The Fed is likely to cut rates for the first time in a decade this week and signal further cuts given the stress world economies are going through, which could filter into the US economy. ECB in its meeting last week signaled that it would weigh options on accommodation and may come out with concrete action in September. The Fed and ECB moves will prompt RBI to stay highly accommodative, as will other central banks across the globe. Low global bond yields with Bund yields in deep negative territory will keep down down yields across the globe and in India too.

The 10 year benchmark government bond, the 7.26% 2029 bond, saw yields rise by 17bps week on week to close at levels of 6.53%. The bond yield rose on the back of profit taking at lower levels, as the government is debating on the issuance of external bonds. Yields across the OIS Curve, CP, CD curve and corporate bond curve rose in sympathy with the rise in the 10 year government bond yield.

The government sent out conflicting signals on its external bond issuance with both the details of the issue under discussion and the debate on the issue of the external bonds. Read our note on the Risks of Issuing External Bonds. The RBI governor also played down expectations of an ultra loose policy and said further rate cuts would be data dependent.

The data is not looking good for economic growth with banks guiding for slower loan growth and key companies in sectors like automobiles and FMCG reporting poor numbers. Going by data and lending conditions with a liquidity freeze for NBFCs and private sector banks showing high stress on loans, RBI is more likely to cut rates in August and signal an accommodative stance.

The 10 year government bond is trading at a spread of 85bps over the expected repo rate of 5.50% and 98bps over the 5 year OIS. The spread is steep but the supply through auctions is relentless and the market is factoring in the supply. However, any indications of a global bond issue by the government would be bullish for the 10 year bond yield, as it will lower the supply. The global bond will also be issued at fine spreads given scarcity of Indian Government Bond in the global market and this is a further sign of low rates, which would keep the 10 year bond yield down.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 17 bps up at 6.53% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 13 bps higher at 6.46% and the 6.68% 2031 bond yield closed 22 bps up at 6.90%. The long bond, the 7.63% 2059 bond, saw yields close up 18 bps at 6.88% levels.

One-year OIS yield closed higher by 11 bps and five-year OIS yield closed up by 12 bps. One-year OIS yield closed at 5.52% while five-year OIS yield closed at 5.50%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 935 billion as of 26th July 2019. Liquidity was in a surplusof Rs 1100 billion as of 19th July 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the short end of the curve, as 10-year G-sec yield sharply rose by 17 bps while the long-end bond yields rose by 15-20 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec were staedy last week

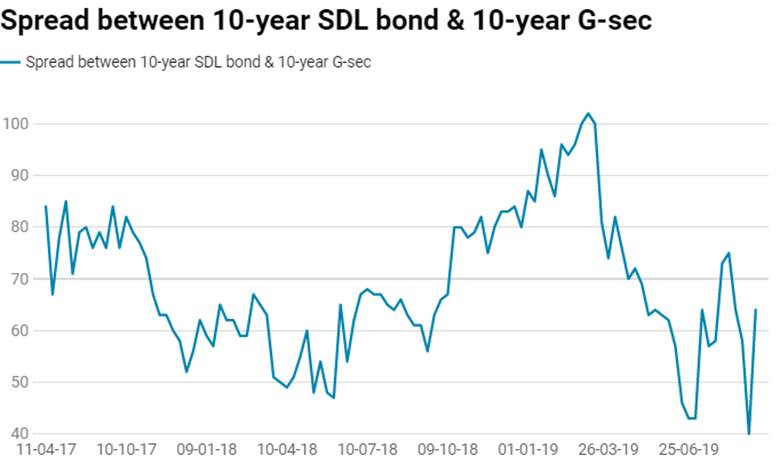

· On the 23rd July 2019 auction, the spread between SDL with 10-year G-sec came in at 58 bps,states borrowed Rs 85.44 billion last week through SDLs auction. On 16th July 2019 auction, the spread between SDLs with 10-year G-sec was at 57 bps