50bps rate hike will take up bond yields by around 25bps after which yields will stabilise. Overall, bond markets will view the 50bps rate hike as positive as pace of rate hikes can then be easily calibrated going forward removing market uncertainty.

RBI no longer needs to provide growth support to the economy. The focus is more on cleaning up the banking system, managing volatility in the INR and keeping liquidity comfortable. Core CPI inflation at 6.4% in June, provides the RBI a strong reason to raise the repo rate by 50bps from 6.25% to 6.75% in its policy meet this week.

RBI will also take comfort from the fact that bond yields have largely front run multiple rate hikes. 10 year benchmark government bond yield is at levels of 7.80% while credit yields are over 8% levels at the one year segment of the money market curve. System liquidity is in surplus despite fx reserves dropping by almost USD 20billion over the last 3 months on the back of RBI selling USD and INR depreciation.

The 1st quarter of fiscal 2018-19 corporate results are showing a healthy earnings trend from NBFCs to FMCG and auto companies. NBFCs have upped their lending in the face of strong demand for loans for consumption and also demand from medium and small scale enterprises that are witnessing higher demand for their products and services. The PSU banking system is still in the act of cleaning up balance sheets on the back of surging bad loans and all their business is being taken away by aggressive NBFCs.

Given the rising demand in the economy with capacity utilization across manufacturers moving up, rising raw material costs due to rise in oil and global commodity prices are being passed on to consumers. This will add to rising inflation expectations despite the fact that GST rates have been cut for most goods this month.

Government has been spending heavily, largely on the road construction sector, with all non debt laden road construction companies showing healthy rise in order books and also healthy rise in revenues on execution. L&T the largest infrastructure company in India, showed good 1st quarter fy 19 results with healthy rise in order book. Pick up in infrastructure activities bode well for economic growth in the 1st quarter of fiscal 2018-19.

Monsoons have been largely on track though states such as UP and Bihar have received below normal rainfall. Government has raised MSP for crops and while the raise is not likely to impact CPI by much higher rural demand would lead to higher overall economic growth.

US economy expanded by 4.1% annualised in the 2nd quarter of 2018, the fastest growth recorded since 2014. Fed is on track to raise rates two more times this year. Strong US economy, strong domestic corporate earnings and expectations of strong earnings in the coming quarters driven by corporate guidance has taken the Sensex and Nifty to record highs.

The government will also start the bulk of its borrowing in the second half of this fiscal year and with supply pressures RBI will have to carefully manage the borrowing to prevent any undue rise in bond yields. Front loading of rate hikes will help the RBI manage the borrowing for the second half of this fiscal year.

The 10-year benchmark government bond, the 7.17% 2028 bond, saw yields close 1 bps down at 7.78% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields saw yields close 2 bps down at 7.89% and the 6.68% 2031 bond saw yields remain unchanged at 7.97%. The long bond, the 7.06% 2046 bond, saw yields close 3 bps up at levels of 8.10%.

In the OIS market 5 year OIS yields and 1 year OIS yields remain unchanged on weekly basis at a level of 7.28% and 6.93% respectively.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 140 billion as of 27th July 2018. Liquidity was in surplus of Rs 348 billion as of 20th July 2018.

Total Corporate bonds outstanding touches record levels of Rs 28.37 trillion

As on June 2018, total corporate bond outstanding was Rs 28.37 trillion. Outstandings rose 14.36% against Rs 24.81 trillion in June 2017. Comfortable liquidity in the system, low interest rates and increased demand for corporate bonds in the market have led to more corporates issuing bonds rather than go to banks for loans.

· As on 27th July, FII debt utilisation status stood at 70% of total limits, 14 bps lower against the previous week. FII investment position was at Rs 4162 billion in INR debt. FII investment position stands at Rs 2105 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2056 billion in corporate bonds.

· For the week ended 27th July, credit spreads have risen. Three-year AAA corporate bonds were trading at levels of 8.54%, spreads were higher by 5 bps at 71 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.65%. Spreads were at 60 bps, 7 bps higher against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.59% with spreads unchanged at 66 bps.

· Three months and twelve months PSU bank CDs were trading at 7.00% and 8.00% levels at spreads of 30 bps and 77 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.20% and 7.85% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.28% and 8.48% levels respectively.

Weekly G-sec Curve Spread Analysis

o The yield curve steppened, as 10-year bond yields fell by 1 bps while other long bond yields rose by 1-3 bps.

o Extreme long end largely remains untraded.

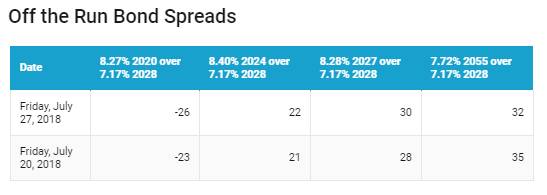

o Off the run bond spreads with the 10-year G-sec were mixed last week. (Table 2)

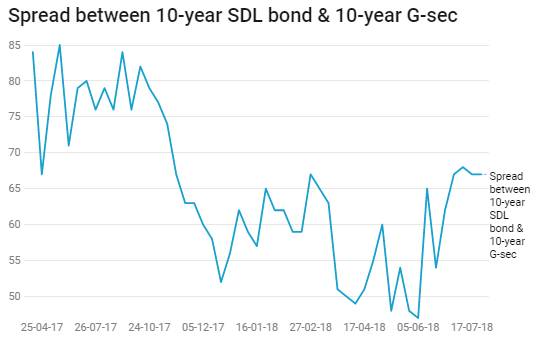

o On the 27th July 2018 auction, the spread between SDLs with 10-year G-sec came in at 67 bps. On 20th July 2018 auction, the spread between SDLs with 10-year G-sec was at 67 bps