Onion prices have fallen by more than 80% and this is worrying the bond market. Government bond yields had fallen to 7 months lows on the back of falling oil prices, RBI OMO and falling inflation expectations. GST cuts and fall in food prices added to lower inflation expectations.

Normally, fall in onion and other vegetable prices are positive for lower inflation expectations, which should drive down bond yields. However, farmer distress in an election year is prompting the government to look at fiscal options to address the low prices. Bond market is worried about higher borrowing to fund farmer subsidies, loan waivers and other relief measures.

Onion prices too are volatile and fluctuate sharply up and down. It is difficult to forecast right inflation levels based on the volatile food basket. RBI too has its task cut out in framing a right policy with sharply fluctuating food prices.

Government bond yields are likely to rise going into 2019 and the 10 year government bond should stabilize at 7.50% levels given RBI OMO purchases. RBI will buy Rs 500 billion of bonds in January to add to system liquidity.

Yields on credits at the short end of the curve should come off on RBI liquidity measures and the fact that they are at elevated levels, trading at over 200bps over the repo rate. Market will play for RBI turning neutral on policy in February 2019 post December inflation release and repo rates will be stable for a longer period of time.

OIS yields will stabilise at current levels and move in tandem with government bond yields.

System liquidity will ease in the first week of January on government spending and banks releasing quarter end fund hoards.

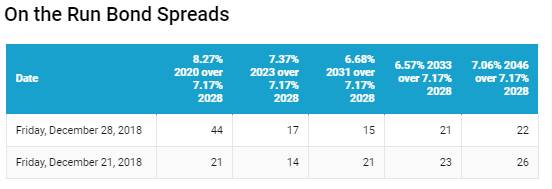

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 11 bps up at 7.39% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 8 bps up at 7.22% and the 6.68% 2031 bond saw yields close 5 bps up at 7.54%. The long bond, the 7.06% 2046 bond yields close 7 bps up at 7.61% on weekly basis.

OIS market saw one year yield close down by 1 bps and five year OIS yield close up by 2 bps last week. One year OIS yield closed at 6.55% while five year OIS yield closed at 6.62%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 1657 billion as of 28st December 2018. Liquidity was in a deficit of Rs 1686 billion as of 21st December 2018. Liquidity will stay in deficit on advance tax outflows this month.

MF exposure to CDs rose 10% in a month

As on November 2018, mutual fund exposure to CDs rose Rs 1219.09 billion against Rs 1114.65 billion in October 2018, up by 9.37% month on month. MFs preferred to keep excess liquidity in CDs given risk aversion in CPs.

· As on 28th December, FII debt utilisation status stood at 63.43% of total limits, 21 bps higher against the previous week. FII investment position was at Rs 4122 billion in INR debt. FII investment position stands at Rs 2101 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2020 billion in corporate bonds.

· For the week ended 28th December, credit spreads increased. Three-year AAA corporate bonds were trading at levels of 8.65%, spreads were 1 bps higher at 148 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.65%. Spreads were 1 bps higher at 139 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.67% with spreads 1 bps higher at 128 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.03% and 8.05% levels at spreads of 36 bps and 112 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.10% and 7.45% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.57% and 8.80% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end as 10-year G-sec yields rose by 11 bps while other long end bonds (6.68% 2031 & 7.06% 2046) yields rose by 5-9 bps.

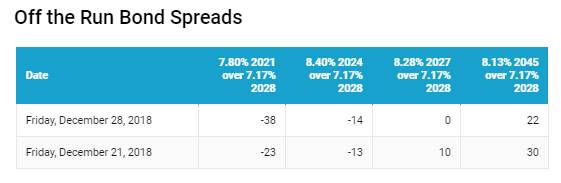

· Off the run bond spreads with the 10-year G-sec were mixed last week.

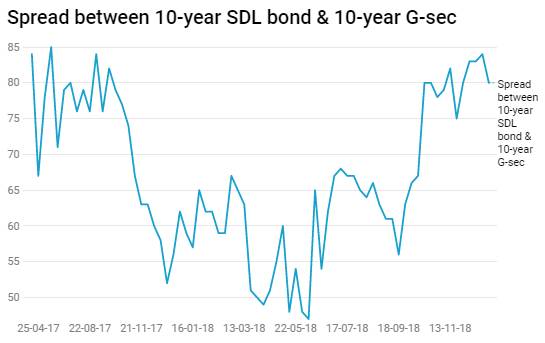

· On the 24th December 2018 auction, the spread between SDLs with 10-year G-sec came in at 80 bps. On 18th December 2018 auction, the spread between SDLs with 10-year G-sec was at 84 bps.