Bond Yields have Topped, Play on the Long Side

The worst looks to be over for the bond markets, that have seen a sharp rise in yields across segments of the curve over the last two months. Markets went into a risk aversion mode on factors of oil, INR depreciation, Fed rate hikes, trade wars, elections, PSU bank NPA issues, RBI hawkish minutes of April policy and rise in core CPI inflation. Liquidity too came off from surplus to deficit.

10 year government bond yields at around 7.85% levels, 3, 5 and 10 year AAA corporate bond yields in a 8.50% to 8.65% range and one year CP, CD yields at 8.25% levels and above have factored in the negatives in the market and are poised for a rally.

The rally in bond markets will come about on the back of

a. Oil prices peaking out globally and a sharp fall of around 5% seen last week on back of Saudi and Russia seeking higher output will lead to pessimism on both current account deficit and inflation coming off.

b. Talks of fuel being brought under GST, which will lead to fall in fuel prices and lower inflation expectations

c. China – US trade war fears waning on both countries negotiation over the table.

d. US 10 year treasury yields stabilizing around 3% levels as Fed is guiding for a gradual pace of rate hikes

e. State elections getting over in Karnataka lowering political risk in the market

f. Banks cleaning up their books in the 4th quarter of fiscal 2017-18 and stressed asset sales under NCLT seeing closures.

The risk premium in bond yields on the back of FII selling due to a falling INR will come off gradually and bond market sentiments will improve going forward.

Government bond yields will fall this week on the back of the above mentioned factors. Five year OIS yields will come off from levels of 7.16% on the back of improving market sentiments.

AAA Corporate Bond Curve to Steepen on INR Strengthening

The flat AAA corporate bond yield curve will start to steepen as the INR strengthens on falling global risk aversion and oil prices peaking out. Read our Weekly Currency Report on INR.

Corporate bond yields have risen across the curve on worries of FII selling, falling INR and falling system liquidity. The AAA yield curve flattened as markets sold off the short end. Liquidity worries pulled up money market securities yields, despite the fact that overnight rates stayed at around the repo rate of 6%.

The rise in corporate bond yields saw short end of the curve mutual fund schemes showing deep losses in April and May. However at these levels of yields and flat curve, Ultra Short Funds and Short term Income Funds will see strong traction as yields fall.

Corporate Bond Market Movements for the Week

· As on 25th May, FII debt utilisation status stood at 72.04% of total limits,71 bps lower against the previous week. FII investment position was at Rs 4283 billion in INR debt. FII investment position stands at Rs 2226 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2056 billion in corporate bonds.

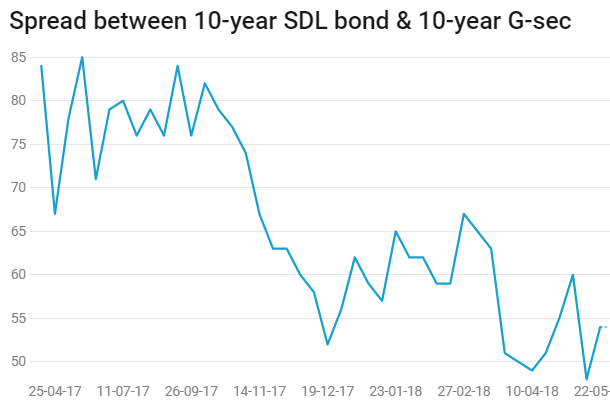

· For the week ended 25th May,Credit spreads movement was mixed.Three-year AAA corporate bonds were trading at levels of 8.56%, spreads came down 9 bps at 76 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.65%. Spreads were at 66 bps, 5 bps lower against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.58% with spreads 12 bps higher at 64 bps.

· Three months and twelve months PSU bank CDs were trading at 7.70% and 8.25% levels each at attractive spreads of 136 bps and 137 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.89% and 8.43% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.45% and 8.65% levels respectively.