The government has been eyeing RBIs contingency reserves of more than Rs 3 trillion as it believes that the money belongs to the government and not the RBI. This reserve has been built up over the years, across different political spectrums and there is resistance from the RBI in handing over this money to the government,

If the RBI does give the government the money held in reserves, the government can in one stroke lower fiscal deficit substantially and also have money to spend for growth. Bond yields will fall sharply, liquidity will be in high surplus, credit can grow sharply and economic growth can rise. However, this may not last as the government will have to sustain the growth momentum through prudent policies, that may or may not happen.

A one time gain is not ideal for the economy and prudence is required in asking for this money.

The reserves of the RBI are created by putting away the undistributed portion of its net income to meet fluctuations of its mark to market assets, in cases of losses. RBI distributes all its income leass expenses to the government in the form of dividend as by statute it is not a profit making enterprise and its objectives are largely to print money on behalf of the government. The question is how of reserves the RBI requires? The government is asking this question as it asks the RBI to release its reserves to the government.

The Rift between Government of India and RBI increased after Dr. Viral Acharya, Deputy Governor, Reserve Bank of India delivered a speech on “The Importance of Independent Regulatory Institutions – The Case of the Central Bank” which highlights ongoing Challenges in Maintaining Independence of the Reserve Bank of India. “Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution; their wiser counterparts who invest in central bank independence will enjoy lower costs of borrowing, the love of international investors, and longer life spans” was the message sent to the government.

RBI has to some extent supported liquidity through OMOs and easing bank lending regulations to NBFCs. RBI has also relaxed lending norms for stressed banks to improve credit flows. However, acceding to all government requests is not possible and should not be done.

Ongoing Challenges in Maintaining Independence of the Reserve Bank of India

Regulation of Public Sector Banks – One important limitation is that the Reserve Bank is statutorily limited in undertaking the full scope of actions against public sector banks such as asset divestiture, replacement of management and Board, license revocation, and resolution actions such as mergers or sales, all of which it can and does deploy effectively in case of private banks. As per speech Legislation should be amended to enable the RBI to extend all the powers currently exercised over private sector banks to PSBs; in particular, regarding Board member dismissals, mergers and license revocation. It should also remove the option of an appeal to the government when the RBI revokes a license.

The Reserve Bank’s Balance-sheet Strength – It is considered an important part of central bank’s independence from the government,having adequate reserves to bear any losses that arise from central bank operations and having appropriate rules to allocate profits (including rules that govern the accumulation of capital and reserves). A thorny ongoing issue on this front has been that of the rules for surplus transfer from the Reserve Bank to the government.

The longer-term fiscal consequences would be the same if the government issued new securities today to fund the expenditure.RBI’s capital (transfer surplus of capital) creates no new government revenue on a net basis over time, and only provides an illusion of free money in the short term.The use of such a transfer would erode whatever confidence that exists in the government’s intention to practice fiscal prudence.

Regulatory Scope – Other issue is one of regulatory scope, the most recent case in point being the recommendation to bypass the central bank’s powers over payment and settlement systems by appointing a separate payments regulator.The Reserve Bank has posted its dissent note against this recommendation.

There are several issues where government and RBI are not on concurrence,such as exempting Power companies from the 12th February circular, which scraps all restructuring process and directing them under IBC,NCLT process.Lending relaxation for bank in PCA (Prompt corrective action) list,relaxing constraints on these banks for loans to small and medium enterprises and special liquidity support to NBFCs.

On this backdrop, the government initiated consultation on RBI Act’s Section 7 (1), not invoked yet, under which the government can direct the RBI as it may, after consultation with the Governor of the Bank, considered necessary in the public interest.Government clarified that the autonomy for the Central Bank, within the framework of the RBI Act, is an essential and accepted governance requirement.

