The 10 year benchmark government bond, the 7.26% 2029 bond saw yields close 18bps higher from lows seen a couple of weeks ago, as markets took profits ahead of the budget. The government will present the full budget for fiscal 2019-20 on the 5th of July.

Bond markets too profits on worries of a higher spending budget that could derail RBI August policy rate cuts, as RBI June minutes suggest some worries from a few members on the fiscal deficit front. However, expectations are that the government will broadly stick to its fiscal deficit of 3.4% of GDP as projected in its interim budget for this fiscal year. The gross and net government for the fiscal is projected at Rs 7.1 trillion and Rs 4.23 trillion respectively.

The government is going into the 2nd quarter of the fiscal year with a marginal cash surplus and will receive RBI dividend in August. At this juncture the government is unlikely to show any macro weakness on the fiscal deficit front given that bond yields are down sharply by over 100bps over the last one year and that low rates need to prevail given need to increase demand in the economy.

On the government sticking to its borrowing numbers, 10 year government bond yield will fall sharply to below 6.5% from current levels of 6.88%. RBI rate cut expectations will gather while in July, the Fed will start to cut rates. The INR has strengthened on the back of CAD falling to 0.7% of GDP in the 4th quarter of fiscal 2018-19 from 2.7% seen in the 3rd quarter. Foreign exchange reserves are at all time highs on the back of USD/INR swaps of USD 10 billion and on the back of positive FII flows.

The 10*30 government spread spread is just around 18bps and this flatness suggests that the market is still bullish on bond yields and will pull down the yields once the budget numbers are released.

Even if the government exceeds borrowing marginally, government bond yields will still rally though there could be a temporary spike. Markets will still expect RBI rate cuts and global yields are at multi year lows, driving in positive sentiments.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 2 bps up at 6.88% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 7 bps up at 6.77% and the 6.68% 2031 bond yield closed 1 bps down at 7.04%. The long bond, the 7.63% 2059 bond yields 17 bps down at at 7.05%.

One-year OIS yield closed up by 7 bps and five-year OIS yield closed up by 3 bps. One-year OIS yield closed at 5.63% while five-year OIS yield closed at 5.67%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 54.70 billion as of 28th June 2019. Liquidity was in a deficit of Rs 31.89 billion as of 21st June 2019.

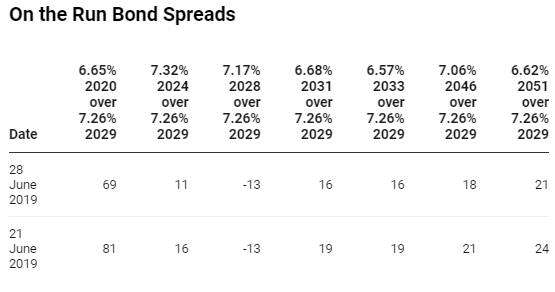

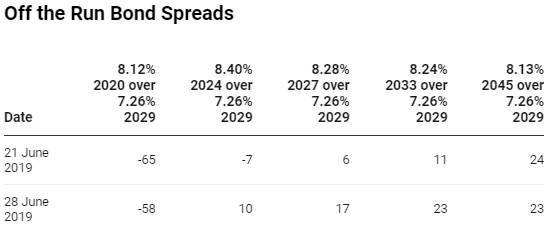

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as 10-year G-sec yield rose by 2 bps while the long-end bond yields fell by 8-5 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec fell last week

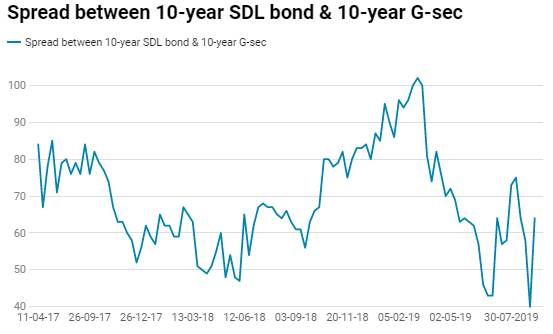

· On the 25th June 2019 auction, the spread between SDLs with 10-year G-sec came in at 43 bps,states borrowed Rs 134.90 billion last week through SDLs auction.On 18th June 2019 auction, the spread between SDLs with 10-year G-sec was at 46 bps.