The government bond market is being pushed and pulled resulting in bond yields trading in a range and having no clear direction. On one side the weakening domestic economy is keeping RBI rate cut hopes alive and pulling yields downwards while on the other side election uncertainty and global issues are pushing yields upwards. In the middle of it all, the supply of bonds is heavy from the government and state governments even as a credit crisis is threatening to worsen.

Bond yields are directionless and are trading in a range, with movements dictated by short term news. Direction will come from election results, RBI policy in June and global events such as trends in the US-China trade war and oil price movements.

On the positive side for bond yields, interest rates are likely to stay low for a longer period of time given weak corporate guidance, falling industrial production and low inflation. Read our Economic Data Analysis for details. Hopes of a rate cut by RBI in its June policy review is growing, as markets believe that weak corporate guidance could force RBI to cut rates. The fact that the economy is going through a credit crisis, necessitates low rates., is positive for markets.

On the negative side is the global uncertainty brought about by political sanctions on Iran by the US, fueling jingoism and taking up oil prices is causing risk aversion. Escalating US-China trade war is also hurting markets and weighing on currencies including the INR. Election uncertainty too can hurt risk appetite for INR assets. Bond markets are wary of the uncertainties and preferring to stay cautious despite rate cut expectations.

Government bond yields will stay ranged though volatility could rise on election outcomes. OIS markets will see yield curve steepen on rate cut expectations. Credit spreads will stay stressed on the crisis in the market. Liquidity will stay in deficit on lack of government spending prompting more OMOs by the RBI.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 2 bps up at 7.41% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 6 bps down at 7.25% and the 6.68% 2031 bond yield closed 3 bps down at 7.61%. The long bond, the 7.63% 2059 bond, saw yields close 1 bps up at 7.59% on a weekly basis.

One-year OIS yield closed down by 7 bps and five-year OIS yield closed down by 10 bps. One-year OIS yield closed at 6.01% while five-year OIS yield closed at 6.17%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 544 billion as of 10th May 2019. Liquidity was in a deficit of Rs 656.3 billion as of 3rd May 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as long end bond yields fell by 2-10 bps while 10-year G-sec yields rose by 2 bps on a weekly basis.

· Long end off the run bond spreads with the 10-year G-sec fell last week,

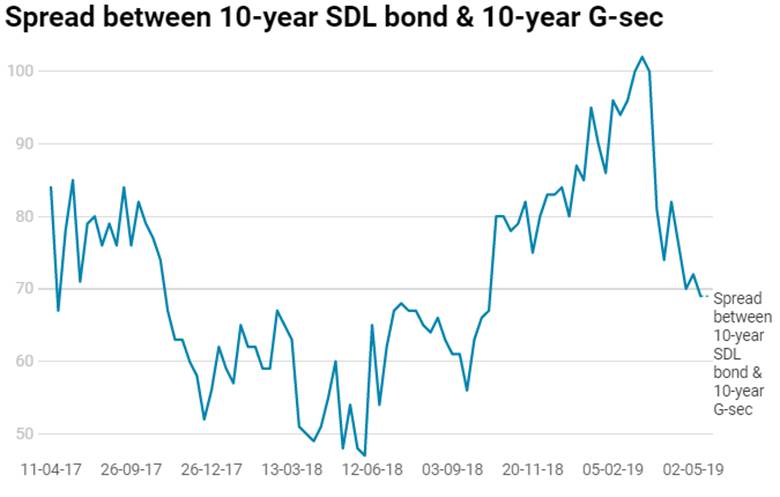

· On the 7th May 2019 auction, the spread between SDLs with 10-year G-sec came in at 69 bps. On 2nd May 2019 auction, the spread between SDLs with 10-year G-sec was at 72 bps.