The OMO announcement will provide support to bond yields in the near term but markets will stay nervous on borrowing and rate hike worries. Measures to bring in capital flows will not help the INR unless risk aversion eases.These measures includes review of mandatory hedging for infrastructure loans,manufacturing companies allowed to borrow upto USD 50 million under ECB(External commercial borrowing) route for one year,review of FPI restriction in corporate debt of single corporate entity bond in portfolio,Masala bonds exemption from withholding tax,Indian banks allowed to underwrite and market maker for Masala bonds,curbing non essential imports,focusing on exports.

Bond yields turned volatile last week as the INR threatened to breach the Rs 73 mark to the USD. INR rose from lows on profit taking as the Prime Minister called for a meeting on the economy and INR fall. The 10 year benchmark government bond, the 7.17% 2028 bond saw yields cross multi year highs of 8.20% before falling to close at 8.11% levels.

The bond yield will stay volatile as the market worries about rate hikes by the RBI, government borrowing for the 2nd half of the fiscal year and global issues including Fed rate hikes and trade wars.

RBI is expected to hike rates in October despite CPI inflation for August falling below 4%. Core CPI at 6% levels and steadily falling INR on capital outflows due to global risk aversion will drive the RBI to hike rates. Government bond supply will rise sharply starting October as the government looks to complete the bulk of its borrowing in the next six months.

Fed rate hikes this month and more hikes expected by the end of the year on strong US jobs data will also play on the markets mind. EM currencies have seen high volatility on the back of trade war worries and rising US interest rates and until this stabilizes, the INR will stay under pressure.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 10 bps up at 8.13% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 10 bps up at 8.19% and the 6.68% 2031 bond saw yields close 4 bps up at 8.23%. The long bond, the 7.06% 2046 bond, saw yields close 6 bps up at 8.38%.

OIS market saw one year yield close up by 22 bps and five year OIS yield close up by 15 bps last week. One year OIS yield closed at 7.46% while five year OIS yield closed at 7.69%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 536.35 billion as of 14th September 2018. Liquidity was in surplus of Rs 704 billion as of 7th September 2018.

Banks Selling PSU Bonds in FY19

In the April-July 2018 period, Banks investment in total amount of PSU bonds exposure fell 12.11% to Rs 1230 billion.In March 2018,it was at Rs 1399 billion.While Private Corporate Sector bonds exposure rose 1.42% to Rs 2253 billion in same period.

· As on 14th September,FII debt utilisation status stood at 70.14% of total limits, 1 bps lower against the previous week. FII investment position was at Rs 4171 billion in INR debt. FII investment position stands at Rs 2122 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2048 billion in corporate bonds.

· For the week ended 14th September,credit spreads was mixed. Three-year AAA corporate bonds were trading at levels of 8.95%, spreads were flat at 68 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 9.0%. Spreads were 4 bps higher at 64 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.90% with spreads 3 bps lower at 60 bps.

· Three months and twelve months PSU bank CDs spiked and were trading at 7.37% and 8.30% levels at spreads of 32 bps and 65 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.55% and 8.00% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.65% and 8.85% levels respectively.

· Weekly G-sec Curve Spread Analysis

· The yield curve flattened, as 10-year bond yields rose by 10 bps while long-end bond yields, the 6.68% 2031, 6.57% 2033 & 7.06% 2046 bond yields, rose by 4-6 bps.

· Off the run bond spreads with the 10-year G-sec fell last week. (Table 2)

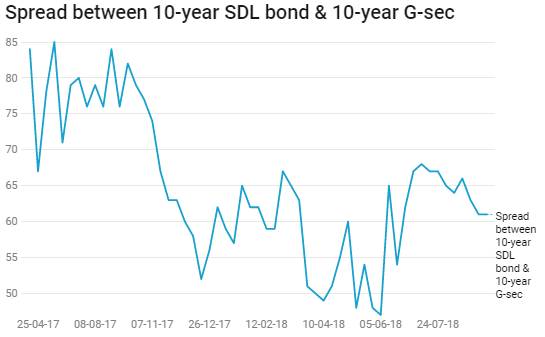

· On the 11th September 2018 auction, the spread between SDLs with 10-year G-sec came at 61 bps. On 03rd September 2018 auction, the spread between SDLs with 10-year G-sec was at 61 bps