Government bond yields fell on the back of INR strength, easing global oil prices, RBI OMO bond purchases and FII buying of INR Bonds. However, the market may come under stress if the crucial RBI board meeting on the 19th of November sees the resignation of the RBI governor, Dr. Urjit Patel. There are rumors floating on his resignation on the back of government pressure on various issues.

The resignation of Dr. Urjit Patel, if it happens, is a long term negative for markets as the next RBI governor will be seen as a political appointee rather than as an economic appointee, Markets will doubt the policies on inflation and this will lead to various kinds of stress on all asset classes. This is also unprecedented in the RBI history and sends out completely wrong signals to investors who have until now come to respect the RBI’s stance on various policy issues.

RBI is also the manager of government borrowing and any pro government stance will send up bond yields as markets shun artificially inflated prices of bonds.

In the immediate future, if government gets its way and RBI releases its reserves for the government, bond yields will fall sharply with a steepening bias as the markets factor in high liquidity and low borrowing. However, the yield curve will steepen sharply as inflation expectations rise and faith in the RBI and INR falls.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 2 bps down at 7.76% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 9 bps down at 7.61% and the 6.68% 2031 bond saw yields close 4 bps down at 7.77%. The long bond, the 7.06% 2046 bond yields remain flat at 8.17% on weekly basis.

OIS market saw one year yield close up by 2 bps and five year OIS yield close up by 4 bps last week. One year OIS yield closed at 7.13% while five year OIS yield closed at 7.44%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 757.93 billion as of 9th November 2018. Liquidity was in a deficit of Rs 558 billion as of 2nd November 2018. Currency in circulation rose on festive season demand for cash while bank credit growth was at multi year highs even as deposit growth lagged.

In the last three weeks, FIIs exposure to G-secs rose from Rs 1988 billion to Rs 2062 billion G-sec exposure increased by Rs 74.54 billion.Government bond yields fell on the back of RBI OMO bond purchases, INR rallying from record lows and drop in UST yields from multiyear highs.

· As on 9th November, FII debt utilisation status stood at 62.20% of total limits, 2 bps higher against the previous week. FII investment position was at Rs 4042 billion in INR debt. FII investment position stands at Rs 2086 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1956 billion in corporate bonds.

· For the week ended 9th November, credit spreads closed mixed. Three-year AAA corporate bonds were trading at levels of 8.77%, spreads were 10 bps lower at 100 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.82%. Spreads were 8 bps higher at 101 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.75% with spreads 2 bps lower at 82 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.35% and 8.48% levels at spreads of 42 bps and 108 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.40% and 8.38% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 9.0% and 9.25% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end.

· 10-year G-sec yields declined further due to continued fall in crude oil prices and RBI liquidity support through open market bond purchase.

· Off the run bond spreads with the 10-year G-sec were mixed last week.

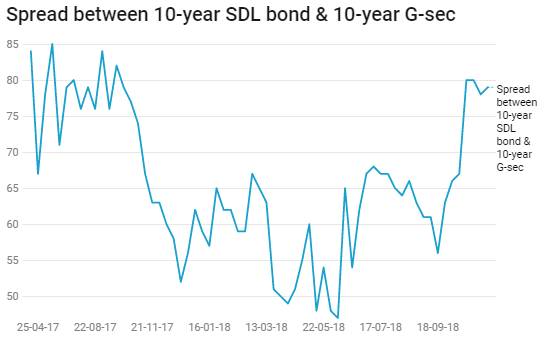

· On the 5th November 2018 auction, the spread between SDLs with 10-year G-sec came in at 79 bps. On 30th October 2018 auction, the spread between SDLs with 10-year G-sec was at 78 bps.