RBI at beginning of rate hike cycle, our Fixed Income Growth Portfolio is Long Bonds plus Lower Rate Credits

RBI hiked the repo rate by 25bps last week and will hike rates by at least 3 more times in the next nine months. However bond yields have largely factored in the multiple rate hikes and will stabilize at current levels.

We have released our for 2018 and based on our analysis, we are going long on long maturity Gsecs and AAA corporate bond and also lower rated credits. The long maturity bonds are pricing in multiple rate hikes and higher inflation and this will keep yields steady going forward. RBI’s inflation targeting at 4% CPI inflation in the medium term is positive for long end of the curve.

The turning of the economic cycle will also improve prospects for lower rated issuers as their balance sheets start to look healthy.

Government bond auctions saw cut offs at higher levels of yields post the rate hike but the auctions sailed through indicating that markets are largely comfortable at currenlt levels of yields.

Government is spending heavily and is running high overdraft with the RBI and the central bank is auctioning CMBs to cover the overdraft. Advance tax and GST inflows in the second half of this month will improve government finances.

The benchmark 10 year bond, the 7.17% 2028 bond, saw yields rise by 10 bps to close at 7.95%. The benchmark 5 year bond, the 7.37% 2023 bond saw yields rise by 19 bps to close at 8.05% and the 6.68% 2031 bond saw yields close up by 11 bps at 8.12%. The long bond, the 7.06% 2046 bond yields remain unchanged. Government bond yields will steady at higher levels.

The OIS market saw 5 year OIS yields closing 4 bps up week on week at levels of 7.24%. The one year OIS yield closed up by 3 bps at 6.84%. OIS yield curve will flatten going forward on rate hike expectations being built into one year OIS yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 567.12 billion as of 8th June 2018. Liquidity was in surplus of Rs 152 billion as of 1st June 2018. Liquidity will tighten on CMB auctions and advance tax outflows in mid June.

10 Year AAA Corporate Bond Spreads Rose post RBI policy.

The flat corporate bond curve will start to steepen post RBI rate hike. Rate hike has removed uncertainty from yields, which is the reason for the flatness. Positive liquidity and improved economic growth are positive for corporate bonds and credit spreads.

· As on 8th June, FII debt utilisation status stood at 71.65% of total limits,35 bps lower against the previous week. FII investment position was at Rs 4260 billion in INR debt. FII investment position stands at Rs 2227 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2037 billion in corporate bonds.

· For the week ended 8th June,Credit spreads movement was mixed. Three-year AAA corporate bonds were trading at levels of 8.73%, spreads up 8 bps at 81 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.83%. Spreads were at 62 bps, 1 bps lower against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.88% with spreads 12 bps higher at 78 bps.

· Three months and twelve months PSU bank CDs were trading at 7.12% and 8.17% levels each at spreads of 62 bps and 119 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.34% and 7.87% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.40% and 8.60% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened as the 10-year G-sec (7.17% 2028) yield rose by 10 bps while 6.68% 2031 & 6.57% 2033 bond yield rose by 11 bps and 14 bps respectively.

· G-sec yields had risen sharply after RBI raised its benchmark interest rate by 25bps (to Read Our Note on RBI Policy).

· Extreme long-end bond yields largely remained untraded.

· Off the run bond spreads with the 10-year G-sec were mixed last week. (Table 2)

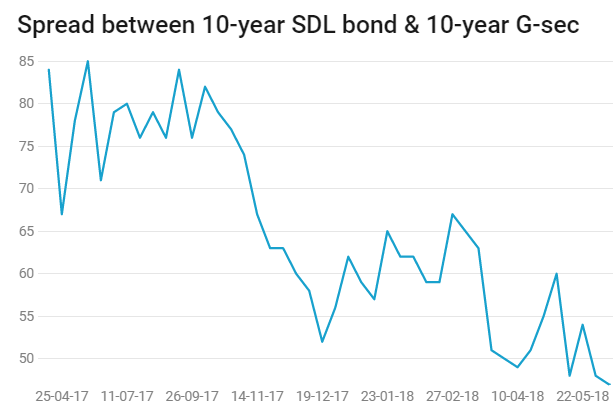

· On the 5th June 2018 auction, the spread between SDL bonds with 10-year G-sec came in at 47 bps. 29th May 2018 auction, the spread between SDL bonds with 10-year G-sec came was at 48 bps