The RBI is going into this week’s policy review on the back of global bond yields plunging to fresh lows on Fed rate cut and increased tensions in the US-China trade war, the government calling for large rate cuts to shore up a flagging economy and the bond markets pulling down yields to levels factoring in more accommodation in the form of rate cuts and liquidity. RBI is being pressured on all sides to deliver a market friendly policy and is expected to cut rates by 25bps with a guidance of continuing accommodation.

10 year benchmark government bond yield is trading at levels of 6.35% and yields will fall further on a dovish RBI policy. 5 year OIS yield at 5.29% is already factoring in 50bps rate cut by the RBI and does not have too much of room to go further down. 1 year CD and CP yields at 6.60% and 7.50% can fall further given wide spreads over the repo rate while 3, 5 and 10 year AAA credits spread look attractive given rate cuts and liquidity.

US and Eurozone bond yields fell to fresh lows, as the Fed cut rates last week and US President Donald Trump, in a surprise move, slapped tarrifs on more Chines goods exported to the US. This has sparked fears of sharp economic slowdown globally driving markets into high risk aversion. Read our Global Currency and Bond Market report for details.

The first quarter earnings of domestic corporates saw weak earnings and muted guidance while July auto sales numbers pointed to a continued fall in demand. The government is calling for a strong easing by the RBI in its policy review, even as it spends to shore up the economy. The government is in high overdraft with the RBI, prompting a CMB (Cash Management Bill) auction for Rs 250 billion this week. RBI dividend to be paid out this month will help lower the overdraft.

RBI will also have to address the continued freeze in liquidity in the credit markets with fresh signs of bad loans cropping up across lenders. The credit market freeze has impaired the pass through of monetary transmission and this needs to be thawed quickly for the economy to revive.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 18 bps down at 6.35% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 21 bps lower at 6.21% and the 6.68% 2031 bond yield closed 14 bps down at 6.76%. The long bond, the 7.63% 2059 bond, saw yields close down 12 bps at 6.76% levels.

One-year OIS yield closed lower by 16 bps and five-year OIS yield closed up by 21 bps. One-year OIS yield closed at 5.36% while five-year OIS yield closed at 5.29%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1881 billion as of 2nd August 2019. Liquidity was in a surplusof Rs 935 billion as of 26th July 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as 10-year G-sec yield fell by 18 bps while the long-end bond yields fell by 12-14 bps.

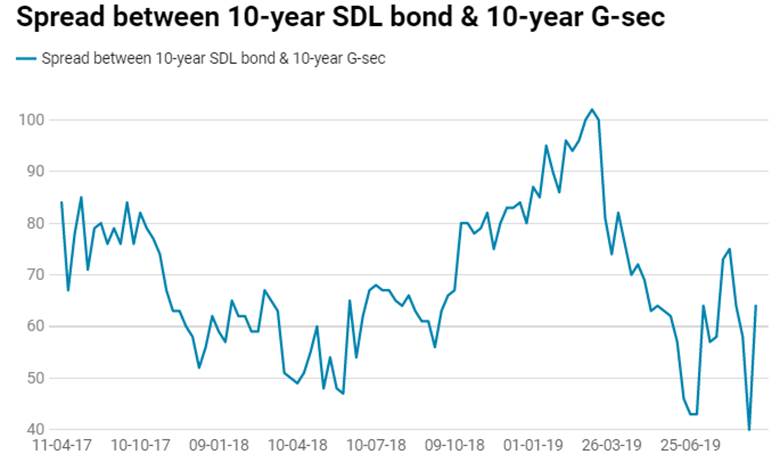

· Long end off the run bond spreads with the 10-year G-sec rose last week

· On the 30th July 2019 auction, the spread between SDL with 10-year G-sec came in at 73 bps,states borrowed Rs 134.24 billion last week through SDLs auction. On 23rd July 2019 auction, the spread between SDLs with 10-year G-sec was at 58 bps.