Volatility shifted to credit markets last week on the back of contagion effect of IL&FS default. Yields on DHFL CPs and bonds spiked on Friday as rumors of liquidity issues with the company hit the market. DHFL equity share price fell over 50% on Friday before recovering marginally. The company management were quick to clarify their liquidity position to calm nervous markets, but the damage had been done and nervousness on credits will continue for a while.

Mutual Funds are at the receiving end of credit market volatility as well over 90% of their fixed income assets are in credit markets. Rise in corporate bond yields and credit spreads across the yield curve will hit NAVs of mutual fund fixed income schemes, which could prompt investors to pull money out of the schemes, leading to large scale credit sales by Mutual Funds.

Insurance companies and provident funds will have to absorb the sales and RBI may have to step in to tell banks to calm the situation through backstop measures. This is the worst case scenario.

In a best case scenario, credit spreads will still rise as tight system liquidity coupled with lack of inflows into debt mutual funds will tilt the demand supply balance towards the supply side.

Government bond yields fell last week as the government unofficially indicated that it may lower its borrowing against the budgeted amount, for the October – March 2018-19 period. However bond markets will stay nervous on Fed rate hikes and expected rate hikes by the RBI in its October policy review.

Money market yields spiked on credit market worries with sharp rise in yields on CPs, especially NBFC CPs. Money market yields will stay pressured on liquidity and credit market worries.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 5 bps down at 8.08% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 10 bps down at 8.09% and the 6.68% 2031 bond saw yields close 4 bps down at 8.19%. The long bond, the 7.06% 2046 bond, saw yields close 7 bps down at 8.31%.

OIS market saw one year yield close down by 2 bps and five year OIS yield close up by 2 bps last week. One year OIS yield closed at 7.44% while five year OIS yield closed at 7.71%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 1485 billion as of 21st September 2018. Liquidity was in a deficit of Rs 536.35 billion as of 14th September 2018.

MF debt portfolios have 9.78% of total assets in NBFCs Commercial Papers

As on August 2018, Mutual Funds had total commercial papers (CP) investments of Rs 4906.88 billion, of which NBFC CPs amounted to Rs 1442 billion, 9.78% of total debt MF portfolio. Mutual Funds hold 77.58% of total CP outstanding.

· As on 21st September,FII debt utilisation status stood at 69.68% of total limits, 46 bps lower against the previous week. FII investment position was at Rs 4143 billion in INR debt. FII investment position stands at Rs 2106 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2036 billion in corporate bonds.

· For the week ended 21st September,credit spreads rose. Three-year AAA corporate bonds were trading at levels of 8.95%, spreads were 11 bps higher at 79 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 9.06%. Spreads were 15 bps higher at 79 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.90% with spreads 6 bps higher at 66 bps.

· Three months and twelve months PSU bank CD yields spiked and were trading at 7.32% and 8.37% levels at spreads of 24 bps and 75 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.45% and 8.09% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.75% and 8.95% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened, as 10-year bond yields fell by 5 bps while long-end bond yields, 6.57% 2033 & 7.06% 2046 bond yields, fell by 7-8 bps. Largely, most of the long end bonds were untraded last week

· Off the run bond spreads with the 10-year G-sec were mixed last week. Off the run bonds were largely untraded last week. (Table 2)

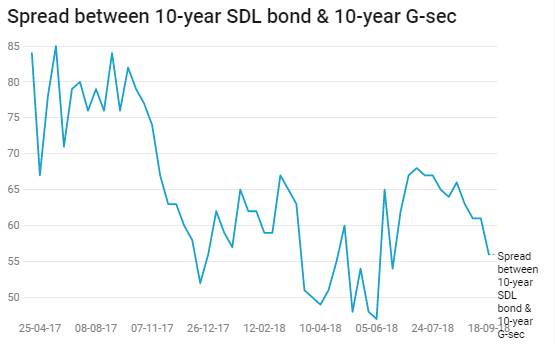

· On the 18th September 2018 auction, the spread between SDLs with 10-year G-sec came in at 56 bps (Only 3 states participated in the SDL auction). On 11th September 2018 auction, the spread between SDLs with 10-year G-sec was at 61 bps