Bond markets in India and globally are factoring in policy normalization by central banks. RBI hiked the repo rate in its meeting on the 6th of June while Fed hiked rates for the 2nd time this year in its meeting last week. ECB signaled the end of bond purchases this year, tapering the program from Eur 30 billion a month to Eur 15 billion a month in the last three months of 2018. Bond purchases will stop starting January 2019.

Central banks are expressing confidence on their respective economies but are not sounding worried on inflation rising faster than expectations. Bond markets are positioning for rate hikes but are also being benign on inflation. UST yield curve is flat while German 10 year yields are at 0.40% levels indicating that inflation expectations are still low. German 2 year and 5 year yields are still negative as ECB will keep interest rates at 0% for the next one year. ECB Discount Rate is negative.

RBI hiked rates for the first time in over 4 years and given a policy normalization path, will continue to hike rates over the next one year. Core CPI inflation printed at 6.1% for May 2018, which is above RBI 4% +2% range, though headline CPI inflation was at 4.87%.

RBI raised its inflation forecast by 20bps in its policy review in June but the expectations are still below 5%. Monsoons are on track in India and global oil prices are stabilizing after climbing 50% over the last one year. Liquidity too has eased while a depreciating INR has kept capital flows weak to negative. Cost of liquidity has risen by 100bps from lows over the last one year and this will temper inflation expectations.

Government bond yields will stay ranged at around 8% levels given the global policy environment and expectations of RBI rate hikes in its forthcoming policies. The markets will play more on credits for trading gains as a strengthening economy will improve corporate balance sheets.

The benchmark 10 year bond, the 7.17% 2028 bond, saw yields fall by 6bps to close at 7.89%. The benchmark 5 year bond, the 7.37% 2023 bond saw yields fall by 5 bps to close at 8.00% and the 6.68% 2031 bond saw yields fall by 5 bps to close at 8.07%. The long bond, the 7.06% 2046 bond, saw yields close flat week on week. Government bond yields will steady at higher levels.

The OIS market saw 5 year OIS yields closing 3 bps up week on week at levels of 7.27%. The one year OIS yield closed up by 2 bps at 6.86%. OIS yield curve will flatten going forward on rate hike expectations being built into one year OIS yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 623 billion as of 15th June 2018. Liquidity was in surplus of Rs 967 billion as of 8th June 2018. Liquidity will tighten on advance tax outflows in mid June.

FIIs Are Allowed to Invest in T-bills and Short Term Corporate Bonds

RBI has relaxed Foreign Portfolio Investors Debt investments regulation. FIIs are allowed to invest in Central Government securities, including Treasury Bills, and State Development Loans (SDLs) without any minimum residual maturity requirement with 20% upper limit of total investments.Investments in corporate bonds with minimum residual maturity limit has been brought down from three years to one year. Concentration limits, Long-term FPIs at 15% of prevailing investment limit for that category, for other FPIs at 10% of prevailing investment limit for that category.FPIs are not allowed to invest in partly paid instruments. Given the depreciating INR, RBI is encouraging FPIs to buy short maturity bonds to bring in flows. Since April 2018, FIIs sold USD 5.13 billion INRBONDS.

· As on 15th June, FII debt utilisation status stood at 71.02% of total limits, 63 bps lower against the previous week. FII investment position was at Rs 4222 billion in INR debt. FII investment position stands at Rs 2194 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2028 billion in corporate bonds.

· For the week ended 15th June, credit spreads fell. Three-year AAA corporate bonds were trading at levels of 8.65%, spreads were down 3 bps at 78 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.75%. Spreads were at 59 bps, 3 bps lower against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.77% with spreads 5 bps lower at 73 bps.

· Three months and twelve months PSU bank CDs were trading at 7.01% and 8.12% levels each at spreads of 51 bps and 107 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.18% and 7.74% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.35% and 8.55% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve is distorted as the 10-year G-sec (7.17% 2028) yield is trading lower than 5-year G-sec yields.

· Spread between 10-year G-sec and extreme long bond (6.62% 2051) fell sharply to 8 bps.

· Extreme long-end bond yields largely remained untraded.

· Off the run bond spreads with the 10-year G-sec were mixed last week. (Table 2)

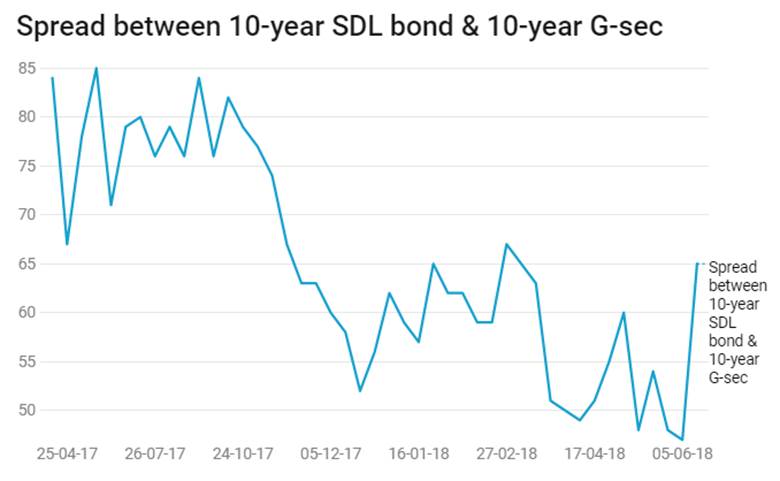

· On the 12th June 2018 auction, the spread between SDLs with 10-year G-sec came in at 65 bps. 5th June 2018 auction, the spread between SDLs with 10-year G-sec was at 47 bps (Chart 1). SDL spreads has risen due to RBI removing the 25bps mark up over G-secs for banks SDL investments.