The 2 year government bond saw yields at 5.87% levels with strong bids seen in the last auction. However the benchmark 10 year bond has seen yields rise by over 25 bps from lows over the last three weeks on worries of extra borrowing by the government to provide stimulus to the economy. Expectations of a new 10 year bond is also hurting the levels for the 7.26% 2029 bond. Read our note on the New 10 year bond issuance.

The OIS yield curve is however inverted with the 5 year OIS yield trading 10bps below the 1 year OIS yield, indicating Repo rate expectations at 5% from current 5.4%. Liquidity is also expected to be comfortable despite the recent fall in the INR on the back of the fall in the Yuan.

The steep government bond curve is in contrast to the OIS curve and what can be inferred from this contrast? The markets expect interest rates to stay low over an extended period of time, but is worried about the long end of the government bond curve.

The worry over longer end government bond yields is that at some point of time down the line, inflation will pick up if government spends to pump prime the economy and this will result in rising bond yields.

The short end is a safer bet given rate cut expectations and high liquidity and that is driving yields down at the short end of the curve.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 3 bps up at 6.57% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 5 bps lower at 6.28% and the 6.68% 2031 bond yield closed 1 bps higher at 6.84%. The long bond, the 7.63% 2059 bond, saw yields close up 5 bps at 6.97% levels.

One-year OIS yield closed down by 2 bps and five-year OIS yield closed down by 1 bps. One-year OIS yield closed at 5.18% while five-year OIS yield closed at 5.08%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1218 billion as of 23rd August 2019. Liquidity was in a surplusof Rs 1334 billion as of 16th August 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the short end of the curve, as 10-year G-sec yield rose by 3 bps while the short-end bond yields fell by 2-5 bps.

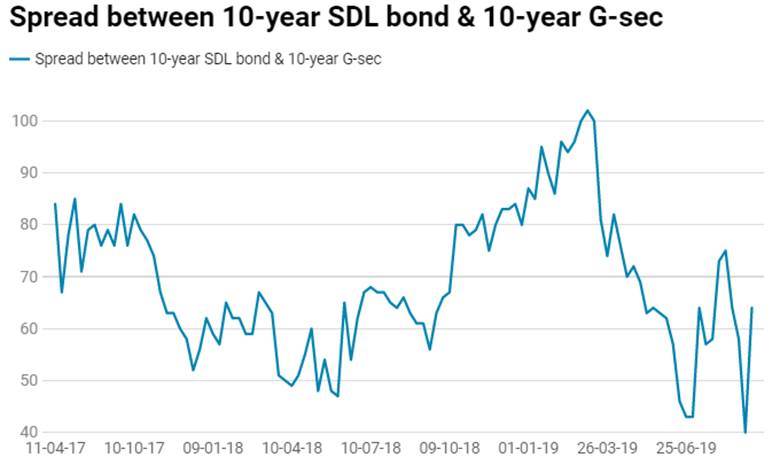

· Long end off the run bond spreads with the 10-year G-sec remained steady last week

· On the 20th August 2019 auction, the spread between SDL with 10-year G-sec came in at 59 bps,states borrowed Rs 59.50 billion last week through SDLs auction. On 13th August 2019 auction, the spread between SDLs with 10-year G-sec was at 65 bps.