Bond markets are returning to normalcy after three months of high volatility that saw 10 year government bond yields jumping sharply by 80bps from levels of 7.20% seen post RBI April policy meet to multi year high levels of 8%. FIIs are continuing to sell bonds but the pace of selling is expected to come off as global risk aversion is seen as easing. Global markets are discounting Fed rate hikes and policy normalisation by the ECB and are also learning to live with trade war posturing by US and China.

The Indian economy is doing well as seen by strong 4th quarter fy 18 results from consumption driven stocks especially from consumer finance companies such as Bajaj Finance. There is vibrant activity in the lending space, which is leading to higher sales of vehicles and consumer durables. May 2018 exports grew over 28% indicating good activity in the manufacturing sector. The strength of the economy is seen in GST collections that have been steady at over Rs 900 billion monthly and on advance tax payments estimated at Rs 800 billion going by the fall in liquidity from positive Rs 500 billion to negative Rs 300 billion post advance tax.

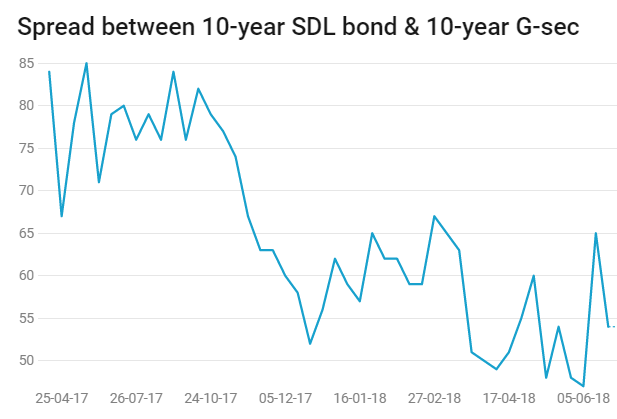

Government bond auctions too are going smoothly with bids coming in at market levels and bid to cover ratios at around 3x. SDL auctions too are going smoothly with latest auction seeing spreads fall by 10bps. Money market securities yields have fallen indicating markets are easing off on sentiments.

RBI policy minutes post June rate hike suggests that the Central Bank is not going on a rate hike spree but will gradually raise rates if incoming data is showing positive growth trends. RBI is buying bonds to infuse durable liquidity in the system given that it has sold USD to prevent sharp INR depreciation.

Bond markets will give off the risk premium in bond yields and yield curves will start to normalise.

The benchmark 10-year bond, the 7.17% 2028 bond, saw yields fall by 7 bps to close at 7.82%. The benchmark 5 year bond, the 7.37% 2023 bond saw yields fall by 9 bps to close at 7.91% and the 6.68% 2031 bond saw yields fall by 8 bps to close at 7.99%. The long bond, the 7.06% 2046 bond, saw yields close fall by 2 bps to close at 8.04%.

The OIS market saw 5 year OIS yields fall by 4 bps at levels of 7.23%. The one year OIS yield fall by 2 bps at 6.84%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 300 billion as of 22nd June 2018. Liquidity was in surplus of Rs 623 billion as of 15th June 2018. Liquidity will tighten on advance tax outflows in mid June.

FIIs selling INR Bonds

FIIs are continuously selling INR bonds. In the three weeks of this month, FIIs sold USD 1.36 billion of INR bonds .Falling INR and policy normalization by central banks are leading to FIIs offloading Indian bonds.

· As on 22nd June, FII debt utilisation status stood at 70.38% of total limits, 64 bps lower against the previous week. FII investment position was at Rs 4184 billion in INR debt. FII investment position stands at Rs 2159 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2025 billion in corporate bonds.

· For the week ended 22nd June, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.57%, spreads were down 3 bps at 75 bps against previous week.

· Five-year AAA corporate bonds were trading at levels of 8.67%. Spreads were at 61 bps, 2 bps higher against last week.

· Ten-year AAA corporate bonds were trading at levels of 8.60% with spreads 10 bps lower at 63 bps.

· Three months and twelve months PSU bank CDs were trading at 6.93% and 8.08% levels at spreads of 49 bps and 103 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.08% and 7.57% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.32% and 8.63% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened at the long end, bond yields fell sharply after RBI minutes signalled that central bank will rely on data for future rate hike decisions.

· The 10-year G-sec (7.17% 2028) yield is trading lower than 5-year G-sec (7.37% 2023) yields .

· Extreme long-end bond yields largely remained untraded.

· Off the run bond spreads with the 10-year G-sec were mixed last week. (Table 2)

· On the 19th June 2018 auction, the spread between SDLs with 10-year G-sec came in at 54 bps. 12th June 2018 auction, the spread between SDLs with 10-year G-sec was at 65 bps