The “Noise” surrounding bond markets has increased in volume and this is moving bond yields at present. Bond yields are being jerked up and down on the various factors that are hitting the markets on an almost everyday basis. The most worrying noise for bonds is the prospects of higher than budgeted government borrowing and this has taken up the 10 year benchmark government bond yield by around 20bps from lows over the last couple of weeks.

Economic data and business sentiments have made the government to think about a stimulus plan. Economic data from IIP to trade are showing weak growth while inflation for July 2019 came in below RBI target of 4%. Globally there are fears of recession after the inversion of US treasury yield curve last week and there are stimulus measures expected from China and Germany for their respective economies. Read our economic data analysis for details.

Business sentiments in India are weak with auto sector facing production shutdowns while demand worries are hurting sectors from FMCG to real estate and construction. Topping it all is the worry on external demand on the back of the ongoing US-China trade war.

Indian corporates are reeling under debt burden and that is forcing groups right from Reliance Industries onwards to reduce debt through asset sales. Investment demand stays weak when both consumer demand is weak and corporates are resorting to asset sales.

Industry bodies have met the government and have highlighted their concerns. The government is now considering a stimulus package for the affected sectors and this package could be funded by more borrowings, as fiscal deficit would rise given higher spending and lack of tax revenues.

The government may access global bond market to fund the stimulus, which would be yield positive in India, as RBI rate cuts and low inflation expectations would spur bond demand. However if the government funds the borrowings through domestic borrowing, the markets may react negatively if the borrowings are very high.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps up at 6.54% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 10 bps higher at 6.33% and the 6.68% 2031 bond yield closed 3 bps higher at 6.83%. The long bond, the 7.63% 2059 bond, saw yields close up 4 bps at 6.92% levels.

One-year OIS yield closed down by 1 bps and five-year OIS yield closed down by 2 bps. One-year OIS yield closed at 5.20% while five-year OIS yield closed at 5.09%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1334 billion as of 16th August 2019. Liquidity was in a surplusof Rs 1762 billion as of 9th August 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as 10-year G-sec yield rose by 14 bps while the long-end bond yields fell by 2-5 bps.

· Long end off the run bond spreads with the 10-year G-sec declined last week

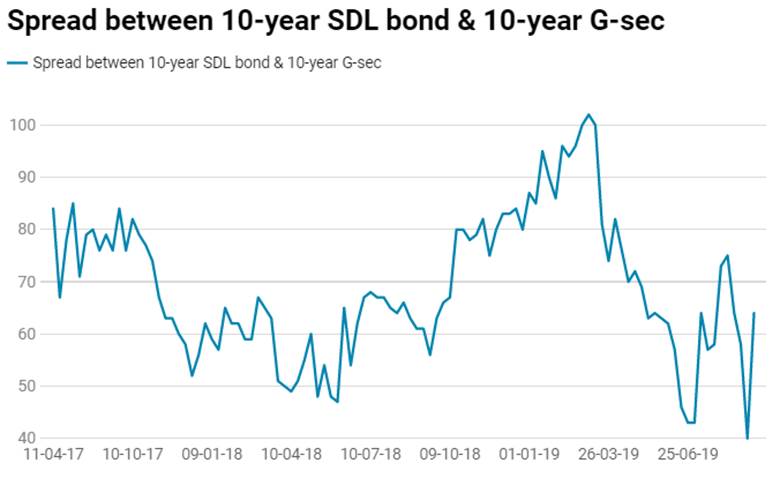

· On the 6th August 2019 auction, the spread between SDL with 10-year G-sec came in at 75 bps,states borrowed Rs 128 billion last week through SDLs auction. On 30th July 2019 auction, the spread between SDLs with 10-year G-sec was at 73 bps.