10 year benchmark gsec yield rose last week by 11bps as the INR fell to below Rs 70 to the USD for the first time on record. In tandem with rise in government bond yields, corporate bond and OIS yields rose. The market sold off a bit on the back of worries of INR fall impact on RBI policy.

The RBI, to its credit, has remained calm in the face of volatility in the INR. External events such as risk aversion on the back of Turkish Lira collapse is beyond RBI’s control. Rise in crude oil prices has taken up trade deficit to levels seen five years ago, which is weighing on the current account. FIIs have been net sellers of equities and bonds so far this year and that would impact balance of payments. However, falling inflation and improving economic health suggests that the country is nowhere close to vulnerability as it was in 2013, when the INR fell to record lows.

July 2018 CPI inflation fell, with core inflation falling by 70bps, easing market fears of a continuous rise in inflation. RBI, going by policy minutes for August, will stay on a rate hike course as MPC members are worried about the MSP hike impact on inflation.

Minutes of RBI August policy meet suggest that the RBI hiked the repo rate in order to keep inflation below the mandated 4% mark on a durable basis. 5 of the 6 members of the MPC voted for a 25bps rate hike, while all the 6 members voted for the policy stance to remain neutral. MPC members are concerned about higher inflation due to rise in crude oil prices, MSP for crops, HRA impact, positive economic outlook and closure of output gap.

Dr. Urjit Patel said inflation measured by CPI ex HRA has risen for the 3rd consecutive month in June 2018, driven by a broad-based increase in inflation in non-food goods and services. Elevated crude oil prices have kept petroleum products high, furthermore, inflation increased in education, health, and clothing. In contrast, inflation in the food group remained benign due to a decline in prices of fruits and vegetables. Going forward excluding HRA impact, CPI is projected at 4.7%-4.8% in H2 2018-19, projection includes the impact of MSP. However, the outlook for inflation faced with both upside and downside risks.

Domestic growth prospects also remains strong, normal monsoon augurs well for the farm sector, the manufacturing sector remains robust, Several high-frequency indicators of services activity have also expanded at a faster pace. However, rising trade protectionism may impact growth prospect by dampening exports.

Government bond yields are likely to trade cautiously on the back of INR fall but yields will not spike given that RBI wis unlikely to use interest rates to stem the INR fall. OIS yield curve will flatten as markets position for more rate hikes. Corporate yields yields will stay sticky at higher levels given that RBI will keep liquidity easy in the system.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 11 bps up at 7.86% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 12 bps up at 7.92% and the 6.68% 2031 bond saw yields close 12 bps up at 8.05%. The long bond, the 7.06% 2046 bond, saw yields close 2 bps down at 8.08%.

OIS market saw one year yield close up by 11 bps and five year OIS yield close up by 9 bps last week. One year OIS yield closed at 7.06% while five year OIS yield closed at 7.33%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 185 billion as of 17th August 2018. Liquidity was in surplus of Rs 460 billion as of 10th August 2018.

MF exposure to NBFCs CP rise sharply

Mutual Funds investments in NBFC commercial papers (CP) were at Rs 1578 billion as of July 2018, 23.34% higher against the previous month at Rs 1279 billion. CPs are offering good spreads over benchmarks leading to liquidity flowing into the higher spreads.

· As on 17th August, FII debt utilisation status stood at 70.92% of total limits, 30 bps lower against the previous week. FII investment position was at Rs 4217 billion in INR debt. FII investment position stands at Rs 2160 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2057 billion in corporate bonds.

· For the week ended 17th August, credit spreads fell. Three-year AAA corporate bonds were trading at levels of 8.55%, spreads were lower by 4 bps at 69 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.64%. Spreads were at 57 bps, 6 bps lower against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.64% with spreads 4 bps lower at 63 bps.

· Three months and twelve months PSU bank CDs were trading at 7.10% and 7.92% levels at spreads of 28 bps and 64 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.23% and 7.74% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.28% and 8.48% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end of the curve, as 10-year bond yields rose by 11 bps while long bond yields (6.57% 2033) rose by 10 bps and exterme long end bond yields (7.06% 2046) fell by 2 bps.

· Off the run bond spreads with the 10-year G-sec largely fell last week. (Table 2)

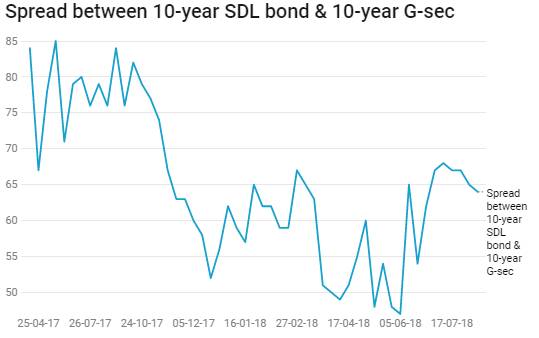

· On the 7th August 2018 auction, the spread between SDLs with 10-year G-sec came in at 64 bps. On 30th July 2018 auction, the spread between SDLs with 10-year G-sec was at 65 bps