The minutes of the October policy review of the MPC is purely focused on inflation and has completely ignored the stress the market is going through at present. There is a crisis of confidence of the INR, NBFCs are facing huge liquidity stress, the banking system is in deep liquidity deficit, fx reserves are falling sharply and global risks abound from trade wars to geo political issues that could derail economic growth.

The MPC seems to be wearing blinkers, and this is clearly not the right way to approach policy, even if the mandate of the MPC is inflation targeting. The need of the hour is a decisive RBI taking big steps to calm and lend confidence to the markets for them to get back to normal. In this, the present RBI governor, Dr. Urjit Patel, needs to follow Raghuram Rajan and Ben Bernanke , former RBI governor and Fed chair respectively to stabilize stressed markets. The results of their actions speak for themselves.

Rajan faced a big crisis of confidence in the economy when he took over as RBI governor in September 2013, when the economy was facing double digit inflation, high fiscal and current account deficits and a plunging INR. He immediately announced steps to address all these issues through rate hikes, FCNR B swaps for NRI deposit flows and active liquidity management. Markets calmed down and the INR stabilized and the economy got time to come back to workable macros.

Bernanke, also known as helicopter Ben, took decisive steps to stabilize stressed markets that were frozen post 2008 credit crisis. He brought down rates to zero percent and pumped in money through QE. Feds primary objective is inflation and employment rate but that did not deter the Fed from going over its objectives to ease market conditions.

RBI has better macros to work with at present, CPI inflation is below 4% and well within RBI target of 4% +/- 2%. CAD is 2.4% of GDP, fiscal deficit at 3.3% of GDP, both well below 2013 levels of 4.7% and 5% respectively. RBI can afford to pump in high amounts of liquidity through OMOs, undertake fx swaps with banks to get in NRI flows and announce other measures to bring confidence to the markets.

The central bank is selling USD to prevent sharp INR depreciation, leading to fx reserves falling by USD 5 billion in the week prior to last to multi month low levels. This is not sustainable. Staying put on rate hikes in one policy too will do nothing to ease market sentiments. Announcements to ease credit flow to NBFCs too will not really unfreeze credit markets.

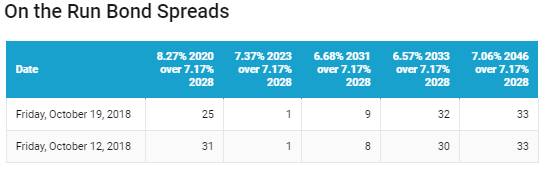

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 6 bps down at 7.92% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 6 bps down at 7.91% and the 6.68% 2031 bond saw yields close 5 bps down at 8.01%. The long bond, the 7.06% 2046 bond, saw yields close 6 bps down at 8.24%.

OIS market saw one year yield close down by 9 bps and five year OIS yield remain unchanged last week. One year OIS yield closed at 7.18% while five year OIS yield closed at 7.58%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 1054 billion as of 19th October 2018. Liquidity was in a surplus of Rs 537 billion as of 12th October 2018.

Total Corporate bonds outstanding touches record levels of Rs 28.38 trillion

As on September 2018, total corporate bonds outstanding was Rs 28.38 trillion, up by 9.74% against Rs 25.86 trillion in September 2017.

· As on 19th October, FII debt utilisation status stood at 61.21% of total limits, 24 bps lower against the previous week. FII investment position was at Rs 3978 billion in INR debt. FII investment position stands at Rs 2012 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1965 billion in corporate bonds.

· For the week ended 19th October, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.85%, spreads were 2 bps lower at 97 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.95%. Spreads were 10 bps higher at 88 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.82% with spreads 1 bps higher at 74 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.25% and 8.40% levels at spreads of 35 bps and 99 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.45% and 8.25% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 9.0% and 9.25% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end, as 10-year bond yields fell by 6bps while long-end bond yields, 6.68% 2031 fell by 5 bps and 6.57% 2033 bond yields fell by 4 bps.

· Off the run bond spreads with the 10-year G-sec were mixed last week.

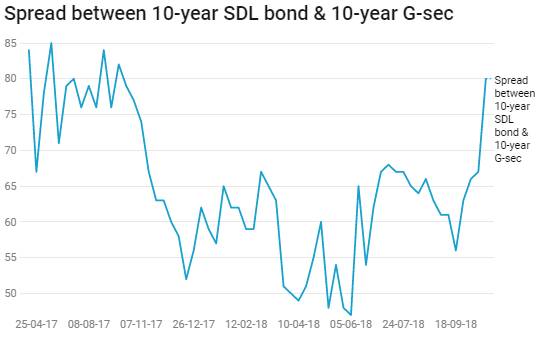

· On the 16th October 2018 auction, the spread between SDLs with 10-year G-sec came in at 80 bps. On 9th October 2018 auction, the spread between SDLs with 10-year G-sec was at 67 bps.