Election results will drive bond yields this week. The biggest risk for bond yields is an opposition win, as implementation of NYAY can cause a huge hole in the fiscal. The NYAY will cost the government upwards of Rs 3 trillion a year and sources of funds are nowhere in sight.

The current government regaining the parliament majority on its own or with allies will stick to its budget projections of 3.3% of GDP and bond yields will trend down on RBI rate cut hopes. A hung parliament will cause uncertainty and bond yields will trend up but notvery sharply.

RBI rate cut expectations are being built into yield curves, with the 5*10 government bond spread widening and OIS yield curve falling sharply. RBI is expected to cut rates by 25bps in June and change its policy stance to accommodative in the face or growth worries. Read our analysis on RBI can cut rates by 50bps.

RBI added Rs 250 billion of liquidity through OMO bond purchases in May and will add another Rs 250 billion in June, given tight liquidity conditions. Fx swaps to add liquidity may not happen due to INR volatility.

Credit markets continue to be in a liquidity freeze and the market will hope for a policy responses post elections.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps down at 7.36% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 13 bps down at 7.12% and the 6.68% 2031 bond yield closed 4 bps down at 7.57%. The long bond, the 7.63% 2059 bond yields remain unchanged at 7.59% on a weekly basis.

One-year OIS yield closed down by 7 bps and five-year OIS yield closed down by 3 bps. One-year OIS yield closed at 5.94% while five-year OIS yield closed at 6.14%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 461 billion as of 17th May 2019. Liquidity was in a deficit of Rs 544 billion as of 10th May 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields fell sharply by 7-8 bps while 10-year G-sec yields fell by 5 bps on a weekly basis. The 5*10 spread steepened on rate cut positioning

· Off the run bond spreads with the 10-year G-sec were mixed last week, largely off the run bonds remained untraded.

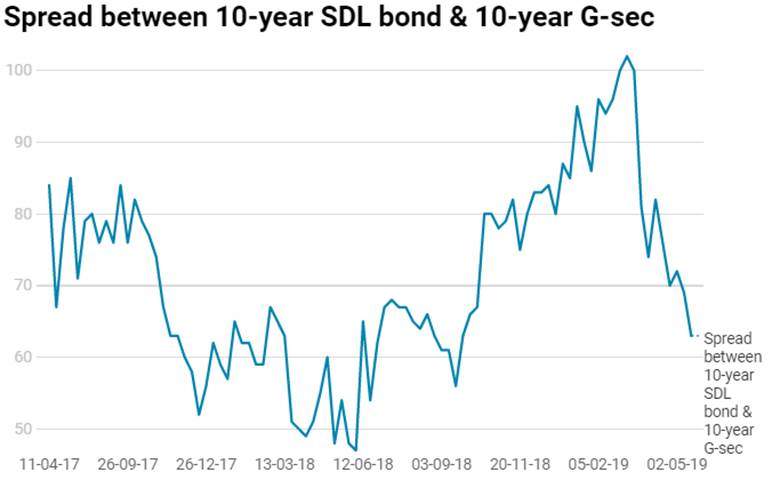

· On the 14th May 2019 auction, the spread between SDLs with 10-year G-sec came in at 63 bps. On 7th May 2019 auction, the spread between SDLs with 10-year G-sec was at 69 bps.