Interest rate curves fell sharply last week on the back of multiple positive cues for rates. Globally, UST yields and German Bund yields have collapsed on the back of rising expectations of Fed rate cut and ECB staying highly accommodative on policy. Economic data including inflation are all pointing to a long period of low rates in global economies.

On the domestic front, weak economic data with IIP growth for April at low single digits, CPI inflation below RBI rateget rate of 4% and weak export growth at low single digits for May 2019 are all pointing to a slowing economy. RBI has turned accommodative and is backing up rate cuts with liquidity infusion. RBI is buying bonds through OMOs and has alread infused Rs 400 billion through OMO bond purchases and will add another Rs 125 billion later this month.

The bond market will bet on more rate cuts in RBI’s next policy meet in August and with liquidity being kept easy, bond yields will trend down sharply. The government bond yield curve is still steep with the spread between the 7% 2021 bond and the 7.26% 2029 bond at 50bps and this spreads will come off on rate cut bets.

OIS yields fell sharply last week on the back of collapse in global bond yields. The OIS market is factoring in more rate cuts, which could be as much as 50bps over the next few policy meets.

Credit spreads rose on the back of ongoing credit issues in the credit markets, but spreads will come off, as markets start to search for yields.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps down at 6.92% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 7 bps down at 6.72% and the 6.68% 2031 bond yield closed 8 bps down at 7.13%. The long bond, the 7.63% 2059 bond yields saw yields close 3 bps down at levels of 7.22%.

One-year OIS yield closed down by 14 bps and five-year OIS yield closed down by 16 bps. One-year OIS yield closed at 5.57% while five-year OIS yield closed at 5.63%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 490 billion as of 14th June 2019. Liquidity was in a surplust of Rs 620 billion as of 7th June 2019.

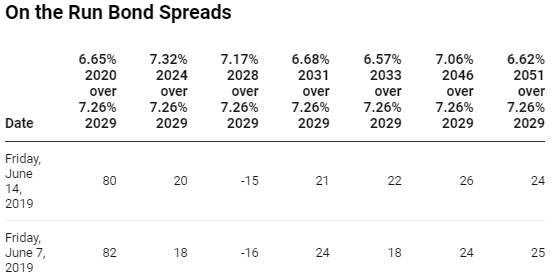

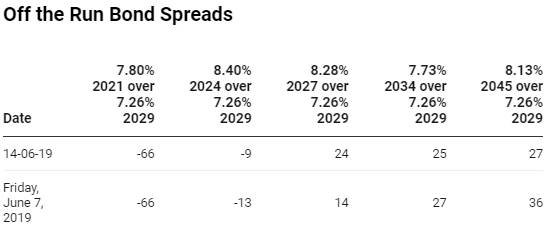

Weekly G-sec Curve Spread Analysis

· The yield curve is distorted at the long end of the curve, as the spread between the long end bond yields with 10-year G-sec is mixed, For 6.68% 2031 & 6.62% 2051 spreads with 10-year G-sec has fallen and for 6.57% 2033 & 7.06% 2046 spreads with 10-year G-sec has risen. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec were mixed last week,

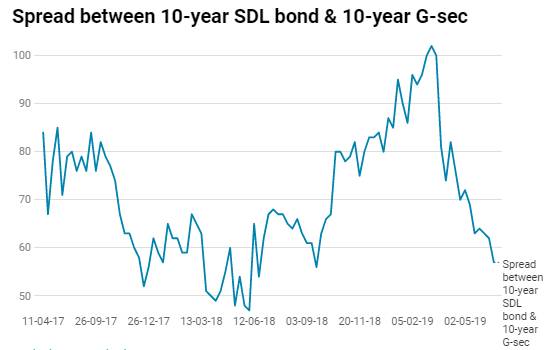

· On the 11th June 2019 auction, the spread between SDLs with 10-year G-sec came in at 57 bps. On 3rd June 2019 auction, the spread between SDLs with 10-year G-sec was at 62 bps