RBI could introduce a refinance window for NBFCs, similar to the one introduced in the 2008 crisis, in its board meeting on 19th November. Indications are that the board meeting will go off smoothly without any undue resignations by the Governor and other board members. This is highly positive for both government bond and credit markets.

Credit markets have seen a literal freeze since the IL&FS default two months ago and spreads have risen sharply, especially at the short end of the curve. There were concerns of NBFC CP maturities being redeemed amid a liquidity freeze, but the redemption of CPs has been going on smoothly. The refinance window will not be used much, as NBFCs would not want to be seen in a liquidity crunch, but it will provide confidence to markets on NBFC liquidity. Credit spreads at the short end of the curve should come off as credit risk aversion eases.

Government bonds will benefit from falling oil prices, strengthening INR, RBI OMO, slowing headline inflation and lower government borrowing for the second half of this fiscal year.

The Fed too is slowly changing its hawkish stance and may slow down the pace of rate hikes in 2019, after Fed members spoke last week on worries over global growth. A slower pace of Fed rate hikes will ease global risk aversion, which will benefit the INR.

Markets have started to factor in RBI maintaining rates on hold in its December policy meet, as seen by fall in OIS yields. Stable repo rate at 6.5% coupled with RBI liquidity infusion will bring down the OIS yield curve.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 6 bps up at 7.82% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 4 bps up at 7.65% and the 6.68% 2031 bond saw yields close 6 bps up at 7.83%. The long bond, the 7.06% 2046 bond yields close 16 bps down at 8.01% on weekly basis.

OIS market saw one year yield close down by 8 bps and five year OIS yield close down by 13 bps last week. One year OIS yield closed at 7.05% while five year OIS yield closed at 7.31%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 340 billion as of 16th November 2018. Liquidity was in a deficit of Rs 757 billion as of 9th November 2018.

MFs Cautiously Increase Exposure to NBFC CPs

In the month of October, Mutual Funds exposure to NBFC CPs rose 1.05% to Rs 1283 billion while PSU bonds exposure saw decline of 2.2% to Rs 1255.70 billion.

· As on 16th November, FII debt utilisation status stood at 62.20% of total limits, 2 bps higher against the previous week. FII investment position was at Rs 4042 billion in INR debt. FII investment position stands at Rs 2086 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1956 billion in corporate bonds.

· For the week ended 16th November, credit spreads closed mixed. Three-year AAA corporate bonds were trading at levels of 8.70%, spreads were 17 bps higher at 117 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.73%. Spreads were 2 bps lower at 99 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.80% with spreads 3 bps higher at 83 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.19% and 8.35% levels at spreads of 40 bps and 108 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.24% and 7.78% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.90% and 9.13% levels respectively.

Weekly G-sec Curve Spread Analysis

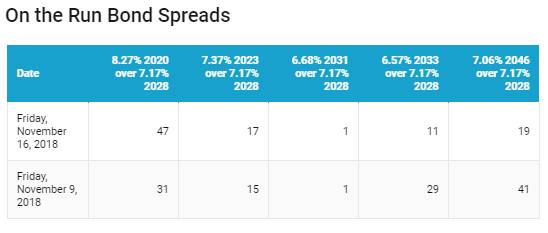

· The yield curve flattened at the long end as 10-year G-sec yields have risen while other long end bond yields have fallen.

· Off the run bond spreads with the 10-year G-sec largely fell last week.

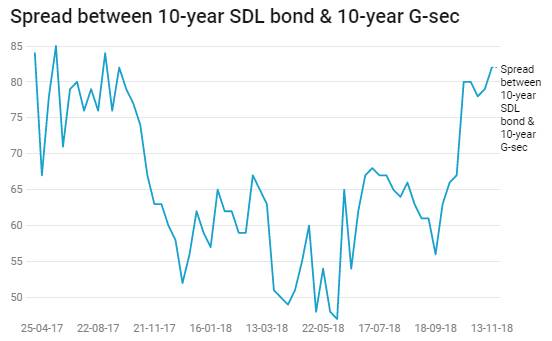

· On the 13th November 2018 auction, the spread between SDLs with 10-year G-sec came in at 82 bps. On 5th November 2018 auction, the spread between SDLs with 10-year G-sec was at 79 bps.