Banks have been beneficiaries of the freeze in credit markets post IL&FS defaults a couple of months back. Bank credit growth at 14.90% year on year as of 9th November 2018 is at five year high levels. Such growth levels was last seen in December 2013. On the other hand, private placement of corporate bonds was at five year lows in October 2018. See our credit market analysis below for details.

Corporates have been accessing bank credit on a virtual freeze in corporate bond and money markets on risk aversion post IL&FS default. However, the fact that banks have been lending to make up for the lack of access to markets for corporates is positive for corporate health as business continues. Going forward, credit markets will thaw as risk aversion eases on various steps taken by the government and RBI to ease market stress.

Credit spreads have ballooned over the last two months on the back of rising corporate bond yields and falling government bond yields. 10 year government bond yields have fallen by over 30bps from highs seen in the last few months. The rally has been on the back of lower government borrowing for this fiscal year, RBI OMO bond purchases, falling oil prices and inflation coming in below RBI target of 4%.

Credit spreads are offering a good risk return profile, given that corporate access to funds have not been cut off despite a credit market freeze and the fact that RBI is expected to infuse liquidity into the system through bond purchases and keep rates steady going forward.

RBI board meeting on 19th November became a non event, with the board passing resolutions to ease credit market stress.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 11 bps down at 7.71% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 11 bps down at 7.54% and the 6.68% 2031 bond saw yields close 4 bps down at 7.79%. The long bond, the 7.06% 2046 bond yields close 3 bps down at 7.98% on weekly basis.

OIS market saw one year yield close down by 10 bps and five year OIS yield close down by 15 bps last week. One year OIS yield closed at 6.95% while five year OIS yield closed at 7.16%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 989 billion as of 22th November 2018. Liquidity was in a deficit of Rs 340 billion as of 16th November 2018.

Private Placement of Corporate Bonds Lowest in the last 5 years

In the month of October 2018, private placement of corporate bonds was at Rs 318.93 billion, lowest in the last five years. In October of FY18, FY17, FY16 and FY15, private placement of corporate bonds was at Rs 441.46 billion, Rs703.95 billion, Rs 439.30 billio and,Rs 383.99 billion respectively.

· As on 22nd November, FII debt utilisation status stood at 62.64% of total limits, 13 bps higher against the previous week. FII investment position was at Rs 4070 billion in INR debt. FII investment position stands at Rs 2106 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1964 billion in corporate bonds.

· For the week ended 22nd November, credit spreads closed mixed. Three-year AAA corporate bonds were trading at levels of 8.70%, spreads were 3 bps lower at 114 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.73%. Spreads were 6 bps higher at 105 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.80% with spreads 11 bps higher at 94 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.19% and 8.35% levels at spreads of 44 bps and 115 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.30% and 7.80% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.90% and 9.13% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end as 10-year G-sec yields fell sharply by 11 bps while other long end bond yields fell by 2-4 bps.

· Off the run bond spreads with the 10-year G-sec largely rose last week.

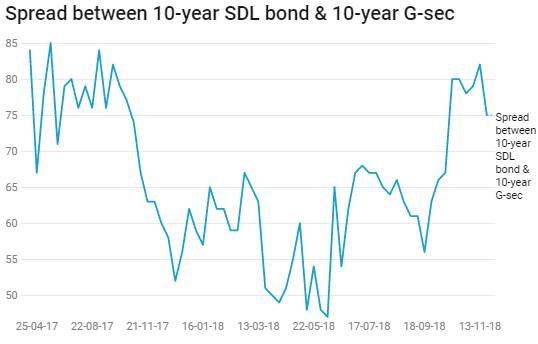

· On the 20th November 2018 auction, the spread between SDLs with 10-year G-sec came in at 75 bps. On 13th November 2018 auction, the spread between SDLs with 10-year G-sec was at 82 bps.