RBI has announced OMO bond purchases of Rs 400 billion in November and this could lead to a short supply of government bonds in the market for this fiscal half year. RBI bought Rs 360 billion of government bonds in October, taking total bond purchases through OMO bond auctions to Rs 860 billion.

RBI is infusion liquidity to negate the impact of fx sales that has sucked out over Rs 1200 billion of liquidity. Currency in circulation has risen by around Rs 400 billion in the last one month while government cash balances were at Rs 340 billion as of 26th October.

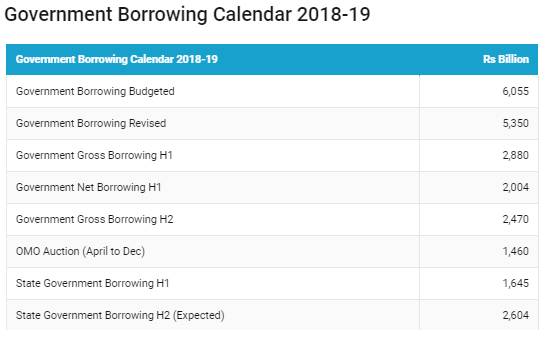

RBI buying of bonds will create a short supply in government bonds, as the government cut its borrowing for the 2nd half of this fiscal year by Rs 700 billion. The government will borrow gross Rs 2470 billion in the October- March 2018-19 period. Net borrowing post redemptions is Rs 1713 billion.

Given that RBI will be buying Rs 760 billion or more of bonds through OMOs, the market will face a supply of below Rs 1000 billion for the whole of 2nd half, unless the government comes in to borrow more. This could lead to bond yields falling largely on lack of supply and given that 10 year government bond yields are trading at 135bps over the repo rate of 6.5%.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 4 bps down at 7.88% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 6 bps down at 7.85% and the 6.68% 2031 bond saw yields close 6 bps down at 7.95%. The long bond, the 7.06% 2046 bond, saw yields close 6 bps down at 8.22%.

OIS market saw one year yield close down by 2 bps and five year OIS yield close down by 7 bps last week. One year OIS yield closed at 7.16% while five year OIS yield closed at 7.43%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 866 billion as of 26th October 2018. Liquidity was in a deficit of Rs 1054 billion as of 19th October 2018.

FIIs offload over USD 1 billion of corporate bonds post IL&FS default

In the last one month, the IL&FS default plus other factors such as global risk aversion, INR weakness and rising global bond yields have prompted FIIs to sell INR Bonds. FIIs sold over USD one billion of corporate bonds in the last one month. FIIs utilization of Corporate bonds limit fell to 67.73%. In the last one month, FIIs offloaded around Rs 78.63 billion of corporate bonds

· As on 26th October, FII debt utilisation status stood at 61.37% of total limits, 16 bps higher against the previous week. FII investment position was at Rs 3988 billion in INR debt. FII investment position stands at Rs 2030 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1958 billion in corporate bonds.

· For the week ended 26th October, credit spreads rose. Three-year AAA corporate bonds were trading at levels of 8.85%, spreads were 8 bps higher at 105 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.90%. Spreads were 2 bps higher at 90 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.80% with spreads 2 bps higher at 77 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.25% and 8.45% levels at spreads of 32 bps and 101 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.45% and 8.25% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 9.0% and 9.25% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end, as 10-year bond yields fell by 4 bps while long-end bond yields, 6.57% 2033 & 7.06% 2046 bond yields fell by 1bps and 3bps respectively.

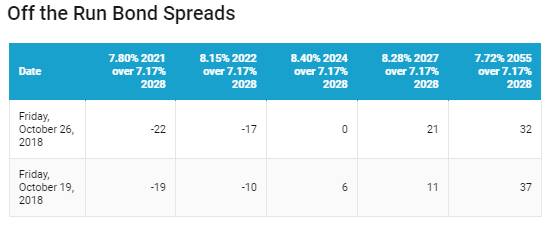

· Off the run bond spreads with the 10-year G-sec were mixed last week.

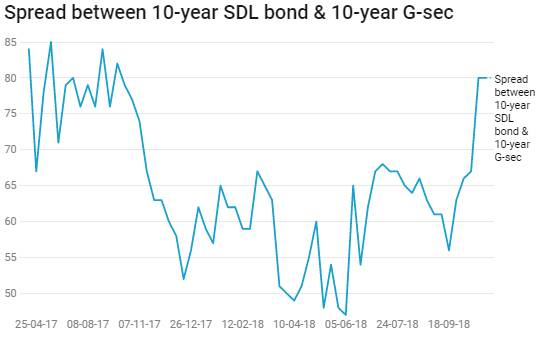

· On the 23rd October 2018 auction, the spread between SDLs with 10-year G-sec came in at 80 bps. On 16th October 2018 auction, the spread between SDLs with 10-year G-sec was at 80 bps.