Bond yields will hover around 7.75% with an inclination to rise but at every higher level of yields, market sentiments will start to change as the market is overly pessimistic at this point of time.

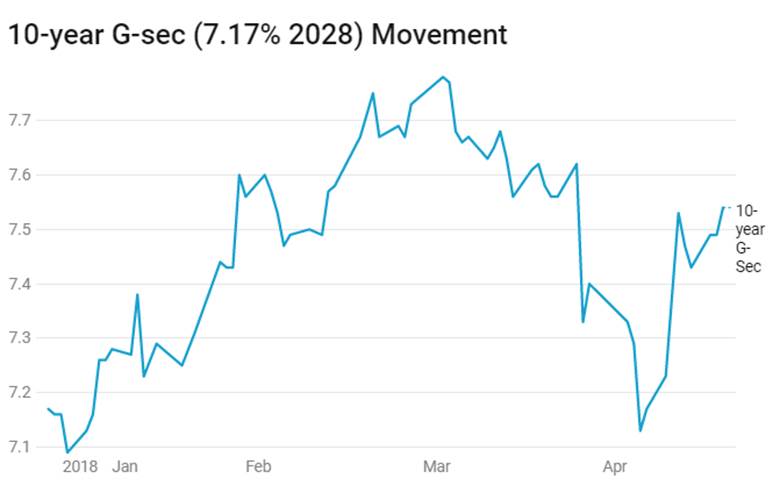

The recent extreme volatility in bond yields with the 10 year benchmark government bond yield rising by 100bps to levels of 7.75% from October 2017 and then falling to levels of 7.15% in April 2018 post RBI policy (Chart 1), and then again rising by 60bps in just a fortnight to levels of 7.75%, has unnerved bond traders and fixed income investors. The bond market sentiment is extremely weak with rising 10 year US treasury yields that is trading at close to a psychological level of 3%, rising crude oil prices that are trading at 3 year highs and a falling INR that has crossed Rs 66 to the USD from levels of Rs 64 to the USD seen a few months ago.

Other reasons for sharp rise in bond yields in April include PSU banks turning net sellers of bonds and higher than expected state borrowings for the 1st quarter of this fiscal year. State borrowings at levels of Rs 1.15 trillion to Rs 1.25 trillion are almost as high as government borrowing.

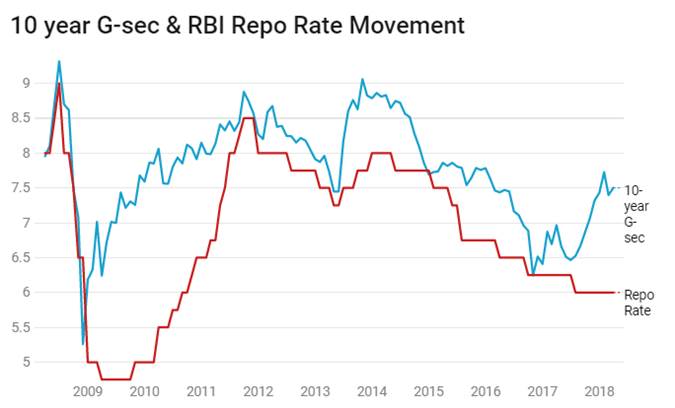

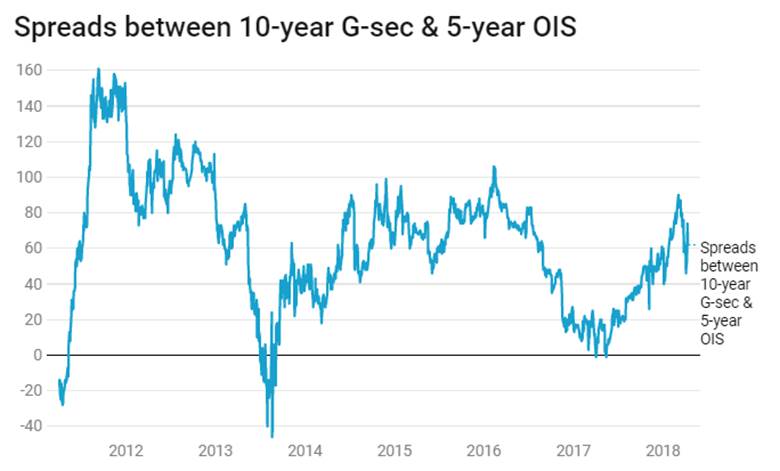

The outlook for the 10 year government bond is weak with nothing other than the higher levels of yields offering support. The 10 year government bond to repo spread and the 10 year government bond to 5 year OIS spread has widened considerably over the last one year, indicating that the bond market is front running many rate hikes, which going by RBI’s April policy guidance is unlikely to come through.

India’s macros are not as bad as the bond market makes it out to be. CPI inflation is projected at below 5% levels for this fiscal year by the RBI, fiscal deficit is projected at 3.2% of GDP, down from 3.5% seen in fiscal 2017-18, forex reserves are at record highs, tax revenues from GST is expected to rise, monsoons are forecast as normal and economic growth is forecast at higher levels than last year. However, even strong macros will not protect the market in the short term as sentiments overlook fundamentals in the short term, whether sentiments are positive or negative. At this point of time, sentiments are negative and the market will need more than fundamentals to turn sentiments.

Sentiments will turn positive when incremental data comes in better than market expectations, sellers turn buyers at higher levels of yields and volatility stabilizes across other markets, primarily the INR. The levels of yields where sentiments may turn positive is difficult to predict, it could be 7.75% or 8% or higher but whether yields can jump over 50bps from current levels of 7.75%, the probability is very low.

Since August 2017, there is clear divergence in repo rate and bond yields and currently the 10 year government bond yield is trading at 175 bps above the repo rate. Since August 2017, 10 year government bond bond yields have risen sharply due to factors such as RBI policy, Higher Inflation, Bond Oversupply, Concerns on Fiscal Slippages and Fed Rate Hikes.

The spread between the 10 year government bond yield and the 5 year OIS is at one and half year high, indicating that the OIS market is unwilling pay a high carry cost for potential rate hike positioning while government bond market is front running many potential rate hikes.

The benchmark 10 year bond, the 7.17% 2028 bond, saw yields rise by 29 bps to close at 7.72%. The benchmark 5 year bond, the 7.37% 2023 bond saw yields rise by 23 bps to close at 7.56% and the 6.68% 2031 bond saw yields close up by 27 bps at 7.93%. The long bond, the 7.06% 2046 bond saw yields close up by 8 bps at levels of 7.73%. Bond yields will be ranged given weak market sentiments.

The OIS market saw 5 year OIS yields closing 18 bps up week on week at levels of 6.99%. The one year OIS yield closed up by 10 bps at 6.57%. OIS yields will stay ranged on uncertain markets.

Corporate bonds saw 5 year AAA corporate bond yields close up by 27 bps at levels of 8.17% and 10 year AAA corporate bond yields close up by 21 bps at 8.37%. 5 year AAA spreads rose up by 4 bps at 61bps and 10 year AAA spreads fell by 8 bps at 65 bps. 10 year AAA credit spreads would fall given attractive levels of yields on the bonds.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 252 billion as of 20th April 2018. Liquidity was in surplus of Rs 1365 billion as of 13th April. Liquidity eased on government spending, government surplus cash fell by Rs trillion to Rs 1 trillion since the beginning of April.