The benchmark 10 year government bond, the 7.26% 2029 bond saw yields rise by 14bps week on week to close at levels of 6.49%. The yield on the bond rose despite the RBI lowering rates by 35bps and maintaining an accommodative policy. Profit taking coupled with a sharp depreciation in the INR on account of Kashmir status being changed and China devaluing the Yuan drove the INR down. The INR is likely to stay volatile but its depreciation will be capped, as government revokes the FPI tax norms and on sharp fall in crude oil prices.

The five year benchmark bond, the 7.32% 20234 bond saw yields falling last week while OIS yields fell sharply in anticipation of more rate cuts. Liquidity at Rs 1.76 trillion surplus is extremely easy and short end yields will stay down on rate cut expectations and liquidity.

The yield on the 10 year bond is likely to trend down once the positions in the market get adjusted. The conditions for yields to fall in the short term are still bullish and this is unlikely to change in the near term. The IIP growth for July came in at 2% and given production cuts across the automobile sector, the growth in IIP will stay muted or even trend down.

Crude oil prices fell sharply on demand worries, as US-China trade war intensified. Commodity prices except gold has fallen on the back of demand weakness with steel and base metal producers reporting slowing revenue growth.

Global bond yields are sharply down with US treasuries at multi year lows and German, French bond yields in deep negative territory. This suggests weak inflation expectations and accommodation by the Fed and ECB that will drive liquidity higher,

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 14 bps up at 6.49% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 2 bps lower at 6.23% and the 6.68% 2031 bond yield closed 4 bps higher at 6.80%. The long bond, the 7.63% 2059 bond, saw yields close up 12 bps at 6.88% levels.

One-year OIS yield closed lower by 15 bps and five-year OIS yield closed down by 18 bps. One-year OIS yield closed at 5.21% while five-year OIS yield closed at 5.11%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1762 billion as of 9th August 2019. Liquidity was in a surplusof Rs 1881 billion as of 2nd August 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as 10-year G-sec yield rose by 14 bps while the long-end bond yields fell by 2-5 bps.

· Long end off the run bond spreads with the 10-year G-sec declined last week

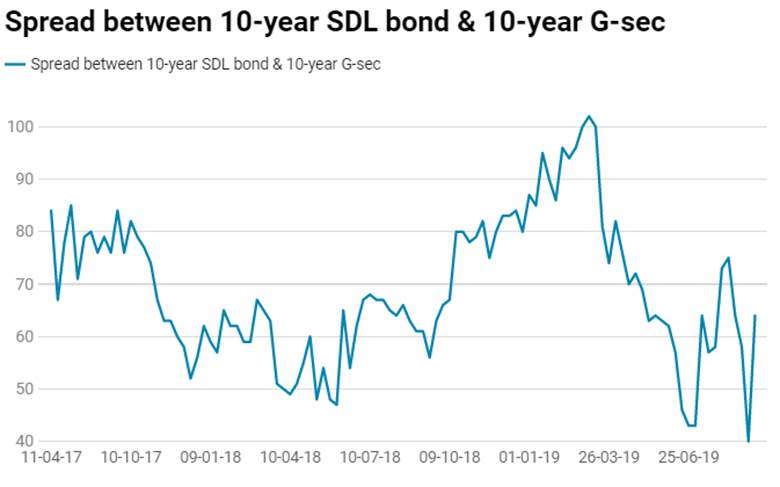

· On the 6th August 2019 auction, the spread between SDL with 10-year G-sec came in at 75 bps,states borrowed Rs 128 billion last week through SDLs auction. On 30th July 2019 auction, the spread between SDLs with 10-year G-sec was at 73 bps. (Chart 1).