Confused where to invest in the current fixed income environment? Look no further than 3 & 5 year AAA corporate bonds that are looking extremely attractive on the curve. At levels of 7.95% and 8.18% for benchmark 3 & 5 year AAA corporate bonds respectively, spread over repo and spread over the corresponding maturity government bonds offer high returns as well as high margin of safety. Hence, even if the repo rate is hiked by 100bps, the yields on these bonds are not likely to rise substantially given that at these levels of spreads, yields are discounting at least 100bps rise in repo rate.

The repo rate is unlikely to be hiked by 100bps, at least in the next one year and RBI has signaled a status quo on rates for the next six months in its last policy review in February.

Liquidity conditions will stay easy for a long time to come given that government will front load its spending for fiscal 2018-19 starting April 2018.

3 & 5 year AAA bond yields have rise by 100bps from lows seen in 2017, largely on the back of a reversal in trend of government bond yields and risk aversion seen in global markets over the last couple of months. 10 year benchmark government bond yields have risen by 100bps since October 2017 on the back of RBI turning hawkish on inflation, government overshooting its budgeted borrowing in fiscal 2017-18 and its fiscal deficit target for 2018-19 and worries over banks participation in bond markets given excess holdings of bonds and high mark to market losses on the holdings. On the global front, spike in US treasury yields to close to 3% levels on faster than expected rate hikes by the Fed and volatility in risk assets that has caused the INR to depreciate to below Rs 65 against the USD from levels of above Rs 64, have led to bond markets worrying about FII’s pulling out money from bonds leading to rise in bond yields.

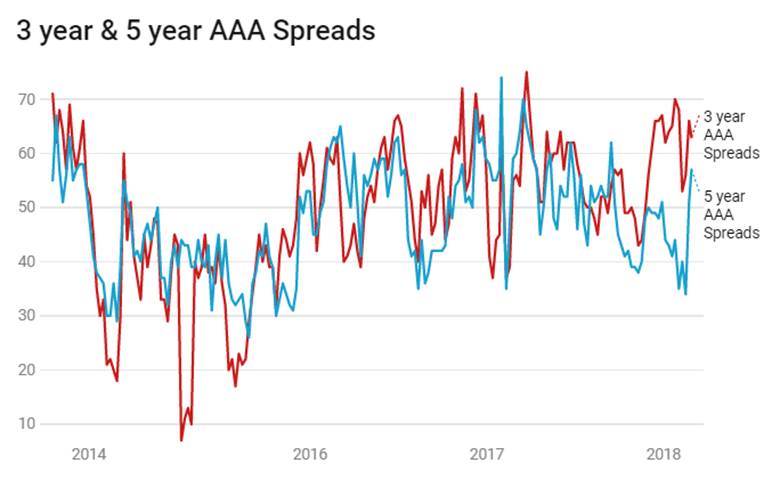

3 & 5 year AAA credit spreads are at levels of 63bps and 57bps respectively while spreads over repo at 6% are at levels of 196bps and 218bps. At these spreads, the bonds are factoring a deep pessimistic outlook on inflation, liquidity and risk aversion, which is not warranted given that India’s macros are looking strong and economic growth is picking up.

The old 10 year benchmark government bond, the 6.79% 2027 bond, saw yields rise by 7bps week on week to close at levels of 7.92% while the new benchmark 10 year bond, the 7.17% 2028 bond, saw yields rise by 7bps to close at 7.74%. The on the run bond, the 6.79% 2029 bond saw yields close 1bps down at 7.82% levels and the 6.68% 2031 bond saw yields close up by 6bps at 8%. The long bond, the 7.06% 2046 bond saw yields close up 5bps at levels of 8.07%. Bond yields will swing violently on thin volumes in a nervous market sentiment environment. .

The OIS market saw 5 year OIS yields closing 3bps lower week on week at levels of 6.90%. The one year OIS yield closed down by 2bps at 6.54%. OIS yields will be volatile given the volatility in the INR.

Corporate bonds saw 5 year AAA corporate bond yields close up by 8bps at levels of 8.18% and 10 year AAA corporate bond yields close up by 14bps at 8.43%. 5 year AAA spreads rose by 6bps at 57bps and 10 year AAA spreads rose by 7bps at 54 bps. Credit spreads should see buying in the weeks leading into April, given the attractive levels.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 932 billion as of 1st March 2018. The surplus was Rs 601 billion as of 16th February. Liquidity will get tight around mid March on advance tax outflows.