RBI rate hike last week was largely shrugged off by the bond markets, with 10 year benchmark government bond yields falling before rising from lows to close the week 2bps lower week on week at 7.76% levels. Yields across money markets, corporate bonds and OIS showed marginal movements, indicating that RBI is playing catch up with the yield curves that have front run multiple rate hikes.

In fact, markets may not appreciate RBI staying status quo on rates in its forthcoming policy meet as it may lead to worries of RBI being behind the inflation curve.

Bond market is looking ahead into October, when the government starts to borrow for the second half of this fiscal year. Supply will be large, as the government will undertake the bulk of its full year borrowing in the second half as against the normal practice of front loading borrowing in the first half and tapering borrowing in the second half.

Absorbing large supply of bonds will require the markets to be co0nvinced of RBI’s efforts of inflation targeting. Bond yields have largely risen on rising inflation expectations with yields rising by 125bps – 150bps and above across yield curves, well before RBI started to hike rates in June 2018. Core inflation at levels of 6.4% as of June 2018 has largely vindicated the bond market inflation fears.

At the current levels of yields on government bonds, corporate bonds, OIS and money market securities, more rate hikes will hardly be felt and markets will move on liquidity rather than any other factor.

Liquidity eased last week on currency in circulation in falling by over Rs 250 billion over the last fortnight. Government spending too raised liquidity levels. Liquidity will stay comfortable this month as government continues to spend and RBI pays dividend to the government.

Government bond yields will see ranged trading between 7.70% to 8% levels going into October while OIS yield curve will flatten on more rate hike expectations. Corporate bond yields will stay stable though 3 year AAA corporate bond yields have scope to fall on easy liquidity and risk aversion coming off.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 2 bps down at 7.76% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields saw yields close 2 bps down at 7.87% and the 6.68% 2031 bond saw yields close 2 bps down at 7.95%. The long bond, the 7.06% 2046 bond, saw yields remain unchanged at 8.10%.

OIS market saw one year yield close up by 3 bps and five year OIS yield closed down by 3 bps last week. One year OIS yield closed at 6.96% while five year OIS yield closed at 7.25%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1013 billion as of 3rd August 2018. Liquidity was in surplus of Rs 140 billion as of 27th July 2018.

FIIs bought INR Bonds last week

FIIs bought INR Bonds in the week ended on 3rd August 2018. FIIs increased G-sec and corporate bond exposure by Rs 32.5 billion and Rs 3.28 billion respectively.On the back of INR depreciation in the last six months, FIIs INR Bonds and this selling is expected to ease going forward on the back of growth optimism.

· As on 3rd August, FII debt utilisation status stood at 70.60% of total limits, 60 bps higher against the previous week. FII investment position was at Rs 4198 billion in INR debt. FII investment position stands at Rs 2138 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2060 billion in corporate bonds.

· For the week ended 3rd August, credit spreads movements were mixed. Three-year AAA corporate bonds were trading at levels of 8.46%, spreads were lower by 5 bps at 66 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.61%. Spreads were at 61 bps, 1 bps higher against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.57% with spreads unchanged at 66 bps.

· Three months and twelve months PSU bank CDs were trading at 7.14% and 7.95% levels at spreads of 38 bps and 70 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.26% and 7.63% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.28% and 8.48% levels respectively.

Weekly G-sec Curve Spread Analysis

o The yield curve steepened at the extreme long end, as 10-year bond yields fell by 1 bps while extreme long bond yields were unchanged.

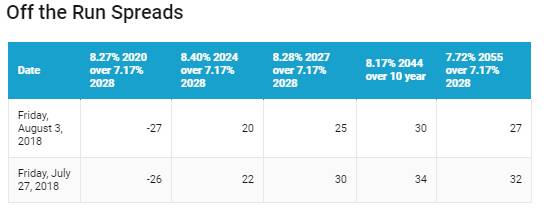

o Off the run bond spreads with the 10-year G-sec fell last week. (Table 2)

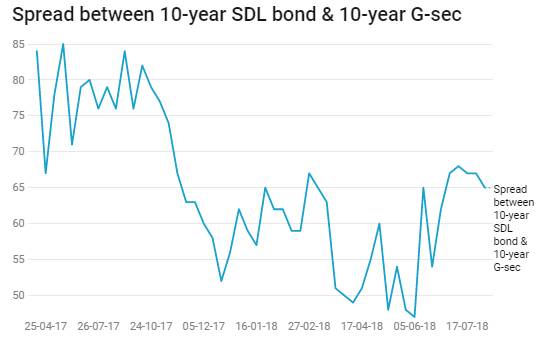

o On the 30th July 2018 auction, the spread between SDLs with 10-year G-sec came in at 65 bps. On 24th July 2018 auction, the spread between SDLs with 10-year G-sec was at 67 bps