Fed rate cut bets pushed down yields on the 10 year UST and also drove down the USD against global majors. FIIs have pumped in USD 1 billion into government bonds post elections in May while the INR has strengthened against the USD.

RBI, by changing its policy stance to accommodative,has increased expectations of more rate cuts in its forthcoming policies. The central bank will also keep liquidity easy to ensure pass through of lower rates.

FIIs will continue to pump in money into INRBONDS, given falling USD and falling UST yields. Government bond yields will trend down while corporate bond yields will follow with a lag given the current ongoing credit crisis in the economy.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps down at 6.97% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 6 bps down at 6.79% and the 6.68% 2031 bond yield closed 9 bps down at 7.21%. The long bond, the 7.63% 2059 bond yields saw yields close 8 bps down at levels of 7.25%.

One-year OIS yield closed down by 9 bps and five-year OIS yield closed down by 7 bps. One-year OIS yield closed at 5.71% while five-year OIS yield closed at 5.79%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 620 billion as of 7th June 2019. Liquidity was in a deficit of Rs 374 billion as of 31st May 2019.

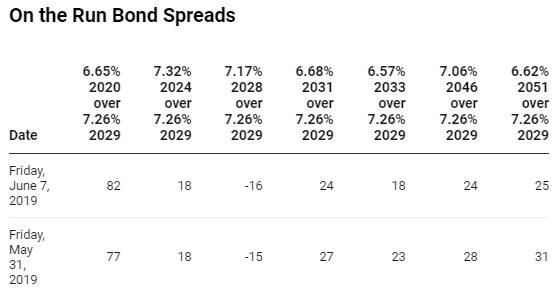

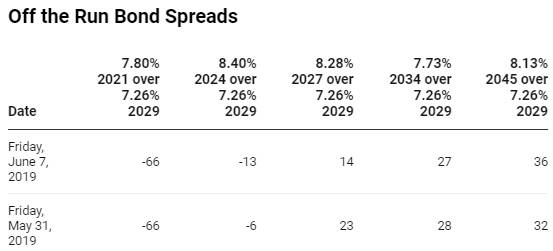

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields fell by 9-12 bps while 10-year G-sec yields fell by 6 bps on a weekly basis. Long end bond yields fell sharply after RBI change its stance to accommodative from neutral, which suggest rate hike is off the table. RBI tone was dovish and it highlights concerns on growth.

· Long end off the run bond spreads with the 10-year G-sec largely fell last week,

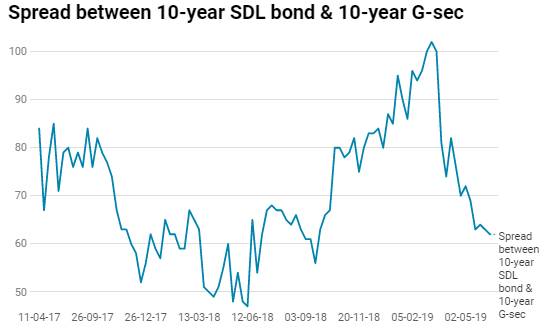

· On the 7th June 2019 auction, the spread between SDLs with 10-year G-sec came in at 62 bps. On 30th May 2019 auction, the spread between SDLs with 10-year G-sec was at 63 bps.