What are the issues with a global bonds? The parallel India draws with other emerging economies that have issued global bonds is the huge volatility these economies face when global markets turn risk averse. Currencies depreciate sharply, bond yields tend to shoot up and accessing global markets gets difficult. Many global bond issuers have high sovreign Debt to GDP ratios, which makes their bonds and currencies more volatile.

The primary risks the government faces in a global bond issue is currency depreciation, as cost of borrowing increases sharply on lower value of the currency. This can negate any savings the government makes, as cost of borrowing globally is cheaper in non hedged terms, given that interest rate differentials between India and US or Eurozone is around 300bps to 600bps.

The government will have to be extremely conservative on fiscal deficit and inflation management and given that we have a current account deficit as well, volatility on account of loose fiscal policy can lead to heavy volatility in both the currency and gobal bond yields.

The positives of global bond issuance is less burden on the domestic system to absorb supply and private sector will not get crowded out. The government will also have to be more responsible and that would lead to better macros overall.

The government is planning to float sovereign bonds, as a part of its annual borrowing program. At present, there is no Indian Government Bond trading in global markets. Indian government external debt totals around USD 104 billion as of March 2019, which is 3.8% of GDP, the lowest in the world.

The government has preferred to fund its fiscal deficit through domestic savings, with banks, provident funds and insurance companies owning 40%, 5.5% and 24.6% of total government bonds outstanding. FIIs own just 3.6% of government bonds outstanding.

The government and RBI have over the years been debating on issue of global bonds, as the high supply of bonds in the domestic market has time to time give rise to absorption issues by local investors. However, until this budget in July 2019, there has been no formal announcement.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 20 bps down at 6.49% on a weekly basis. The benchmark 5-year bond, the 7.32% 2024 bond saw yields close 17 bps down at 6.42% and the 6.68% 2031 bond yield closed 17 bps down at 6.71%. The long bond, the 7.63% 2059 bond, saw yields close down 25 bps at 6.75% levels.

One-year OIS yield closed down by 1 bps and five-year OIS yield closed down by 1 bps. One-year OIS yield closed at 5.55% while five-year OIS yield closed at 5.51%

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1332.43 billion as of 12th July 2019. Liquidity was in a deficit of Rs 1493.55 billion as of 5th July 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end of the curve, as 10-year G-sec yield declined by 20 bps while the long-end bond yields fell by 15-18 bps.

· Long end off the run bond spreads with the 10-year G-sec rose last week

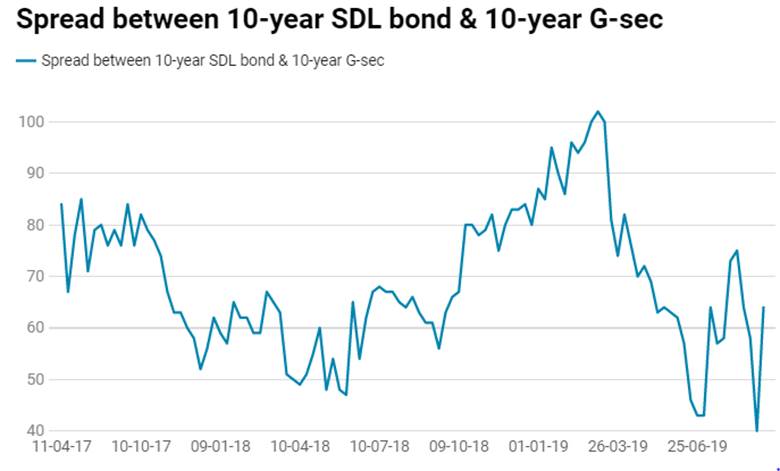

· On the 9th July 2019 auction, the spread between SDL with 10-year G-sec came in at 64 bps,states borrowed Rs 76 billion last week through SDLs auction. On 2nd July 2019 auction, the spread between SDLs with 10-year G-sec was at 43 bps