Government bond yields fell last week on the back of RBI OMO bond purchases, expectations of a lower CPI inflation print for September 2018, INR rallying from record lows and drop in UST yields from multiyear highs. However, short end credit yields stayed at higher levels on concerns of a freeze in credit markets.

Credit risk aversion post IL&FS default has still not gone out of credit yields despite the fact that NHB and SBI have pledged support for Rs 750 billion of liquidity for NBFCs. Credit risk mutual fund schemes are facing redemptions on default worries and that is still keeping credit yields high.

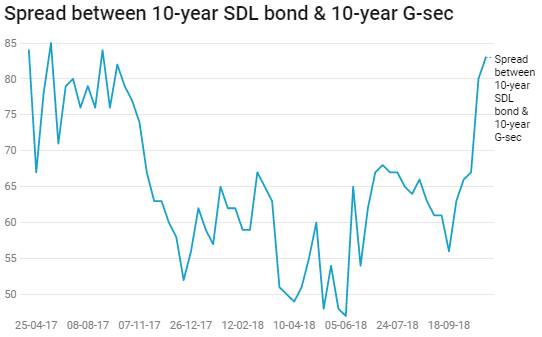

Liquidity, which is a primary driver of credit yields, turned negative on RBI fx sales, as the INR fell to record lows of below Rs 74 to the USD. RBI bought Rs 120 billion of bonds through OMOs last week to ease liquidity pressures. However, with announcement of Rs 150 billion of CMB auction, market will face more supply as states are auctioning around Rs 160 billion of SDLs this week. Liquidity will stay tight as the festive season draws in demand for funds.

Government bond yields will look to trend up despite CPI inflation coming in at 3.77%, while core CPI inflation at 5.8% was below August levels of 6%. IIP growth too fell to 4.3% in August from 6.6% seen in July. However, given rise in import duties of electronic items, higher fuel prices and weak INR, inflation is expected to rise over 4% levels going forward.

The market will be wary of supply and rate hikes ahead and that will push up the 10 year benchmark government bond yields from current levels of 7.98%.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 4 bps down at 7.98% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 1 bps down at 7.97% and the 6.68% 2031 bond saw yields close 4 bps down at 8.06%. The long bond, the 7.06% 2046 bond, saw yields close 3 bps down at 8.30%.

OIS market saw one year yield close down by 9 bps and five year OIS yield close down by 13 bps last week. One year OIS yield closed at 7.26% while five year OIS yield closed at 7.58%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 537 billion as of 12th October 2018. Liquidity was in a surplus of Rs 648 billion as of 05th October 2018.

MF exposure to NBFC CPs and G-secs fell 12% each last month

As on September 2018, mutual fund exposure to G-secs fell 12% to Rs 624.41 billion against Rs 710.46 billion in August 2018. MF exposure to NBFC CPs also fell 12% to Rs 1269.72 billion from Rs 1442.20 billion in the previous month.The IL&FS default and market panic on DHFL caused a stress on credit markets. Yields on NBFC CPs and bonds rose sharply across the board as mutual funds have turned risk averse and have not incrementally invested in NBFC CPs.

· As on 12th October, FII debt utilisation status stood at 61.45% of total limits, 126 bps lower against the previous week. FII investment position was at Rs 3993 billion in INR debt. FII investment position stands at Rs 2018 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1975 billion in corporate bonds.

· For the week ended 12th October,credit spreads were mixed.Three-year AAA corporate bonds were trading at levels of 8.89%, spreads were 3 bps higher at 99 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.91%. Spreads were 2 bps lower at 78 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.87% with spreads 3 bps higher at 73 bps.

· Three months and twelve months PSU bank CD yields were trading at 7.23% and 8.50% levels at spreads of 35 bps and 99 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.39% and 8.20% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.93% and 9.18% levels respectively.