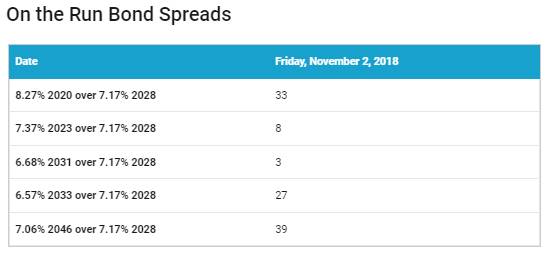

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 10 bps down at 7.78% on weekly basis. The bond yield fell on the back of RBI OMOs that is taking away supply of bonds, rise in INR that rose by 1.42% week on week on the back of a 6.4% fall in oil prices globally, rise in GST collections for September to over Rs 1 trillion and FIIs buying of bonds. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 15 bps down at 7.70% and the 6.68% 2031 bond saw yields close 14 bps down at 7.81%. The long bond, the 7.06% 2046 bond, saw yields close 5 bps down at 8.17%.

OIS market saw one year yield close down by 5 bps and five year OIS yield close down by 3 bps last week. One year OIS yield closed at 7.11% while five year OIS yield closed at 7.40%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 558 billion as of 2nd November 2018. Liquidity was in a deficit of Rs 867 billion as of 26th October 2018.

Total Commercial Paper Outstanding has Increased by 60% since April 2018

At the start FY19, total commercial paper outstanding was at Rs 3725 billion and as on October 2018, CP outstanding rose to Rs 5944 billion, a 60% jump. The CP market was used by corporates, especially NBFCs, to fund their short term borrowings and the current liquidity freeze in the CP market can hurt corporates who are not able to refinance their borrowings. The government and RBI have taken measures to ease liquidity in the credit markets, the latest measure is to allow banks to guarantee in part, bonds of NBFCs to refinance their debt.

· As on 2nd November, FII debt utilisation status stood at 62.18% of total limits, 81 bps higher against the previous week. FII investment position was at Rs 4041 billion in INR debt. FII investment position stands at Rs 2085 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1956 billion in corporate bonds.

· For the week ended 2nd November, credit spreads rose. Three-year AAA corporate bonds were trading at levels of 8.77%, spreads were 66 bps higher at 111 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.78%. Spreads were 3 bps higher at 93 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.75% with spreads 5 bps higher at 82 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.35% and 8.5% levels at spreads of 45 bps and 108 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.45% and 8.45% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 9.0% and 9.25% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the extreme long end but flattened at the long end.

· 10-year G-sec yields fell to near 3 months lows as crude prices declined, which eases concern on inflation and trade deficit.

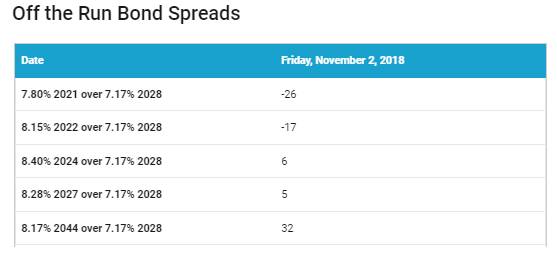

· Off the run bond spreads with the 10-year G-sec were mixed last week.

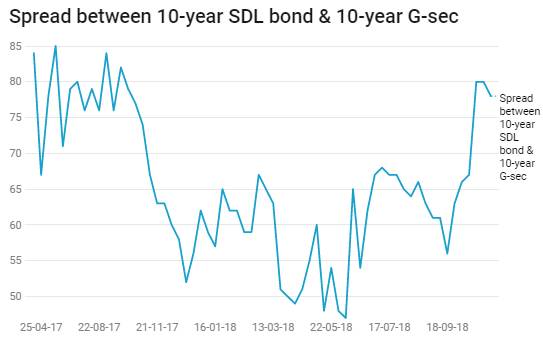

· On the 30th October 2018 auction, the spread between SDLs with 10-year G-sec came in at 78 bps. On 23rd October 2018 auction, the spread between SDLs with 10-year G-sec was at 80 bps.