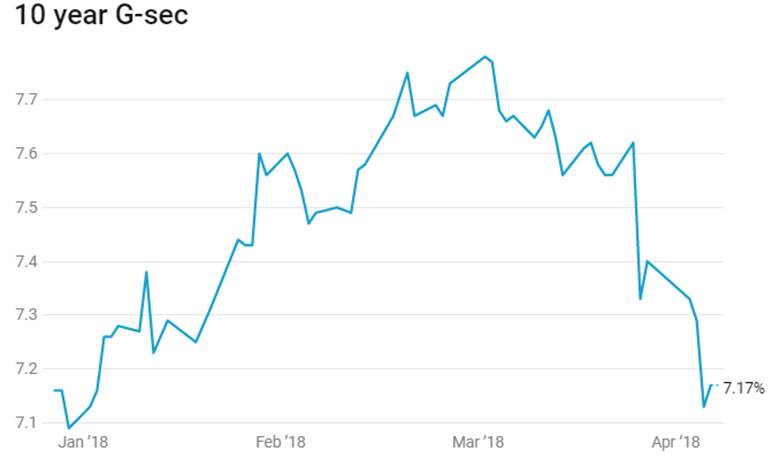

The 10 year government bond, the 7.17% 2028 bond, saw a cut off of 7.15% in the government bond auction on Friday, the 6th of April. The bond yield has fallen by 60bps over the last one month. The fall in yields was on the back of the government announcing a lower than expected borrowing calendar for the first half of fiscal 2018-19 and on the back of a very “Dovish” RBI Policy. Read our notes on the

Bond yields were on a sustained rise since October 2017, when RBI started flagging off inflation concerns. Government also overshot its fiscal deficit target for fiscal 2017-18 and announced a marginally higher deficit at 3.2% of GDP (from targeted 3% of GDP) for fiscal 2018-19. 10 year government bond yields had risen by over 100bps from October 2017 to March 2018 before falling sharply over the last fortnight.

The market having seen such high volatility on the 10 year government bond over the last 6 months will now question the levels of yields on the bond after the 60bps rally. Yield could trend down to 7% in the very near term on lack of supply, dovish RBI, increase in FII limits in government bonds and falling US treasury yields. However, to sustain at 7% levels and trend down from there would require a strong demand environment, which may not be forthcoming.

Supply of 10 year government bond in the first half is down drastically with each auction size of just around Rs 30 billion from Rs 80 billion seen in fiscal 2017-18. Lack of supply will have severe restrictions on short selling and trading demand could pull down yields. RBI guided for a long period of stable rates and with liquidity expected to stay high, there will be demand for yields in liquid bonds such as the 10 year government bond. At yields of 7%, which is 100bps over the repo rate, demand will be strong.

RBI increased limits for FII’s in government bonds, SDL’s and corporate bonds. Limits are higher by Rs 1.05 trillion this year with government bond limits higher by around Rs 320 billion. While limits are not much, market sentiment would improve on higher FII limits as FII’s would chase the limits available to them. 10 year UST yield has fallen from highs of over 2.90% on the back of volatility in asset markets caused by fears of trade wars. Fed is likely to hike rates 3 times in 2018, down from market expectations of 4 times. 10 year UST yields are likely to stabilize around current levels and that would add to the attraction of higher yielding bonds for FIIs.

The negative for the bond market is the demand scenario. Banks are holding government bonds well in excess of statutory requirements at 30% of NDTL against 19.5% SLR. Banks have seen huge losses on their books after the rise in yields over the last 6 months and while RBI has allowed them to spread their losses over 4 quarters, appetite for further interest rate risk would be low. However, in a benign bond market environment with banks seeing a lack of appetite to lend due to issues of NPA’s and scams, all excess liquidity could go into buying of government bonds. If banks can maintain holdings at around 40% of total government bond outstanding, demand will not be an issue for the market.

SDL borrowings have risen substantially over the last few years and in this first quarter of fiscal 2018-19, SDL issue size is fixed in the range of Rs 1.15 trillion to Rs 1.28 trillion. SDL borrowings have usually been below Rs 1 trillion in the first quarter and the rise in borrowings could dent appetite for government bonds.

RBI will step in to buy government bonds if there are any issues on supply absorption.

The 10 year Gsec yield can sustain at levels of 7% unless economic data is adverse.

The benchmark 10 year bond, the 7.17% 2028 bond, saw yields fall by 23 bps to close at 7.17%. The on the run bond, the 6.79% 2029 bond saw yields close 17bps down at 7.25% levels and the 6.68% 2031 bond saw yields close down by 20bps at 7.40%. The long bond, the 7.06% 2046 bond saw yields close down 12bps at levels of 7.61%. Bond yields will tend to stay down on positive sentiments.

The OIS market saw 5 year OIS yields closing 8bps down week on week at levels of 6.68%. The one year OIS yield closed down by 7bps at 6.37%. OIS yields will fall on a benign RBI policy.

Corporate bonds saw 5 year AAA corporate bond yields close down by 10bps at levels of 7.73% and 10 year AAA corporate bond yields close down by 8bps at 7.92%. 5 year AAA spreads rose by 12bps at 50ps and 10 year AAA spreads rose by 12bps at 60 bps. Credit 10 year AAA credit spreads would fall given attractive levels of yields on the bonds.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 648 billion as of 6th April 2018. Liquidity was in deficit of Rs 1914 billion as of 30th March. Liquidity eased on government spending, government surplus cash fell from Rs 1.75 trillion to Rs 1 trillion over the last one week.