The bond market is in for a sustained bull run with RBI, Fed and ECB all suggesting stimulus for their respective economies. The 10 year benchmark government bond yield is trading at levels of 6.86% and the yield is likely to trend down to below 6.50% post the union budget in July. The market is waiting for the fiscal numbers, as there are worries that fiscal pump priming would happen to support a flagging economy.

The government is unlikely to sharply deviate for the deficit targets set in the February 2019 budget and any small deviation would lead to markets pulling down bond yields.

RBI has bought Rs 525 billion of bonds through OMOs in the last two months and has lowered the net supply of bonds in this quarter. The net supply was Rs 814 billion against Rs 1870 of gross supply with redemptions and OMOs lowering the net supply.

RBI will continue to buy bonds through OMOs and will also be paying dividends to the government, which could also include giving back some of its historic reserves to the government. In this case, any additional government spending will be taken care of by a special dividend.

RBI signaled more rates in its June policy minutes and is only waiting for the budget and fiscal deficit numbers before reducing the rates. Fed and ECB too in their policy meets last week have hinted at more stimulus.

OIS yields rose last week on profit taking and budget positioning but will trend down again on dovish policy. Credit spreads are elevated and will come off given search for yields.

Liquidity will ease on government spending and RBI OMO and low rates coupled with easy liquidity will drive down yields at the short end of the curve.

RBI Minutes

Six members of the MPC voted unanimously to cut rates by 25bps due to the low inflation print. and as inflation remains well within the RBI target, members are giving more importance to flat economic growth. Members broadly suggested that inflation is expected to stay within the MPC’s mandated medium-term target of 4% despite the upside risks.

All-time dovish Ravindra Dholakia said- When inflation is under reasonable control and upside risks are muted, this is the right time to correct the high real rates of interest. Michael Patra said- The evolving macroeconomic configuration imparts urgency to strong policy support for the flagging economy in pursuance of the goals set for the MPC

However, the fiscal deficit appears to have dominated discussions, with members including Chetan Ghate & Viral Acharya highlighting the potential disruption government finances could cause. Viral Acharya said important upside risk to RBI’s projected inflation trajectory that I wish to highlight in particular that of fiscal slippage, The upcoming Union Budget is, therefore, key to understanding the inflation outlook, especially the response to ongoing distress in the agrarian economy, caused in part by low food prices and reflected in low rural inflation. RBI Governor Das said over the last few years, the central government has, by and large, followed a policy of fiscal prudence. It has adhered to the fiscal deficit glide path in the last 5 years, though at a somewhat slower pace than committed earlier.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 6 bps down at 6.86% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 2 bps down at 6.70% and the 6.68% 2031 bond yield closed 8 bps down at 7.05%. The long bond, the 7.63% 2059 bond yields remain unchanged at 7.22%.

One-year OIS yield closed up by 7 bps and five-year OIS yield closed up by 3 bps. One-year OIS yield closed at 5.64% while five-year OIS yield closed at 5.66%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 31.89 billion as of 21st June 2019. Liquidity was in a surplus of Rs 490 billion as of 14th June 2019.

Weekly G-sec Curve Spread Analysis

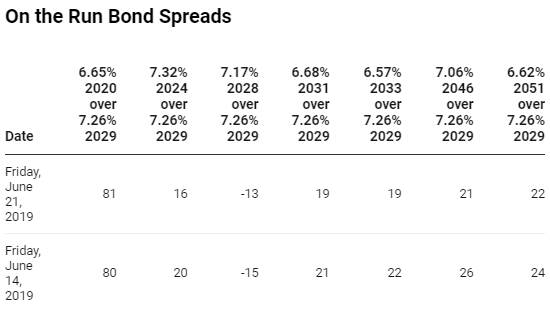

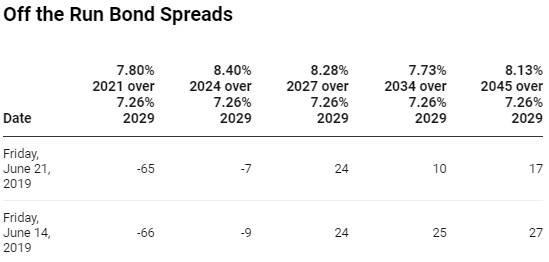

· The yield curve flattened at the long end of the curve, as 10-year G-sec yield fell by 6 bps while the long-end bond yields fell by 8-11 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec fell last week

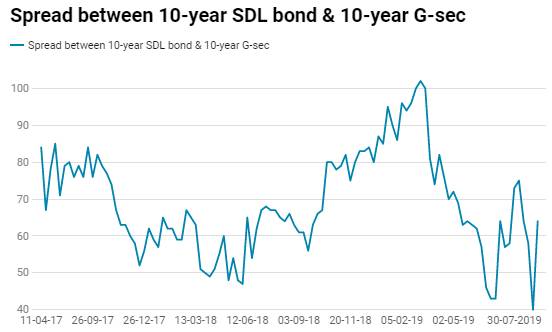

· On the 20th June 2019 auction, the spread between SDLs with 10-year G-sec came in at 46 bps, as only one state participated in the auction. On 11th June 2019 auction, the spread between SDLs with 10-year G-sec was at 57 bps.