17 bps down at 7.30%. The long bond, the 7.63% 2059 bond yields saw yields falling sharply in the auction at levels of 7.33%.

One-year OIS yield closed down by 5 bps and five-year OIS yield closed down by 9 bps. One-year OIS yield closed at 5.80% while five-year OIS yield closed at 5.86%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 374 billion as of 31st May 2019. Liquidity was in a deficit of Rs 218 billion as of 24th May 2019.

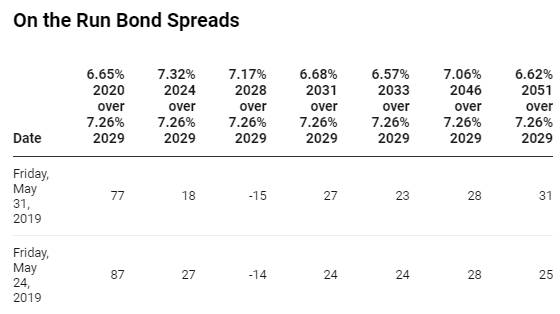

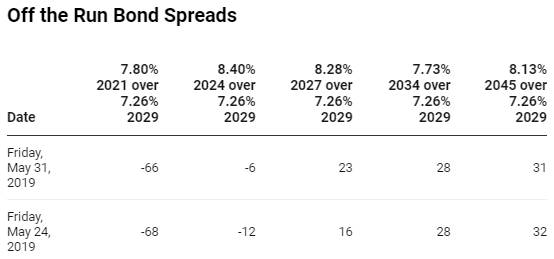

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as long end bond yields fell by 14-20 bps while 10-year G-sec yields fell by 20 bps on a weekly basis. 10-year G-sec yields fell sharply last week to 7.03% the lowest level since 6th December 2017. Bond yields fell sharply as the market is expecting another rate cut from RBI.

· Long end off the run bond spreads with the 10-year G-sec were mixed last week,

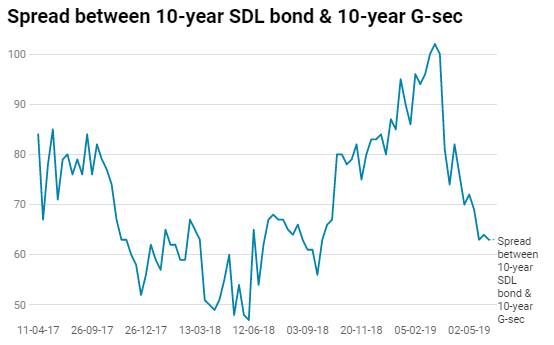

· On the 30th May 2019 auction, the spread between SDLs with 10-year G-sec came in at 63 bps. On 21st May 2019 auction, the spread between SDLs with 10-year G-sec was at 64 bps