The first quarter 2018-19 GDP growth at 8.2% is higher than RBI full year forecast of around 7.4%. To a certain extent, base effect contributed to higher growth but given that growth is looking strong, the economy seems to be moving on a fast track.

The strong GDP growth will give headroom for RBI to hike the repo rate in its October policy review as the central bank looks to temper inflation expectations that are rising on factors such as strong economic growth, closing output gap, rising oil prices and falling INR. Higher economic growth is positive for government revenues as tax collections rise and fiscal deficit is kept in check despite high government spending.

Rate hike by the RBI will be welcomed by markets as the central bank looks to catch up with the yield curve. However, given issues such as liquidity tightness in September on advance tax outflows, INR weakness and a heavy 2nd half borrowing calendar, bond markets will take up bond yields in anticipation of rate hikes.

Gsec yields will trend up with money market yields while lower rated corporate bonds will see spreads coming off on improved economic health. OIS yield curve will flatten on liquidity and rate hike expectations.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 8 bps up at 7.95% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 7 bps up at 8.01% and the 6.68% 2031 bond saw yields close 7 bps up at 8.13%. The long bond, the 7.06% 2046 bond, saw yields close 2 bps up at 8.23%.

OIS market saw one year yield close up by 9bps and five year OIS yield close up by 9 bps last week. One year OIS yield closed at 7.14% while five year OIS yield closed at 7.42%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 236 billion as of 31st August 2018. Liquidity was in deficit of Rs 150 billion as of 24th August 2018.

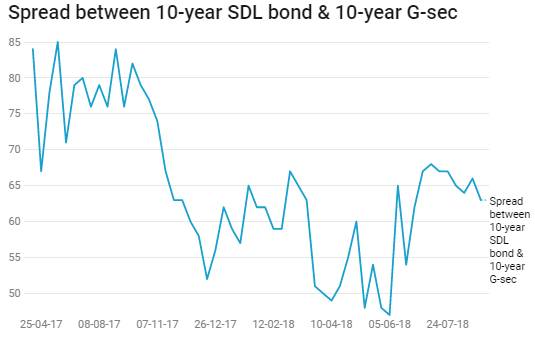

Aggregate expenditure of the state governments rose 1.35 times in last 6 years

As per RBI reports,in recent years state governments collectively spend significantly more than the central government.In FY18 aggregate expenditure of the state governments increased to Rs 30285 billion in 2017-18 from 12847 billion in FY12 and expected to rise to 33592 billion in 2018-19.State governments market borrowings, main source of funding of their gross fiscal deficits, have risen sharply in past years with estimates Rs 5.3 trillion for FY19,28% yearly growth.

· As on 31st August, FII debt utilisation status stood at 70.93% of total limits, 13 bps lower against the previous week. FII investment position was at Rs 4217 billion in INR debt. FII investment position stands at Rs 2139 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2078 billion in corporate bonds.

· For the week ended 31st August, credit spreads mixed. Three-year AAA corporate bonds were trading at levels of 8.60%, spreads were higher by 1 bps at 66 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.70%. Spreads were flat at 53 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.66% with spreads 7 bps lower at 56 bps.

· Three months and twelve months PSU bank CDs were trading at 7.15% and 8.04% levels at spreads of 35 bps and 74 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.25% and 7.75% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.35% and 8.55% levels respectively.

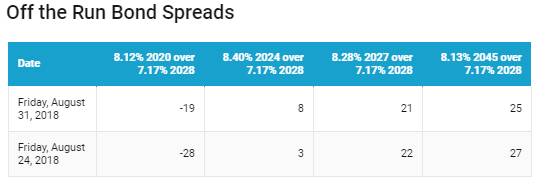

Weekly G-sec Curve Spread Analysis

· The yield curve flattened, as 10-year bond yields rose by 8 bps while long end bond yields 6.68% 2031 & 7.06% 2046 rose by 3-7 bps.

· Off the run bond spreads with the 10-year G-sec were mixed last week. (Table 2)

· On the 28th August 2018 auction, the spread between SDLs with 10-year G-sec came at 63 bps. On 20th August 2018 auction, the spread between SDLs with 10-year G-sec was at 66 bps