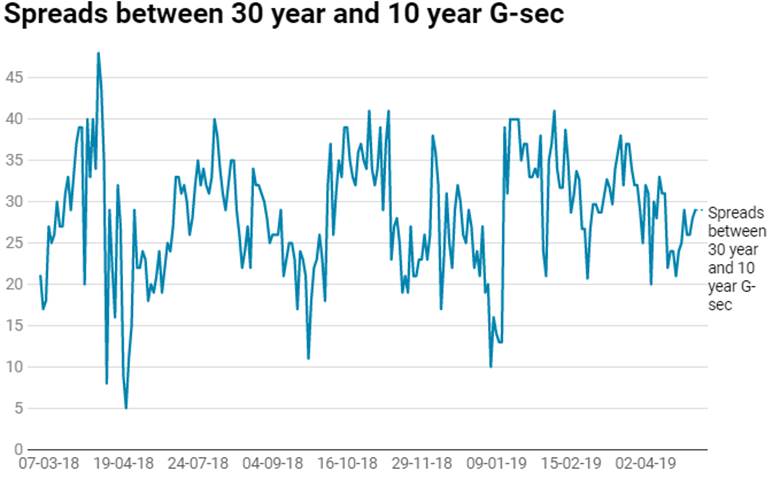

The government issued a New 30 year bond, the 7.63% 2059 bond, at spreads of 29bps over the 10 year benchmark bond, the 7.26% 2029 bond. The 10*30 spread has widened from 21bps to 29bps over the last one year. The spread is however lower than the 10*30 UST spread, which is currently at 39bps, widening by 18bps over the last one year, from levels of 21bps.

The Indian government bond and the UST 10*30 spreads have widened over the last one year but the UST spreads have widened by 18bps while the government bond spread has widened by 8bps. The 10*30 government bond spread is still flat, with the market giving just a 29bps premium for the 20 year maturity gap. The 1*10 government bond spread is at levels of 90bps while the 1*10 UST spread is at levels of just 10bps.

The wider 10*30 UST spreads suggest that the US economy is expected to see a rise in both GDP and inflation over the longer term, while the flat 1*10 spread suggests that the Fed will hold rates at current levels and inflation outlook is still benign.

On the other hand, the steepness of the government bond 1*10 spread suggests that the RBI is more likely to raise short term rates going forward while the flat 10*30 spread suggests that long term inflation outlook is still low.

To some extent, 30 year government bond has a segmentation premium, as it is in demand from insurers and provident funds who require the bond for their long term liabilities. The 10 year bond is well traded and reflects market near term sentiments.

Strong GST collections in April, over Rs 1 trillion and the highest since the roll out in July 2017 helped improve market sentiments on the government’s fiscal position. Oil prices fell ,as US produced record shale oil, fending off worries of Iran sanctions on supply. Government bond yields fell last week and will stay down on expectations of more RBI OMO bond purchases, as liquidity still remains tight.

OIS yields fell on the back of fall in oil prices, which improves sentiments on the INR and foreign capital flows. OIS yields will stay ranged given election results coming up in the next three weeks.

CP yields rose sharply, as Reliance ADAG group companies defaulted on debt servicing. Mutual funds face redemption pressures on the back of credit events such as Reliance ADAG group default, IL&FS SPVs being downgraded to default, Essel group companies default and downgrade in DHFL bonds and CPs. Mutual funds staying out of CP markets add to liquiidty pressure from NBFCs leading to rise in CP yields.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 2 bps down at 7.39% on a weekly basis. The new benchmark 5-year bond, the 7.32% 2024 bond saw yields close 2 bps up at 7.31% and the 6.68% 2031 bond yield closed 5 bps down at 7.64%. The long bond, the 7.06% 2046 bond, saw yields close 1 bps up at 7.68% on a weekly basis.

One-year OIS yield closed down by 5 bps and five-year OIS yield closed down by 10 bps. One-year OIS yield closed at 6.08% while five-year OIS yield closed at 6.27%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 656.3 billion as of 03rd May 2019. Liquidity was in a deficit of Rs 750.4 billion as of 26th April 2019. Liquidity deficit will ease on government spending and RBI OMO purchases but will again tighten in June on advance tax payments.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as long end bond yields (7.06% 2046) rose by 1 bps and 6.62% 2051 bond yields fell by 1 bps while 10-year G-sec yields fell by 3 bps on a weekly basis.

· Off the run bond spreads with the 10-year G-sec were mixed last week, off the run bonds largely didn’t trade last week. Volume in the bond market was also less due to truncated week.

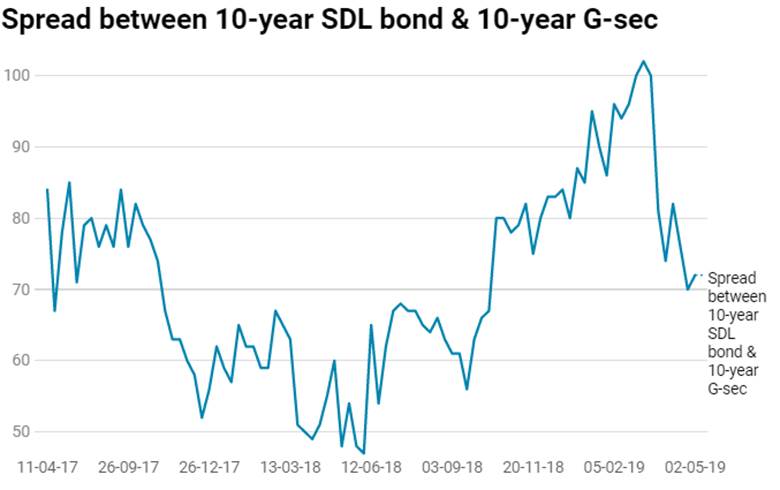

· On the 2nd May 2019 auction, the spread between SDLs with 10-year G-sec came in at 72 bps. On 23rd April 2019 auction, the spread between SDLs with 10-year G-sec was at 70 bps.