The benchmark 10 year government bond yield fluctuated wildly, rising and falling by 20bps in a couple of days on the back of the drama played out in the RBI. Dr. Urjit Patel resigned on the 10th of December citing personal reasons, which the market saw as the outcome of the interference of the government in the running of the RBI. The 11th of December saw the BJP losing in 3 key states, adding to political risk in 2019 given general elections. 10 year government bond yield rose 20bps in knee jerk reaction to the events.

The bond yield fell sharply by 20bps from highs, as the government quickly announced Shaktikanta Das as the new RBI governor.

The new governor is coming on to a red hot seat. The government is keen on pressing its demands on reserves, easing of bank lending norms and more focus on growth. The market is worried that if the RBI gives in to the government, inflation will shoot up, taking down INR as FIIs sell INR bonds.

Bond markets can be extremely fickle. Bond yields fell on the back of markets expecting the new governor to continue OMO purchases and change the policy stance from calibrated tightening to neutral. However, the scenario may change next year if inflation expectations start rising on the back of low base effect and higher food prices even as the government announces a new borrowing program for the next fiscal year. Political uncertainty too will play on the minds of the market participants.

The market may also start to worry whether the RBI will lose focus on inflation if it gives in to government demands. If this faith is lost, bond yields will rise sharply and turn against the policy stance.

The market will be watching the new governor closely and for now there will be calm.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 5 bps down at 7.41% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 7 bps down at 7.30% and the 6.68% 2031 bond saw yields close 1 bps up at 7.56%. The long bond, the 7.06% 2046 bond yields close 12 bps down at 7.66% on weekly basis. Governments bonds will stabilize at current levels with a bit of profit taking.

OIS market saw one year yield close down by 10 bps and five year OIS yield close down by 2 bps last week. One year OIS yield closed at 6.67% while five year OIS yield closed at 6.75%. OIS yield curve will stay flat given lack of rate hike expectations.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 525 billion as of 13th December 2018. Liquidity was in a deficit of Rs 117 billion as of 07th December 2018. Liquidity will stay in deficit on advance tax outflows this month.

Credit Spreads Rise Sharply on Risk Aversion

Credit spreads rose sharply on risk aversion, as the INR jumped on RBI governor drama, state election results, US-China trade worries and oil output cut by Saudi and Russia. Government bond yields were volatile on RBI drama but traded at lows while corporate bond yields rose on multiple issues.

· As on 13th December, FII debt utilisation status stood at 62.77% of total limits, 32 bps lower against the previous week. FII investment position was at Rs 4079 billion in INR debt. FII investment position stands at Rs 2090 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1988 billion in corporate bonds.

· For the week ended 13th December, credit spreads increased. Three-year AAA corporate bonds were trading at levels of 8.75%, spreads were 35 bps higher at 146 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.80%. Spreads were 29 bps higher at 137 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.75% with spreads 17 bps higher at 120 bps.

· Three months and twelve months PSU bank CD yields were trading at 6.98% and 8.18% levels at spreads of 33 bps and 113 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.08% and 7.30% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.77% and 9.00% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end as 10-year G-sec yields fell by 5 bps while other long end bonds (6.68% 2031 & 6.57% 2033) yields rose by 1-4 bps.

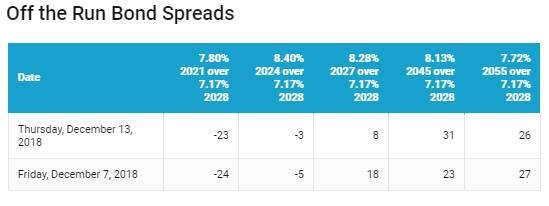

· Off the run bond spreads with the 10-year G-sec were mixed last week.

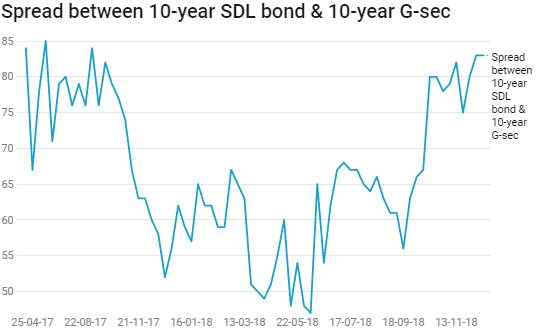

· On the 11th December 2018 auction, the spread between SDLs with 10-year G-sec came in at 83 bps. On 4th December 2018 auction, the spread between SDLs with 10-year G-sec was at 83 bps.