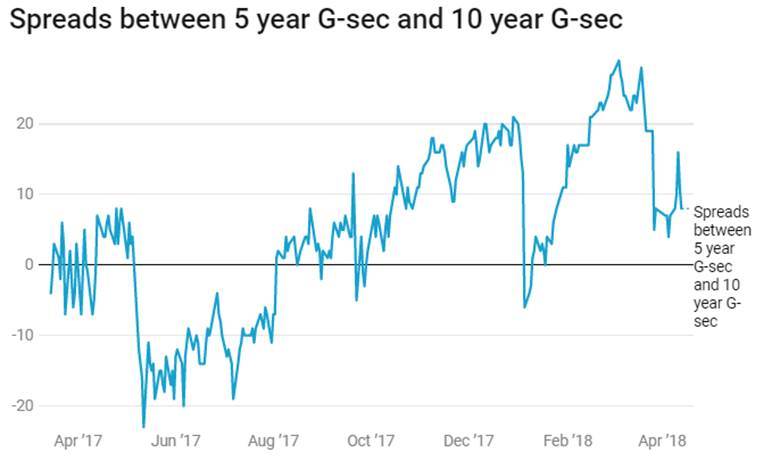

The government issued a new 5 year bond for Rs 30 billion on Friday the 13th of April. The cut off for the bond came in at 7.37% and bids were 4x the auction size, indicating good demand for the bond. The spread of the 7.37% 2023 bond to the benchmark 10 year bond, the 7.17% 2028 bond was at 10bps at close as the yield fell to 7.33% post auction.

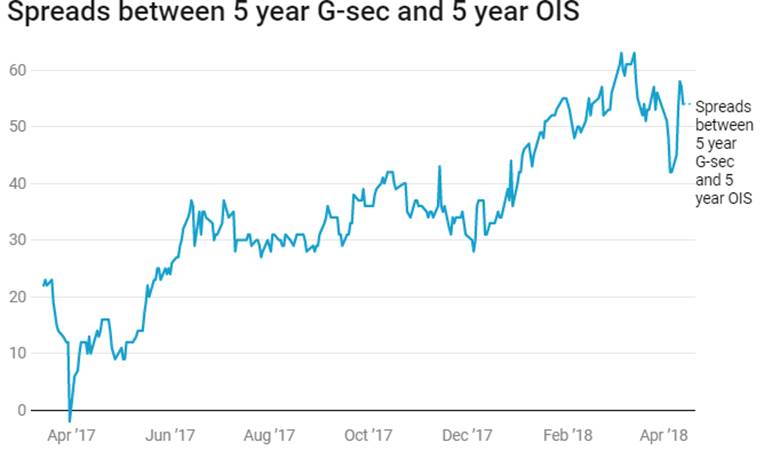

The 7.37% 2023 bond look good on the curve on an absolute and on a relative basis. On an absolute basis, the spread to the repo rate at 6% offers at levels of 137bps offers good “Carry” as overnight rates are trending at the repo rate level. The 5 year bond spread over the 5 year OIS is at levels of 56bps, indicating that spreads can compress as swap markets are not factoring a sharp rise in repo rate. One year OIS is trading at yields of 6.47%, indicating a maximum of 25bps repo rate hike, if and when it happens.

The 5 year bond to the 10 year bond at spreads of 10bps has scope to widen with fall in 5 year bond yields. The yield curve is flat at the 5*10 segment and should steepen as markets buy into the 5 year bond for a low risk, carry strategy.

RBI indicated in its April 2018 policy that it would keep rates status quo for a while given that inflation expectations are down. CPI inflation at 4.28% in March 2018 is at a 5 months low.

Liquidity is expected to stay easy on government spending. Government has spent Rs 1 trillion in just a fortnight in April and this will keep system liquidity comfortable. Stable repo rate coupled with easy system liquidity will lead to markets buying into the 5 year bond, which is trading at attractive levels of yields and spreads.

Bond markets are nervous post a sharp rise in yields last week. The 7.17% 2028 bond saw yields rise by 26bps week on week to close at levels of 7.43%. The bond yield touched highs of 7.53% before closing lower. The sudden rise in bond yields has spooked the market given that yields had fallen 60bps from highs over the last 2 months.

Market nervousness will continue given the high volatility and places of comfort will be in bonds that offer lower risk as well as a high “Carry”.

The benchmark 10 year bond, the 7.17% 2028 bond, saw yields rise by 26 bps to close at 7.43%. The on the run bond, the 6.79% 2029 bond saw yields close 29bps up at 7.54% levels and the 6.68% 2031 bond saw yields close up by 26bps at 7.66%. The long bond, the 7.06% 2046 bond saw yields close up by 4bps at levels of 7.65%. Bond yields will be ranged given weak market sentiments.

The OIS market saw 5 year OIS yields closing 13bps up week on week at levels of 6.81%. The one year OIS yield closed up by by 10bps at 6.47%. OIS yields will stay ranged on uncertain markets.

Corporate bonds saw 5 year AAA corporate bond yields close up by 17bps at levels of 7.90% and 10 year AAA corporate bond yields close up by 24bps at 8.16%. 5 year AAA spreads fell by 9bps at 41bps and 10 year AAA spreads fell by 2bps at 58 bps. 10 year AAA credit spreads would fall given attractive levels of yields on the bonds.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1365 billion as of 13th April 2018. Liquidity was in surplus of Rs 648 billion as of 30th March. Liquidity eased on government spending, government surplus cash fell by Rs trillion to Rs 1 trillion since the beginning of April.