The bullish case for interest rates is still high and that will keep the 10 year government bond yield down and on a downward path, with bits of volatility here and there. RBI, if it sounds caution on more rate cuts in its August policy meet, can drive up the bond yield sharply.

The 10 year benchmark government bond, the 7.26% 2029 bond, saw yields fall by 11bps week on week to close at over one year low levels of 6.36%. The bond yield fell on the back of rate cut expectations. RBI and Fed are expected to cut rates in the coming weeks amidst concerns over the path of economic growth and inflation.

Rate cut expectations and sharp fall in global bond yields helped drive down OIS yield curve while 1 year CP and CD yields that fell by 15bps and 30bps respectively, week on week. Interest rate curves are pointing to low rates and high liquidity.

The question is what next for the 10 year government bond from current levels of 6.36%. The last time the bond yield fell to such levels, the climb back up was sharp with yields rising by almost 175bps from lows, before it again fell to current levels. The repo rate at the time of 10 year bond yield at below 6.50% was 6%, which was then increased to levels of 6.50% by the RBI.

The repo rate now is at 5.75% and will fall to 5.5% in August, as RBI is likely to cut the rate by 25bps. The 1 and 5 year OIS at yields of 5.41% and 5.38% indicate further 25bps rate cut to levels of 5.25%, which could be an overreaction to fall in global bond yields. The 5*10 government bond spreads is almost flat at just 3bps spread and this could also indicate more expectations of rate cut post August 25bps cut.

The 10 year government bond is trading at a spread of 85bps over the expected repo rate of 5.50% and 98bps over the 5 year OIS. The spread is steep but the supply through auctions is relentless and the market is factoring in the supply. However, any indications of a global bond issue by the government would be bullish for the 10 year bond yield, as it will lower the supply. The global bond will also be issued at fine spreads given scarcity of Indian Government Bond in the global market and this is a further sign of low rates, which would keep the 10 year bond yield down.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 13 bps down at 6.36% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 12 bps down at 6.33% and the 6.68% 2031 bond yield closed 3 bps down at 6.68%. The long bond, the 7.63% 2059 bond, saw yields close down 5 bps at 6.70% levels.

One-year OIS yield closed down by 14 bps and five-year OIS yield closed down by 13 bps. One-year OIS yield closed at 5.41% while five-year OIS yield closed at 5.38%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1100 billion as of 19th July 2019. Liquidity was in a deficit of Rs 1332.43 billion as of 12th July 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as 10-year G-sec yield declined by 13 bps while the long-end bond yields fell by 5-10 bps. (Table 1)

· Long end off the run bond spreads with the 10-year G-sec declined last week

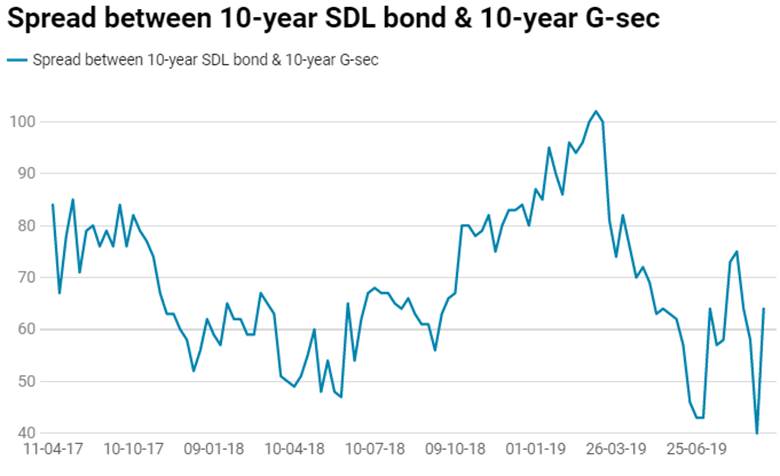

· On the 16th July 2019 auction, the spread between SDL with 10-year G-sec came in at 57 bps,states borrowed Rs 72.5 billion last week through SDLs auction. On 9th July 2019 auction, the spread between SDLs with 10-year G-sec was at 64 bps.